Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 ANNUAL<br />

THE GROUP<br />

<strong>Capgemini</strong><br />

TME at <strong>Capgemini</strong>. As well as the price war, the competition<br />

is also fighting tooth and nail over service quality, the key to<br />

obtaining customer loyalty and a prerequisite for selling yet<br />

more services. This trend is making for increased complexity<br />

in customer relations. Finally, as well as introducing these<br />

new services, operators are turning their attentions to emergent<br />

countries as an avenue for revitalizing their growth. Vodafone is<br />

an example of this, in India.<br />

Taking stock of 2006. Against this background, <strong>Capgemini</strong>,<br />

on the strength of its great knowledge of the sector and its<br />

technological expertise, is helping the operators to define their<br />

strategies with regard to the new services, to manage their launches<br />

and to find new business models that will guarantee the<br />

operators’ revenues and growth of their margins. The Group is<br />

also involved, via dedicated service centers, in the development<br />

and consolidation of customer billing systems. These centers<br />

make it possible to leverage the benefits of knowing the IT system<br />

inside-out while guaranteeing efficient integration between<br />

the system components, so that the operators will be able to<br />

measure and profit from all the aspects of convergence. “What<br />

is more, targeted outsourcing focused on specific applications or<br />

BPO is starting to make an appearance in Europe”, Didier Bonnet<br />

points out. It is also the case that new web service and mobile<br />

providers could end up outsourcing their billing and their customer<br />

management.<br />

Prospects for 2007. In light of the anticipated boom in convergence<br />

services, <strong>Capgemini</strong> will be looking to underpin its business<br />

and technological capacities in certain market segments.<br />

This will include, in particular, the creation of dedicated telecom<br />

centers in Morocco and India, using specialized structures in<br />

order to provide operators with the advantages of our Rightshore<br />

approach. Last but not least, the Group is also intending to play<br />

a key role as intermediary between the operators and the content<br />

producers – those who supply the content for the convergent<br />

services – via Digital Media Delivery, an entity of <strong>Capgemini</strong><br />

dedicated to the management of digital content.<br />

IV - THE IT SERVICES MARKET<br />

AND COMPETITION<br />

A) Market size and forecasts by segment<br />

2006 – 2010<br />

Continued economic recovery and sustained expenditure<br />

outside of IT organizations enabled continued growth in IT<br />

expenditure in 2006. Investment in innovation is more widespread<br />

than in recent years although many businesses remain<br />

focussed on improving internal processes and reducing costs.<br />

REPORT 2006 <strong>Capgemini</strong><br />

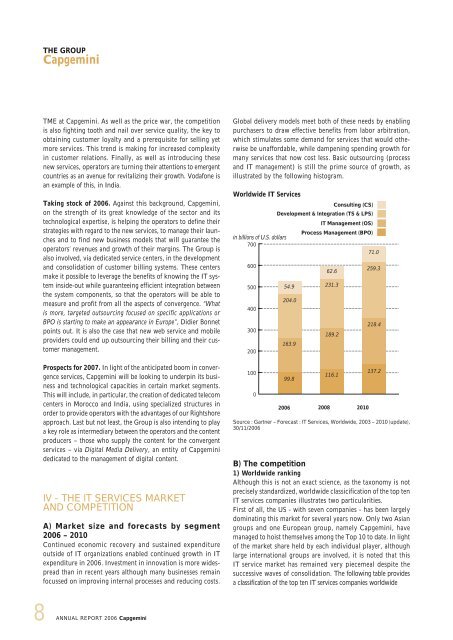

Global delivery models meet both of these needs by enabling<br />

purchasers to draw effective benefits from labor arbitration,<br />

which stimulates some demand for services that would otherwise<br />

be unaffordable, while dampening spending growth for<br />

many services that now cost less. Basic outsourcing (process<br />

and IT management) is still the prime source of growth, as<br />

illustrated by the following histogram.<br />

Worldwide IT Services<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

54.9<br />

204.0<br />

163.9<br />

99.8<br />

62.6<br />

231.3<br />

189.2<br />

116.1<br />

Consulting (CS)<br />

Development & Integration (TS & LPS)<br />

IT Management (OS)<br />

Process Management (BPO)<br />

in billions of U.S. dollars<br />

700<br />

71.0<br />

2006 2008 2010<br />

259.3<br />

218.4<br />

137.2<br />

Source : Gartner – Forecast : IT Services, Worldwide, 2003 – 2010 (update),<br />

30/11/2006<br />

B) The competition<br />

1) Worldwide ranking<br />

Although this is not an exact science, as the taxonomy is not<br />

precisely standardized, worldwide classicification of the top ten<br />

IT services companies illustrates two particularities.<br />

First of all, the US - with seven companies - has been largely<br />

dominating this market for several years now. Only two Asian<br />

groups and one European group, namely <strong>Capgemini</strong>, have<br />

managed to hoist themselves among the Top 10 to date. In light<br />

of the market share held by each individual player, although<br />

large international groups are involved, it is noted that this<br />

IT service market has remained very piecemeal despite the<br />

successive waves of consolidation. The following table provides<br />

a classification of the top ten IT services companies worldwide