Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90 ANNUAL<br />

GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

<strong>Capgemini</strong><br />

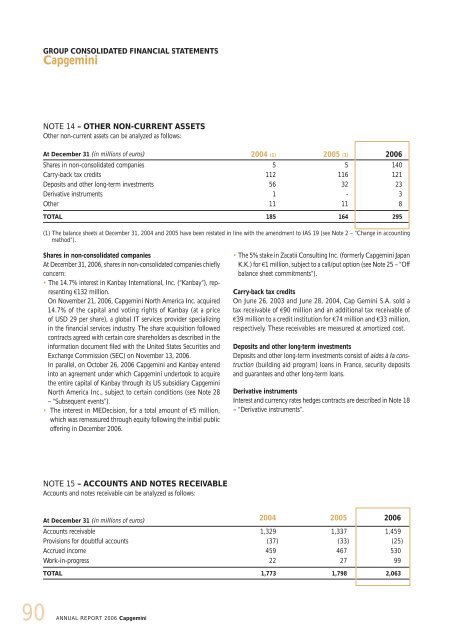

NOTE 14 – OTHER NON-CURRENT ASSETS<br />

Other non-current assets can be analyzed as follows:<br />

At December 31 (in millions of euros) 2004 (1) 2005 (1) 2006<br />

Shares in non-consolidated companies 5 5 140<br />

Carry-back tax credits 112 116 121<br />

Deposits and other long-term investments 56 32 23<br />

Derivative instruments 1 - 3<br />

Other 11 11 8<br />

TOTAL 185 164 295<br />

(1) The balance sheets at December 31, 2004 and 2005 have been restated in line with the amendment to IAS 19 (see Note 2 – “Change in accounting<br />

method”).<br />

Shares in non-consolidated companies<br />

At December 31, 2006, shares in non-consolidated companies chiefly<br />

concern:<br />

The 14.7% interest in Kanbay International, Inc. (“Kanbay”), representing<br />

€132 million.<br />

On November 21, 2006, <strong>Capgemini</strong> North America Inc. acquired<br />

14.7% of the capital and voting rights of Kanbay (at a price<br />

of USD 29 per share), a global IT services provider specializing<br />

in the financial services industry. The share acquisition followed<br />

contracts agreed with certain core shareholders as described in the<br />

information document filed with the United States Securities and<br />

Exchange Commission (SEC) on November 13, 2006.<br />

In parallel, on October 26, 2006 <strong>Capgemini</strong> and Kanbay entered<br />

into an agreement under which <strong>Capgemini</strong> undertook to acquire<br />

the entire capital of Kanbay through its US subsidiary <strong>Capgemini</strong><br />

North America Inc., subject to certain conditions (see Note 28<br />

– “Subsequent events”).<br />

The interest in MEDecision, for a total amount of €5 million,<br />

which was remeasured through equity following the initial public<br />

offering in December 2006.<br />

NOTE 15 – ACCOUNTS AND NOTES RECEIVABLE<br />

Accounts and notes receivable can be analyzed as follows:<br />

REPORT 2006 <strong>Capgemini</strong><br />

The 5% stake in Zacatii Consulting Inc. (formerly <strong>Capgemini</strong> Japan<br />

K.K.) for €1 million, subject to a call/put option (see Note 25 – “Off<br />

balance sheet commitments”).<br />

Carry-back tax credits<br />

On June 26, 2003 and June 28, 2004, Cap Gemini S.A. sold a<br />

tax receivable of €90 million and an additional tax receivable of<br />

€39 million to a credit institution for €74 million and €33 million,<br />

respectively. These receivables are measured at amortized cost.<br />

Deposits and other long-term investments<br />

Deposits and other long-term investments consist of aides à la construction<br />

(building aid program) loans in France, security deposits<br />

and guarantees and other long-term loans.<br />

Derivative instruments<br />

Interest and currency rates hedges contracts are described in Note 18<br />

– “Derivative instruments”.<br />

At December 31 (in millions of euros) 2004 2005 2006<br />

Accounts receivable 1,329 1,337 1,459<br />

Provisions for doubtful accounts (37) (33) (25)<br />

Accrued income 459 467 530<br />

Work-in-progress 22 27 99<br />

TOTAL 1,773 1,798 2,063