Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

74 ANNUAL<br />

GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

<strong>Capgemini</strong><br />

T) Exchange gains and losses on intragroup<br />

transactions<br />

The results and financial position of a foreign subsidiary are included<br />

in the Group’s consolidated financial statements using normal consolidation<br />

procedures, such as the elimination of intragroup balances and<br />

intragroup transactions. However, an intragroup short- or long-term<br />

monetary asset (or liability) cannot be eliminated against the corresponding<br />

intragroup liability (or asset) without showing the results of<br />

currency fluctuations in the consolidated financial statements. This is<br />

because the monetary item represents a commitment to convert one<br />

currency into another and exposes the Group to a gain or loss through<br />

currency fluctuations. Accordingly, in the consolidated financial<br />

NOTE 2 – CHANGE IN ACCOUNTING METHOD<br />

The Group has decided to recognize in equity the full amount of actuarial<br />

gains and losses relating to defined benefit plans in the period in<br />

which they arise, in line with the amendment to IAS 19 – “Employee<br />

Benefits: Actuarial Gains and Losses, Group Plans and Disclosures”,<br />

effective January 1, 2006. It will no longer use the corridor method,<br />

which consists of recognizing the portion of net cumulative unrecognized<br />

actuarial gains and losses that exceeds the greater of (i) 10%<br />

of the present value of the defined benefit obligation and (ii) 10%<br />

of the fair value of the plan assets at the balance sheet date, over the<br />

average remaining service lives of plan participants.<br />

This change in accounting method was applied retrospectively in<br />

accordance with the transitional provisions of the amended IAS 19,<br />

as follows:<br />

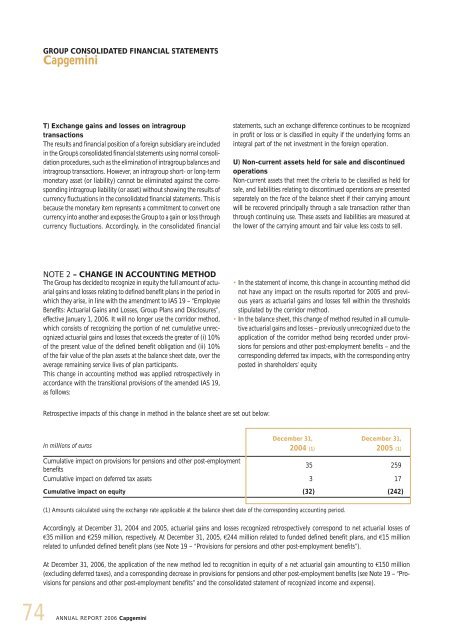

Retrospective impacts of this change in method in the balance sheet are set out below:<br />

in millions of euros<br />

REPORT 2006 <strong>Capgemini</strong><br />

statements, such an exchange difference continues to be recognized<br />

in profit or loss or is classified in equity if the underlying forms an<br />

integral part of the net investment in the foreign operation.<br />

U) Non-current assets held for sale and discontinued<br />

operations<br />

Non-current assets that meet the criteria to be classified as held for<br />

sale, and liabilities relating to discontinued operations are presented<br />

separately on the face of the balance sheet if their carrying amount<br />

will be recovered principally through a sale transaction rather than<br />

through continuing use. These assets and liabilities are measured at<br />

the lower of the carrying amount and fair value less costs to sell.<br />

In the statement of income, this change in accounting method did<br />

not have any impact on the results reported for 2005 and previous<br />

years as actuarial gains and losses fell within the thresholds<br />

stipulated by the corridor method.<br />

In the balance sheet, this change of method resulted in all cumulative<br />

actuarial gains and losses – previously unrecognized due to the<br />

application of the corridor method being recorded under provisions<br />

for pensions and other post-employment benefits – and the<br />

corresponding deferred tax impacts, with the corresponding entry<br />

posted in shareholders’ equity.<br />

December 31,<br />

2004 (1)<br />

December 31,<br />

2005 (1)<br />

Cumulative impact on provisions for pensions and other post-employment<br />

benefits<br />

35 259<br />

Cumulative impact on deferred tax assets 3 17<br />

Cumulative impact on equity (32) (242)<br />

(1) Amounts calculated using the exchange rate applicable at the balance sheet date of the corresponding accounting period.<br />

Accordingly, at December 31, 2004 and 2005, actuarial gains and losses recognized retrospectively correspond to net actuarial losses of<br />

€35 million and €259 million, respectively. At December 31, 2005, €244 million related to funded defined benefit plans, and €15 million<br />

related to unfunded defined benefit plans (see Note 19 – “Provisions for pensions and other post-employment benefits”).<br />

At December 31, 2006, the application of the new method led to recognition in equity of a net actuarial gain amounting to €150 million<br />

(excluding deferred taxes), and a corresponding decrease in provisions for pensions and other post-employment benefits (see Note 19 – “Provisions<br />

for pensions and other post-employment benefits” and the consolidated statement of recognized income and expense).