Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

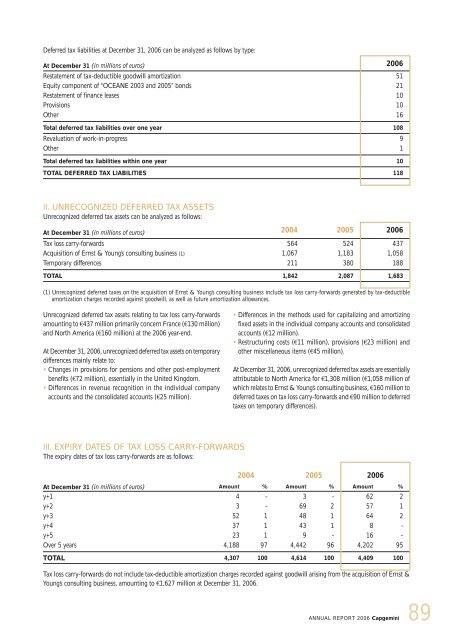

Deferred tax liabilities at December 31, 2006 can be analyzed as follows by type:<br />

At December 31 (in millions of euros)<br />

Restatement of tax-deductible goodwill amortization 51<br />

Equity component of “OCEANE 2003 and 2005” bonds 21<br />

Restatement of finance leases 10<br />

Provisions 10<br />

Other 16<br />

Total deferred tax liabilities over one year 108<br />

Revaluation of work-in-progress 9<br />

Other 1<br />

Total deferred tax liabilities within one year 10<br />

TOTAL DEFERRED TAX LIABILITIES 118<br />

II. UNRECOGNIZED DEFERRED TAX ASSETS<br />

Unrecognized deferred tax assets can be analyzed as follows:<br />

At December 31 (in millions of euros) 2004 2005 2006<br />

Tax loss carry-forwards 564 524 437<br />

Acquisition of Ernst & Young’s consulting business (1) 1,067 1,183 1,058<br />

Temporary differences 211 380 188<br />

TOTAL 1,842 2,087 1,683<br />

(1) Unrecognized deferred taxes on the acquisition of Ernst & Young’s consulting business include tax loss carry-forwards generated by tax-deductible<br />

amortization charges recorded against goodwill, as well as future amortization allowances.<br />

Unrecognized deferred tax assets relating to tax loss carry-forwards<br />

amounting to €437 million primarily concern France (€130 million)<br />

and North America (€160 million) at the 2006 year-end.<br />

At December 31, 2006, unrecognized deferred tax assets on temporary<br />

differences mainly relate to:<br />

Changes in provisions for pensions and other post-employment<br />

benefits (€72 million), essentially in the United Kingdom.<br />

Differences in revenue recognition in the individual company<br />

accounts and the consolidated accounts (€25 million).<br />

III. EXPIRY DATES OF TAX LOSS CARRY-FORWARDS<br />

The expiry dates of tax loss carry-forwards are as follows:<br />

2006<br />

Differences in the methods used for capitalizing and amortizing<br />

fixed assets in the individual company accounts and consolidated<br />

accounts (€12 million).<br />

Restructuring costs (€11 million), provisions (€23 million) and<br />

other miscellaneous items (€45 million).<br />

At December 31, 2006, unrecognized deferred tax assets are essentially<br />

attributable to North America for €1,308 million (€1,058 million of<br />

which relates to Ernst & Young’s consulting business, €160 million to<br />

deferred taxes on tax loss carry-forwards and €90 million to deferred<br />

taxes on temporary differences).<br />

2004 2005 2006<br />

At December 31 (in millions of euros)<br />

Amount % Amount % Amount %<br />

y+1 4 - 3 - 62 2<br />

y+2 3 - 69 2 57 1<br />

y+3 52 1 48 1 64 2<br />

y+4 37 1 43 1 8 -<br />

y+5 23 1 9 - 16 -<br />

Over 5 years 4,188 97 4,442 96 4,202 95<br />

TOTAL 4,307 100 4,614 100 4,409 100<br />

Tax loss carry-forwards do not include tax-deductible amortization charges recorded against goodwill arising from the acquisition of Ernst &<br />

Young’s consulting business, amounting to €1,627 million at December 31, 2006.<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

89