You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

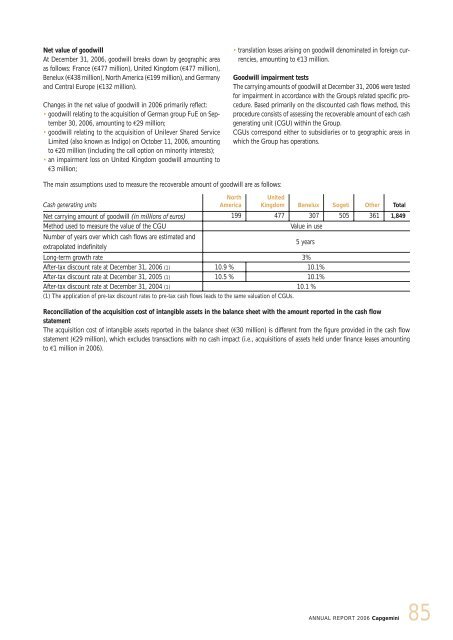

Net value of goodwill<br />

At December 31, 2006, goodwill breaks down by geographic area<br />

as follows: France (€477 million), United Kingdom (€477 million),<br />

Benelux (€438 million), North America (€199 million), and Germany<br />

and Central Europe (€132 million).<br />

Changes in the net value of goodwill in 2006 primarily reflect:<br />

goodwill relating to the acquisition of German group FuE on September<br />

30, 2006, amounting to €29 million;<br />

goodwill relating to the acquisition of Unilever Shared Service<br />

Limited (also known as Indigo) on October 11, 2006, amounting<br />

to €20 million (including the call option on minority interests);<br />

an impairment loss on United Kingdom goodwill amounting to<br />

€3 million;<br />

The main assumptions used to measure the recoverable amount of goodwill are as follows:<br />

Cash generating units<br />

North<br />

America<br />

translation losses arising on goodwill denominated in foreign currencies,<br />

amounting to €13 million.<br />

Goodwill impairment tests<br />

The carrying amounts of goodwill at December 31, 2006 were tested<br />

for impairment in accordance with the Group’s related specific procedure.<br />

Based primarily on the discounted cash flows method, this<br />

procedure consists of assessing the recoverable amount of each cash<br />

generating unit (CGU) within the Group.<br />

CGUs correspond either to subsidiaries or to geographic areas in<br />

which the Group has operations.<br />

United<br />

Kingdom Benelux Sogeti Other Total<br />

Net carrying amount of goodwill (in millions of euros) 199 477 307 505 361 1,849<br />

Method used to measure the value of the CGU Value in use<br />

Number of years over which cash flows are estimated and<br />

extrapolated indefinitely<br />

5 years<br />

Long-term growth rate 3%<br />

After-tax discount rate at December 31, 2006 (1) 10.9 % 10.1%<br />

After-tax discount rate at December 31, 2005 (1) 10.5 % 10.1%<br />

After-tax discount rate at December 31, 2004 (1) 10.1 %<br />

(1) The application of pre-tax discount rates to pre-tax cash flows leads to the same valuation of CGUs.<br />

Reconciliation of the acquisition cost of intangible assets in the balance sheet with the amount reported in the cash flow<br />

statement<br />

The acquisition cost of intangible assets reported in the balance sheet (€30 million) is different from the figure provided in the cash flow<br />

statement (€29 million), which excludes transactions with no cash impact (i.e., acquisitions of assets held under finance leases amounting<br />

to €1 million in 2006).<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

85