You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

96 ANNUAL<br />

GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

<strong>Capgemini</strong><br />

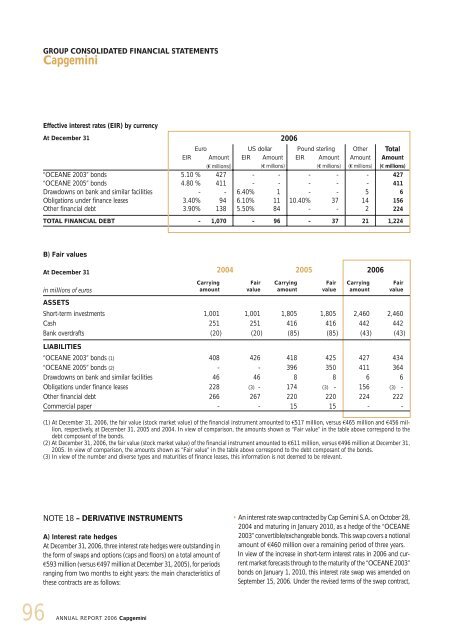

Effective interest rates (EIR) by currency<br />

At December 31 2006<br />

B) Fair values<br />

At December 31<br />

in millions of euros<br />

REPORT 2006 <strong>Capgemini</strong><br />

Carrying<br />

amount<br />

2004 2005 2006<br />

Fair<br />

value<br />

Carrying<br />

amount<br />

Fair<br />

value<br />

Carrying<br />

amount<br />

ASSETS<br />

Short-term investments 1,001 1,001 1,805 1,805 2,460 2,460<br />

Cash 251 251 416 416 442 442<br />

Bank overdrafts (20) (20) (85) (85) (43) (43)<br />

LIABILITIES<br />

“OCEANE 2003” bonds (1) 408 426 418 425 427 434<br />

“OCEANE 2005” bonds (2) - - 396 350 411 364<br />

Drawdowns on bank and similar facilities 46 46 8 8 6 6<br />

Obligations under finance leases 228 (3) - 174 (3) - 156 (3) -<br />

Other financial debt 266 267 220 220 224 222<br />

Commercial paper - - 15 15 - -<br />

(1) At December 31, 2006, the fair value (stock market value) of the financial instrument amounted to €517 million, versus €465 million and €456 million,<br />

respectively, at December 31, 2005 and 2004. In view of comparison, the amounts shown as “Fair value” in the table above correspond to the<br />

debt composant of the bonds.<br />

(2) At December 31, 2006, the fair value (stock market value) of the financial instrument amounted to €611 million, versus €496 million at December 31,<br />

2005. In view of comparison, the amounts shown as “Fair value” in the table above correspond to the debt composant of the bonds.<br />

(3) In view of the number and diverse types and maturities of finance leases, this information is not deemed to be relevant.<br />

NOTE 18 – DERIVATIVE INSTRUMENTS<br />

A) Interest rate hedges<br />

At December 31, 2006, three interest rate hedges were outstanding in<br />

the form of swaps and options (caps and floors) on a total amount of<br />

€593 million (versus €497 million at December 31, 2005), for periods<br />

ranging from two months to eight years: the main characteristics of<br />

these contracts are as follows:<br />

Euro US dollar Pound sterling Other Total<br />

EIR Amount EIR Amount EIR Amount Amount Amount<br />

(€ millions)) (€ millions) (€ millions) (€ millions) (€ millions)<br />

“OCEANE 2003” bonds 5.10 % 427 - - - - - 427<br />

“OCEANE 2005” bonds 4.80 % 411 - - - - - 411<br />

Drawdowns on bank and similar facilities - - 6.40% 1 - - 5 6<br />

Obligations under finance leases 3.40% 94 6.10% 11 10.40% 37 14 156<br />

Other financial debt 3.90% 138 5.50% 84 - - 2 224<br />

TOTAL FINANCIAL DEBT - 1,070 - 96 - 37 21 1,224<br />

Fair<br />

value<br />

An interest rate swap contracted by Cap Gemini S.A. on October 28,<br />

2004 and maturing in January 2010, as a hedge of the “OCEANE<br />

2003” convertible/exchangeable bonds. This swap covers a notional<br />

amount of €460 million over a remaining period of three years.<br />

In view of the increase in short-term interest rates in 2006 and current<br />

market forecasts through to the maturity of the “OCEANE 2003”<br />

bonds on January 1, 2010, this interest rate swap was amended on<br />

September 15, 2006. Under the revised terms of the swap contract,