You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

44 ANNUAL<br />

MANAGEMENT REPORT<br />

<strong>Capgemini</strong><br />

As this authorization is only valid for 18 months, we are asking<br />

shareholders to replace the 2005 authorization with a similar<br />

authorization to allow the Company (in descending order of<br />

priority):<br />

to provide liquidity for the Cap Gemini share within the scope<br />

of a liquidity contract;<br />

to remit the shares thus purchased to holders of securities<br />

convertible, redeemable, exchangeable or otherwise exercisable<br />

for Cap Gemini S.A. shares upon exercise of the rights attached<br />

thereto in accordance with the applicable regulations (including<br />

the possibility of exercising the call options acquired on June<br />

27, 2005);<br />

to purchase shares to be retained with a view to remitting them<br />

in future in exchange or payment for potential external growth<br />

transactions;<br />

to award shares to employees and corporate officers (on the terms<br />

and by the methods provided for by law), in particular in connection<br />

with stock option plans or company savings plans;<br />

to cancel the shares thus purchased subject to adoption of the<br />

eighth resolution of the Extraordinary Shareholders’ Meeting<br />

included in the agenda of the Shareholders’ Meeting of April 26,<br />

2007 (April 10, 2007 on first call).<br />

To this end, the Board of Directors is seeking a maximum<br />

18-month authorization for the Company to buy back shares<br />

representing up to 10% of its capital, at a maximum price of<br />

REPORT 2006 <strong>Capgemini</strong><br />

€70 per share, these purchases taking place within the scope<br />

of:<br />

articles L.225-209 et seq. of the French Commercial Code which<br />

also allow an authorization to be granted to the Board of Directors<br />

to cancel some or all of the shares purchased, up to 10%<br />

of its capital by 24-month period;<br />

European Regulation No. 2273 of December 22, 2003 that came<br />

into effect on October 13, 2004.<br />

4.9 Returned Shares<br />

In the agreements entered into on May 23, 2000 with Ernst &<br />

Young in connection with the sale to Cap Gemini of its consulting<br />

business, it was provided that if any of its former partners<br />

who had become Group employees decided to leave the Group<br />

before a specified period had elapsed, they would be required to<br />

return some or all of the shares they had received at the time of<br />

the sale, the number of shares to be returned depending both on<br />

the reason for and the timing of the individual’s departure. Pursuant<br />

to these agreements, a total of 80,621 Cap Gemini shares<br />

were returned to the Company between February 23, 2006 and<br />

December 31, 2006 (no other shares have been returned since<br />

said date). At December 31, 2006, Cap Gemini no longer held<br />

any such shares following the sale of all of the shares in this portfolio<br />

in December 2006, representing 85,663 shares (including<br />

5,042 shares returned to the Company between February 23,<br />

2005 and February 22, 2006).<br />

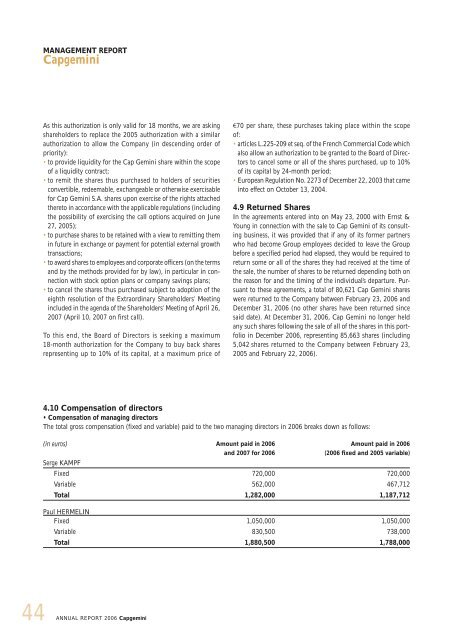

4.10 Compensation of directors<br />

Compensation of managing directors<br />

The total gross compensation (fixed and variable) paid to the two managing directors in 2006 breaks down as follows:<br />

(in euros)<br />

Serge KAMPF<br />

Amount paid in 2006<br />

and 2007 for 2006<br />

Amount paid in 2006<br />

(2006 fi xed and 2005 variable)<br />

Fixed 720,000 720,000<br />

Variable 562,000 467,712<br />

Total 1,282,000 1,187,712<br />

Paul HERMELIN<br />

Fixed 1,050,000 1,050,000<br />

Variable 830,500 738,000<br />

Total 1,880,500 1,788,000