Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

16 ANNUAL<br />

THE GROUP<br />

<strong>Capgemini</strong><br />

The above evolution reflects the following:<br />

The continuing adaptation of our production capacity to the<br />

Rightshore TM model, combining local resources (in the client’s<br />

area) with those situated in specialized production centers, the<br />

balance depending on the technology or offer concerned. This<br />

explains, in particular, the development of our headcount in<br />

the Asia-Pacific region - where 12% of Group resources are<br />

concentrated - and in Central Europe;<br />

The continuing development of the local professional services<br />

activity, with strong representation in France and in Benelux,<br />

and a growth trend in North America;<br />

The maintaining of a local production workforce in all our<br />

geographic zones.<br />

In 2006, recruitment was stepped up and 18,600 new employees<br />

came onboard, compared with 14,500 in 2005. This same trend<br />

was prevalent in all countries and in all areas, a trend which was<br />

particularly marked in India where the headcount rose by 77%<br />

REPORT 2006 <strong>Capgemini</strong><br />

and the total number of new recruits was higher than the total<br />

headcount at the beginning of the year. Sogeti and OS recorded<br />

high recruitment rates - 4,300 and 3,700 respectively. To support<br />

our 2006 priority on recruitment for growth, a new global<br />

recruitment campaign was launched. This campaign received the<br />

2006 Award for the best global press recruitment campaign.<br />

Staff turnover (i.e. percentage of voluntary departures) slightly<br />

increased - reaching 16.6% in 2006 (compared with 15.4% in<br />

2005 and 14.1% in 2004) i.e. almost 10,700 voluntary departures<br />

during the year - which reflects the standard phenomenon i.e.<br />

increased mobility in Consulting and Services when the market is<br />

flourishing. This rate is carefully monitored in order to maintain<br />

it at the customary level for the sector, which is achieved through<br />

specific action or programs (implemented in function of the disciplines<br />

and geographic areas involved). Turnover rates in India,<br />

which has had a booming IT market for several years now, stand at<br />

approximately 20% instead of the 30% recorded two years ago.<br />

The utilization rate of resources - which measures the share of hours (excluding legal holidays or leave) worked by productive<br />

salaried staff and directly allocated to invoiceable services - is globally progressing compared to 2005 in the case of Projects and<br />

Consulting. Breakdown is as follows:<br />

Quarterly utilization 2005 2006<br />

rate Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4<br />

Consulting Services 62 67 66 66 66 69 66 69<br />

Technology Services 78 79 79 79 79 80 80 80<br />

Local Professional Services 85 86 86 86 85 85 86 86<br />

It should be noted that utilization rates are not monitored for outsourcing business, for which the indicator does not reflect the performance<br />

evolution.<br />

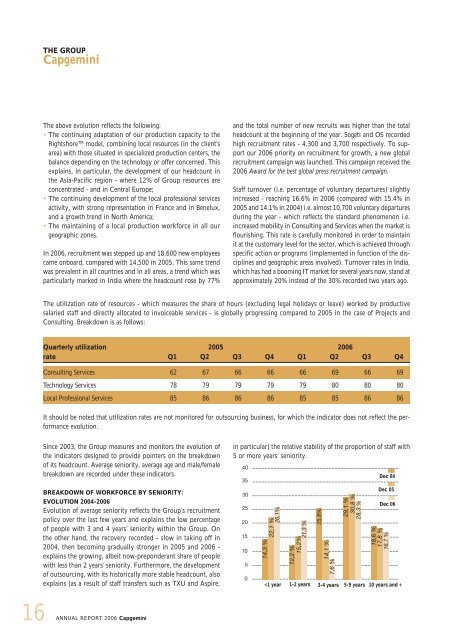

Since 2003, the Group measures and monitors the evolution of<br />

the indicators designed to provide pointers on the breakdown<br />

of its headcount. Average seniority, average age and male/female<br />

breakdown are recorded under these indicators.<br />

BREAKDOWN OF WORKFORCE BY SENIORITY:<br />

EVOLUTION 2004-2006<br />

Evolution of average seniority reflects the Group’s recruitment<br />

policy over the last few years and explains the low percentage<br />

of people with 3 and 4 years’ seniority within the Group. On<br />

the other hand, the recovery recorded - slow in taking off in<br />

2004, then becoming gradually stronger in 2005 and 2006 -<br />

explains the growing, albeit now-preponderant share of people<br />

with less than 2 years’ seniority. Furthermore, the development<br />

of outsourcing, with its historically more stable headcount, also<br />

explains (as a result of staff transfers such as TXU and Aspire,<br />

in particular) the relative stability of the proportion of staff with<br />

5 or more years’ seniority.<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

14,3 %<br />

22,1 %<br />

26,1%<br />

12,2 %<br />

15,2%<br />

21,3 %<br />

25,8%<br />

14,1 %<br />

7,6 %<br />

29,1 %<br />

30,8 %<br />

28,3 %<br />

Dec 04<br />

Dec 05<br />

Dec 06<br />

18,6 %<br />

17,8 %<br />

16,7 %<br />