You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

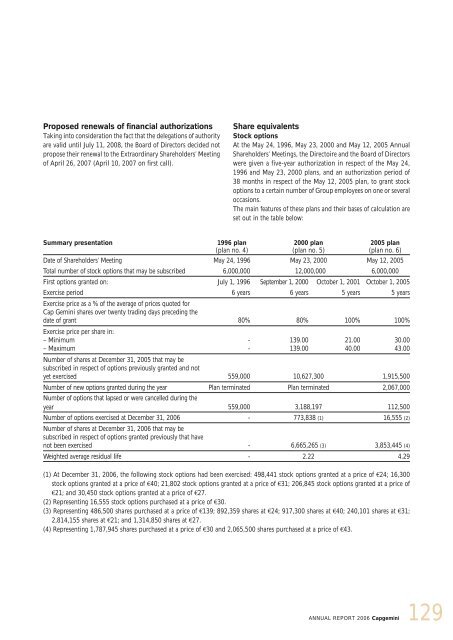

Proposed renewals of financial authorizations<br />

Taking into consideration the fact that the delegations of authority<br />

are valid until July 11, 2008, the Board of Directors decided not<br />

propose their renewal to the Extraordinary Shareholders’ Meeting<br />

of April 26, 2007 (April 10, 2007 on first call).<br />

Summary presentation 1996 plan<br />

(plan no. 4)<br />

Share equivalents<br />

Stock options<br />

At the May 24, 1996, May 23, 2000 and May 12, 2005 Annual<br />

Shareholders’ Meetings, the Directoire and the Board of Directors<br />

were given a five-year authorization in respect of the May 24,<br />

1996 and May 23, 2000 plans, and an authorization period of<br />

38 months in respect of the May 12, 2005 plan, to grant stock<br />

options to a certain number of Group employees on one or several<br />

occasions.<br />

The main features of these plans and their bases of calculation are<br />

set out in the table below:<br />

2000 plan<br />

(plan no. 5)<br />

2005 plan<br />

(plan no. 6)<br />

Date of Shareholders’ Meeting May 24, 1996 May 23, 2000 May 12, 2005<br />

Total number of stock options that may be subscribed 6,000,000 12,000,000 6,000,000<br />

First options granted on: July 1, 1996 September 1, 2000 October 1, 2001 October 1, 2005<br />

Exercise period<br />

Exercise price as a % of the average of prices quoted for<br />

Cap Gemini shares over twenty trading days preceding the<br />

6 years 6 years 5 years 5 years<br />

date of grant<br />

Exercise price per share in:<br />

80% 80% 100% 100%<br />

– Minimum<br />

-<br />

139.00<br />

21.00 30.00<br />

– Maximum<br />

Number of shares at December 31, 2005 that may be<br />

subscribed in respect of options previously granted and not<br />

-<br />

139.00<br />

40.00 43.00<br />

yet exercised 559,000 10,627,300 1,915,500<br />

Number of new options granted during the year<br />

Number of options that lapsed or were cancelled during the<br />

Plan terminated Plan terminated 2,067,000<br />

year 559,000 3,188,197 112,500<br />

Number of options exercised at December 31, 2006<br />

Number of shares at December 31, 2006 that may be<br />

subscribed in respect of options granted previously that have<br />

- 773,838 (1) 16,555 (2)<br />

not been exercised - 6,665,265 (3) 3,853,445 (4)<br />

Weighted average residual life - 2.22 4.29<br />

(1) At December 31, 2006, the following stock options had been exercised: 498,441 stock options granted at a price of €24; 16,300<br />

stock options granted at a price of €40; 21,802 stock options granted at a price of €31; 206,845 stock options granted at a price of<br />

€21; and 30,450 stock options granted at a price of €27.<br />

(2) Representing 16,555 stock options purchased at a price of €30.<br />

(3) Representing 486,500 shares purchased at a price of €139; 892,359 shares at €24; 917,300 shares at €40; 240,101 shares at €31;<br />

2,814,155 shares at €21; and 1,314,850 shares at €27.<br />

(4) Representing 1,787,945 shares purchased at a price of €30 and 2,065,500 shares purchased at a price of €43.<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

129