Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

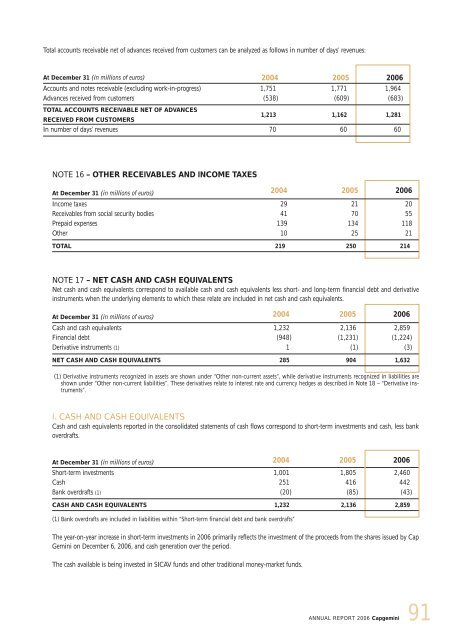

Total accounts receivable net of advances received from customers can be analyzed as follows in number of days’ revenues:<br />

At December 31 (in millions of euros) 2004 2005 2006<br />

Accounts and notes receivable (excluding work-in-progress) 1,751 1,771 1,964<br />

Advances received from customers (538) (609) (683)<br />

TOTAL ACCOUNTS RECEIVABLE NET OF ADVANCES<br />

RECEIVED FROM CUSTOMERS<br />

1,213 1,162 1,281<br />

In number of days’ revenues 70 60 60<br />

NOTE 16 – OTHER RECEIVABLES AND INCOME TAXES<br />

At December 31 (in millions of euros) 2004 2005 2006<br />

Income taxes 29 21 20<br />

Receivables from social security bodies 41 70 55<br />

Prepaid expenses 139 134 118<br />

Other 10 25 21<br />

TOTAL 219 250 214<br />

NOTE 17 – NET CASH AND CASH EQUIVALENTS<br />

Net cash and cash equivalents correspond to available cash and cash equivalents less short- and long-term financial debt and derivative<br />

instruments when the underlying elements to which these relate are included in net cash and cash equivalents.<br />

At December 31 (in millions of euros) 2004 2005 2006<br />

Cash and cash equivalents 1,232 2,136 2,859<br />

Financial debt (948) (1,231) (1,224)<br />

Derivative instruments (1) 1 (1) (3)<br />

NET CASH AND CASH EQUIVALENTS 285 904 1,632<br />

(1) Derivative instruments recognized in assets are shown under “Other non-current assets”, while derivative instruments recognized in liabilities are<br />

shown under “Other non-current liabilities”. These derivatives relate to interest rate and currency hedges as described in Note 18 – “Derivative instruments”.<br />

I. CASH AND CASH EQUIVALENTS<br />

Cash and cash equivalents reported in the consolidated statements of cash flows correspond to short-term investments and cash, less bank<br />

overdrafts.<br />

At December 31 (in millions of euros) 2004 2005 2006<br />

Short-term investments 1,001 1,805 2,460<br />

Cash 251 416 442<br />

Bank overdrafts (1) (20) (85) (43)<br />

CASH AND CASH EQUIVALENTS 1,232 2,136 2,859<br />

(1) Bank overdrafts are included in liabilities within “Short-term financial debt and bank overdrafts”<br />

The year-on-year increase in short-term investments in 2006 primarily reflects the investment of the proceeds from the shares issued by Cap<br />

Gemini on December 6, 2006, and cash generation over the period.<br />

The cash available is being invested in SICAV funds and other traditional money-market funds.<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

91