You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Reconciliation of the acquisition cost of property, plant and equipment in the balance sheet with the amount reported in the cash<br />

flow statement<br />

The acquisition cost of property, plant and equipment reported in the balance sheet (€131 million) is different from the figure provided in<br />

the cash flow statement (€72 million), which excludes transactions with no cash impact (i.e., acquisitions of assets held under finance leases<br />

amounting to €59 million in 2006).<br />

NOTE 13 – DEFERRED TAXES<br />

I. RECOGNIZED DEFERRED TAX ASSETS AND LIABILITIES<br />

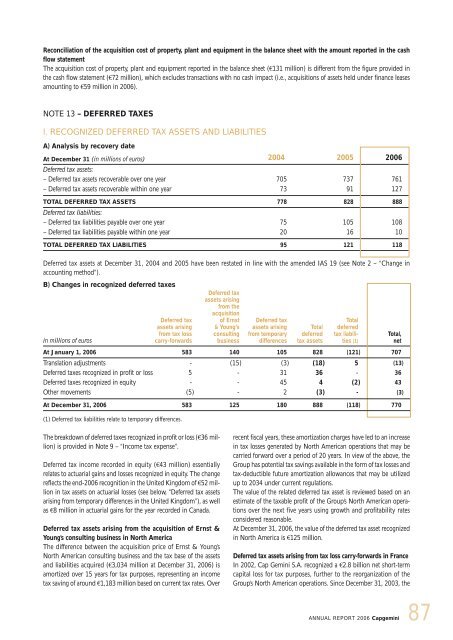

A) Analysis by recovery date<br />

At December 31 (in millions of euros) 2004 2005 2006<br />

Deferred tax assets:<br />

– Deferred tax assets recoverable over one year 705 737 761<br />

– Deferred tax assets recoverable within one year 73 91 127<br />

TOTAL DEFERRED TAX ASSETS<br />

Deferred tax liabilities:<br />

778 828 888<br />

– Deferred tax liabilities payable over one year 75 105 108<br />

– Deferred tax liabilities payable within one year 20 16 10<br />

TOTAL DEFERRED TAX LIABILITIES 95 121 118<br />

Deferred tax assets at December 31, 2004 and 2005 have been restated in line with the amended IAS 19 (see Note 2 – “Change in<br />

accounting method”).<br />

B) Changes in recognized deferred taxes<br />

in millions of euros<br />

Deferred tax<br />

assets arising<br />

from tax loss<br />

carry-forwards<br />

Deferred tax<br />

assets arising<br />

from the<br />

acquisition<br />

of Ernst<br />

& Young’s<br />

consulting<br />

business<br />

Deferred tax<br />

assets arising<br />

from temporary<br />

differences<br />

Total<br />

deferred<br />

tax assets<br />

Total<br />

deferred<br />

tax liabilities<br />

(1)<br />

At January 1, 2006 583 140 105 828 (121) 707<br />

Translation adjustments - (15) (3) (18) 5 (13)<br />

Deferred taxes recognized in profit or loss 5 - 31 36 - 36<br />

Deferred taxes recognized in equity - - 45 4 (2) 43<br />

Other movements (5) - 2 (3) - (3)<br />

At December 31, 2006 583 125 180 888 (118) 770<br />

(1) Deferred tax liabilities relate to temporary differences.<br />

The breakdown of deferred taxes recognized in profit or loss (€36 million)<br />

is provided in Note 9 – “Income tax expense”.<br />

Deferred tax income recorded in equity (€43 million) essentially<br />

relates to actuarial gains and losses recognized in equity. The change<br />

reflects the end-2006 recognition in the United Kingdom of €52 million<br />

in tax assets on actuarial losses (see below, “Deferred tax assets<br />

arising from temporary differences in the United Kingdom”), as well<br />

as €8 million in actuarial gains for the year recorded in Canada.<br />

Deferred tax assets arising from the acquisition of Ernst &<br />

Young’s consulting business in North America<br />

The difference between the acquisition price of Ernst & Young’s<br />

North American consulting business and the tax base of the assets<br />

and liabilities acquired (€3,034 million at December 31, 2006) is<br />

amortized over 15 years for tax purposes, representing an income<br />

tax saving of around €1,183 million based on current tax rates. Over<br />

Total,<br />

net<br />

recent fiscal years, these amortization charges have led to an increase<br />

in tax losses generated by North American operations that may be<br />

carried forward over a period of 20 years. In view of the above, the<br />

Group has potential tax savings available in the form of tax losses and<br />

tax-deductible future amortization allowances that may be utilized<br />

up to 2034 under current regulations.<br />

The value of the related deferred tax asset is reviewed based on an<br />

estimate of the taxable profit of the Group’s North American operations<br />

over the next five years using growth and profitability rates<br />

considered reasonable.<br />

At December 31, 2006, the value of the deferred tax asset recognized<br />

in North America is €125 million.<br />

Deferred tax assets arising from tax loss carry-forwards in France<br />

In 2002, Cap Gemini S.A. recognized a €2.8 billion net short-term<br />

capital loss for tax purposes, further to the reorganization of the<br />

Group’s North American operations. Since December 31, 2003, the<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

87