You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTE 3 – CHANGES IN GROUP STRUCTURE<br />

A) 2004 and 2005<br />

The main changes in Group structure in 2004 and 2005 were as<br />

follows:<br />

In the United States, the Group formed <strong>Capgemini</strong> Energy LP as part<br />

of a ten-year service contract, effective July 1, 2004, with the American<br />

power company TXU Energy Company LLC. At December 31,<br />

2004, <strong>Capgemini</strong> Energy LP, was 97.1%-owned by the Group and<br />

was fully consolidated.<br />

In January 2005, the Group sold its 25.22% stake in IS Energy for<br />

€21 million, further to the exercise by E.ON of the call option it held<br />

on IS Energy’s shares.<br />

On June 16, 2005, the Group sold its US healthcare business to the<br />

Accenture group for €143 million.<br />

On August 12, 2005, the Group entered into an alliance with the<br />

Japanese group NTT Data Corporation and sold its 95% stake in<br />

<strong>Capgemini</strong> Japan K.K. for €30 million.<br />

B) 2006<br />

The main changes in Group structure in 2006 were as follows:<br />

On September 30, 2006, the Group acquired 100% of the capital of<br />

German group FuE (FuE-Future Engineering GmbH, FuE-Future<br />

Engineering & Consulting GmbH and Computer Konzept EDV<br />

Beratung und Betreuung GmbH). The FuE group is Germany’s<br />

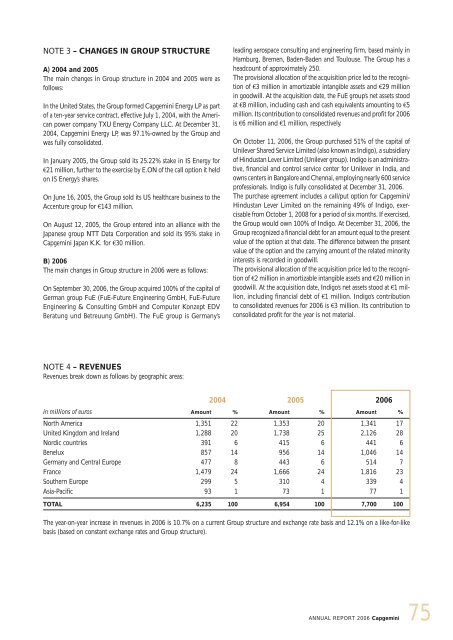

NOTE 4 – REVENUES<br />

Revenues break down as follows by geographic areas:<br />

in millions of euros<br />

leading aerospace consulting and engineering firm, based mainly in<br />

Hamburg, Bremen, Baden-Baden and Toulouse. The Group has a<br />

headcount of approximately 250.<br />

The provisional allocation of the acquisition price led to the recognition<br />

of €3 million in amortizable intangible assets and €29 million<br />

in goodwill. At the acquisition date, the FuE group’s net assets stood<br />

at €8 million, including cash and cash equivalents amounting to €5<br />

million. Its contribution to consolidated revenues and profit for 2006<br />

is €6 million and €1 million, respectively.<br />

On October 11, 2006, the Group purchased 51% of the capital of<br />

Unilever Shared Service Limited (also known as Indigo), a subsidiary<br />

of Hindustan Lever Limited (Unilever group). Indigo is an administrative,<br />

financial and control service center for Unilever in India, and<br />

owns centers in Bangalore and Chennai, employing nearly 600 service<br />

professionals. Indigo is fully consolidated at December 31, 2006.<br />

The purchase agreement includes a call/put option for <strong>Capgemini</strong>/<br />

Hindustan Lever Limited on the remaining 49% of Indigo, exercisable<br />

from October 1, 2008 for a period of six months. If exercised,<br />

the Group would own 100% of Indigo. At December 31, 2006, the<br />

Group recognized a financial debt for an amount equal to the present<br />

value of the option at that date. The difference between the present<br />

value of the option and the carrying amount of the related minority<br />

interests is recorded in goodwill.<br />

The provisional allocation of the acquisition price led to the recognition<br />

of €2 million in amortizable intangible assets and €20 million in<br />

goodwill. At the acquisition date, Indigo’s net assets stood at €1 million,<br />

including financial debt of €1 million. Indigo’s contribution<br />

to consolidated revenues for 2006 is €3 million. Its contribution to<br />

consolidated profit for the year is not material.<br />

2004 2005 2006<br />

Amount % Amount % Amount %<br />

North America 1,351 22 1,353 20 1,341 17<br />

United Kingdom and Ireland 1,288 20 1,738 25 2,126 28<br />

Nordic countries 391 6 415 6 441 6<br />

Benelux 857 14 956 14 1,046 14<br />

Germany and Central Europe 477 8 443 6 514 7<br />

France 1,479 24 1,666 24 1,816 23<br />

Southern Europe 299 5 310 4 339 4<br />

Asia-Pacific 93 1 73 1 77 1<br />

TOTAL 6,235 100 6,954 100 7,700 100<br />

The year-on-year increase in revenues in 2006 is 10.7% on a current Group structure and exchange rate basis and 12.1% on a like-for-like<br />

basis (based on constant exchange rates and Group structure).<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

75