You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

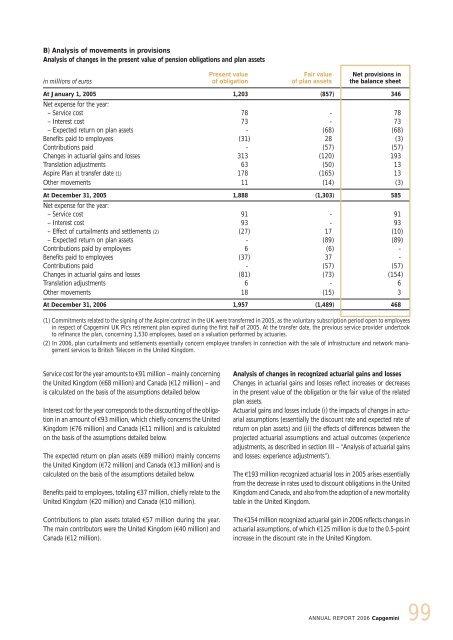

B) Analysis of movements in provisions<br />

Analysis of changes in the present value of pension obligations and plan assets<br />

in millions of euros<br />

Present value<br />

of obligation<br />

Fair value<br />

of plan assets<br />

Net provisions in<br />

the balance sheet<br />

At January 1, 2005<br />

Net expense for the year:<br />

1,203 (857) 346<br />

– Service cost 78 - 78<br />

– Interest cost 73 - 73<br />

– Expected return on plan assets - (68) (68)<br />

Benefits paid to employees (31) 28 (3)<br />

Contributions paid - (57) (57)<br />

Changes in actuarial gains and losses 313 (120) 193<br />

Translation adjustments 63 (50) 13<br />

Aspire Plan at transfer date (1) 178 (165) 13<br />

Other movements 11 (14) (3)<br />

At December 31, 2005<br />

Net expense for the year:<br />

1,888 (1,303) 585<br />

– Service cost 91 - 91<br />

– Interest cost 93 - 93<br />

– Effect of curtailments and settlements (2) (27) 17 (10)<br />

– Expected return on plan assets - (89) (89)<br />

Contributions paid by employees 6 (6) -<br />

Benefits paid to employees (37) 37 -<br />

Contributions paid - (57) (57)<br />

Changes in actuarial gains and losses (81) (73) (154)<br />

Translation adjustments 6 - 6<br />

Other movements 18 (15) 3<br />

At December 31, 2006 1,957 (1,489) 468<br />

(1) Commitments related to the signing of the Aspire contract in the UK were transferred in 2005, as the voluntary subscription period open to employees<br />

in respect of <strong>Capgemini</strong> UK Plc’s retirement plan expired during the first half of 2005. At the transfer date, the previous service provider undertook<br />

to refinance the plan, concerning 1,530 employees, based on a valuation performed by actuaries.<br />

(2) In 2006, plan curtailments and settlements essentially concern employee transfers in connection with the sale of infrastructure and network management<br />

services to British Telecom in the United Kingdom.<br />

Service cost for the year amounts to €91 million – mainly concerning<br />

the United Kingdom (€68 million) and Canada (€12 million) – and<br />

is calculated on the basis of the assumptions detailed below.<br />

Interest cost for the year corresponds to the discounting of the obligation<br />

in an amount of €93 million, which chiefly concerns the United<br />

Kingdom (€76 million) and Canada (€11 million) and is calculated<br />

on the basis of the assumptions detailed below.<br />

The expected return on plan assets (€89 million) mainly concerns<br />

the United Kingdom (€72 million) and Canada (€13 million) and is<br />

calculated on the basis of the assumptions detailed below.<br />

Benefits paid to employees, totaling €37 million, chiefly relate to the<br />

United Kingdom (€20 million) and Canada (€10 million).<br />

Contributions to plan assets totaled €57 million during the year.<br />

The main contributors were the United Kingdom (€40 million) and<br />

Canada (€12 million).<br />

Analysis of changes in recognized actuarial gains and losses<br />

Changes in actuarial gains and losses reflect increases or decreases<br />

in the present value of the obligation or the fair value of the related<br />

plan assets.<br />

Actuarial gains and losses include (i) the impacts of changes in actuarial<br />

assumptions (essentially the discount rate and expected rate of<br />

return on plan assets) and (ii) the effects of differences between the<br />

projected actuarial assumptions and actual outcomes (experience<br />

adjustments, as described in section III – “Analysis of actuarial gains<br />

and losses: experience adjustments”).<br />

The €193 million recognized actuarial loss in 2005 arises essentially<br />

from the decrease in rates used to discount obligations in the United<br />

Kingdom and Canada, and also from the adoption of a new mortality<br />

table in the United Kingdom.<br />

The €154 million recognized actuarial gain in 2006 reflects changes in<br />

actuarial assumptions, of which €125 million is due to the 0.5-point<br />

increase in the discount rate in the United Kingdom.<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

99