Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

80 ANNUAL<br />

GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

<strong>Capgemini</strong><br />

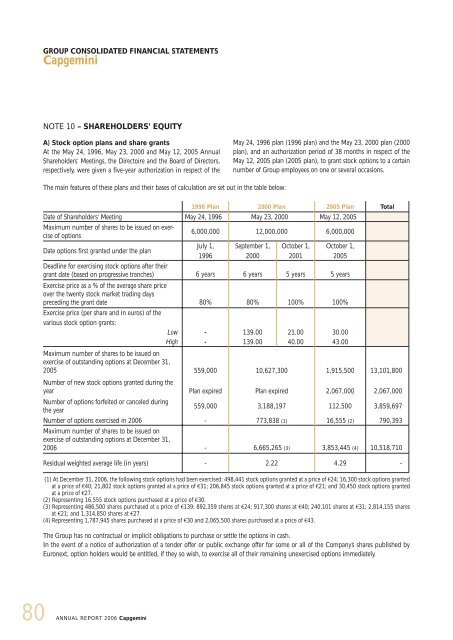

NOTE 10 – SHAREHOLDERS’ EQUITY<br />

A) Stock option plans and share grants<br />

At the May 24, 1996, May 23, 2000 and May 12, 2005 Annual<br />

Shareholders’ Meetings, the Directoire and the Board of Directors,<br />

respectively, were given a five-year authorization in respect of the<br />

The main features of these plans and their bases of calculation are set out in the table below:<br />

REPORT 2006 <strong>Capgemini</strong><br />

1996 Plan 2000 Plan 2005 Plan Total<br />

Date of Shareholders’ Meeting May 24, 1996 May 23, 2000 May 12, 2005<br />

Maximum number of shares to be issued on exercise<br />

of options<br />

6,000,000 12,000,000 6,000,000<br />

Date options first granted under the plan<br />

July 1,<br />

1996<br />

September 1,<br />

2000<br />

October 1,<br />

2001<br />

October 1,<br />

2005<br />

Deadline for exercising stock options after their<br />

grant date (based on progressive tranches) 6 years 6 years 5 years 5 years<br />

Exercise price as a % of the average share price<br />

over the twenty stock market trading days<br />

preceding the grant date 80% 80% 100% 100%<br />

Exercise price (per share and in euros) of the<br />

various stock option grants:<br />

May 24, 1996 plan (1996 plan) and the May 23, 2000 plan (2000<br />

plan), and an authorization period of 38 months in respect of the<br />

May 12, 2005 plan (2005 plan), to grant stock options to a certain<br />

number of Group employees on one or several occasions.<br />

Low - 139.00 21.00 30.00<br />

High - 139.00 40.00 43.00<br />

Maximum number of shares to be issued on<br />

exercise of outstanding options at December 31,<br />

2005 559,000 10,627,300 1,915,500 13,101,800<br />

Number of new stock options granted during the<br />

year Plan expired Plan expired 2,067,000 2,067,000<br />

Number of options forfeited or canceled during<br />

the year<br />

559,000 3,188,197 112,500 3,859,697<br />

Number of options exercised in 2006<br />

Maximum number of shares to be issued on<br />

exercise of outstanding options at December 31,<br />

- 773,838 (1) 16,555 (2) 790,393<br />

2006 - 6,665,265 (3) 3,853,445 (4) 10,518,710<br />

Residual weighted average life (in years) - 2.22 4.29 -<br />

(1) At December 31, 2006, the following stock options had been exercised: 498,441 stock options granted at a price of €24; 16,300 stock options granted<br />

at a price of €40; 21,802 stock options granted at a price of €31; 206,845 stock options granted at a price of €21; and 30,450 stock options granted<br />

at a price of €27.<br />

(2) Representing 16,555 stock options purchased at a price of €30.<br />

(3) Representing 486,500 shares purchased at a price of €139; 892,359 shares at €24; 917,300 shares at €40; 240,101 shares at €31; 2,814,155 shares<br />

at €21; and 1,314,850 shares at €27.<br />

(4) Representing 1,787,945 shares purchased at a price of €30 and 2,065,500 shares purchased at a price of €43.<br />

The Group has no contractual or implicit obligations to purchase or settle the options in cash.<br />

In the event of a notice of authorization of a tender offer or public exchange offer for some or all of the Company’s shares published by<br />

Euronext, option holders would be entitled, if they so wish, to exercise all of their remaining unexercised options immediately.