Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

98 ANNUAL<br />

GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

<strong>Capgemini</strong><br />

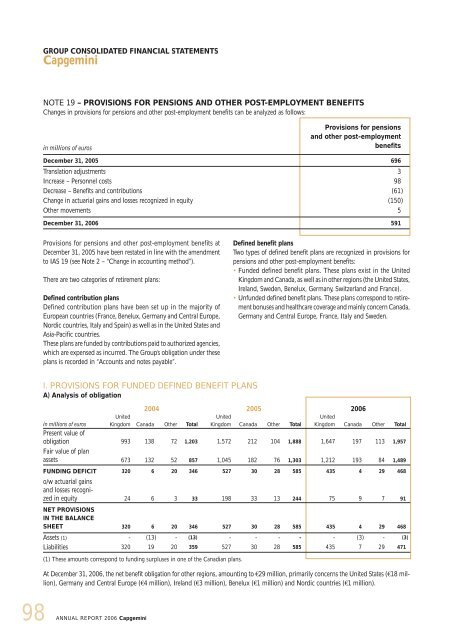

NOTE 19 – PROVISIONS FOR PENSIONS AND OTHER POST-EMPLOYMENT BENEFITS<br />

Changes in provisions for pensions and other post-employment benefits can be analyzed as follows:<br />

in millions of euros<br />

Provisions for pensions and other post-employment benefits at<br />

December 31, 2005 have been restated in line with the amendment<br />

to IAS 19 (see Note 2 – “Change in accounting method”).<br />

There are two categories of retirement plans:<br />

Defined contribution plans<br />

Defined contribution plans have been set up in the majority of<br />

European countries (France, Benelux, Germany and Central Europe,<br />

Nordic countries, Italy and Spain) as well as in the United States and<br />

Asia-Pacific countries.<br />

These plans are funded by contributions paid to authorized agencies,<br />

which are expensed as incurred. The Group’s obligation under these<br />

plans is recorded in “Accounts and notes payable”.<br />

I. PROVISIONS FOR FUNDED DEFINED BENEFIT PLANS<br />

A) Analysis of obligation<br />

in millions of euros<br />

REPORT 2006 <strong>Capgemini</strong><br />

Defined benefit plans<br />

Two types of defined benefit plans are recognized in provisions for<br />

pensions and other post-employment benefits:<br />

Funded defined benefit plans. These plans exist in the United<br />

Kingdom and Canada, as well as in other regions (the United States,<br />

Ireland, Sweden, Benelux, Germany, Switzerland and France).<br />

Unfunded defined benefit plans. These plans correspond to retirement<br />

bonuses and healthcare coverage and mainly concern Canada,<br />

Germany and Central Europe, France, Italy and Sweden.<br />

2004 2005 2006<br />

United<br />

Kingdom Canada Other Total<br />

United<br />

Kingdom Canada Other Total<br />

United<br />

Kingdom Canada Other Total<br />

Present value of<br />

obligation 993 138 72 1,203 1,572 212 104 1,888 1,647 197 113 1,957<br />

Fair value of plan<br />

assets 673 132 52 857 1,045 182 76 1,303 1,212 193 84 1,489<br />

FUNDING DEFICIT<br />

o/w actuarial gains<br />

and losses recogni-<br />

320 6 20 346 527 30 28 585 435 4 29 468<br />

zed in equity 24 6 3 33 198 33 13 244 75 9 7 91<br />

NET PROVISIONS<br />

IN THE BALANCE<br />

SHEET 320 6 20 346 527 30 28 585 435 4 29 468<br />

Assets (1) - (13) - (13) - - - - - (3) - (3)<br />

Liabilities 320 19 20 359 527 30 28 585 435 7 29 471<br />

(1) These amounts correspond to funding surpluses in one of the Canadian plans.<br />

Provisions for pensions<br />

and other post-employment<br />

benefits<br />

December 31, 2005 696<br />

Translation adjustments 3<br />

Increase – Personnel costs 98<br />

Decrease – Benefits and contributions (61)<br />

Change in actuarial gains and losses recognized in equity (150)<br />

Other movements 5<br />

December 31, 2006 591<br />

At December 31, 2006, the net benefit obligation for other regions, amounting to €29 million, primarily concerns the United States (€18 million),<br />

Germany and Central Europe (€4 million), Ireland (€3 million), Benelux (€1 million) and Nordic countries (€1 million).