You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

94 ANNUAL<br />

GROUP CONSOLIDATED FINANCIAL STATEMENTS<br />

<strong>Capgemini</strong><br />

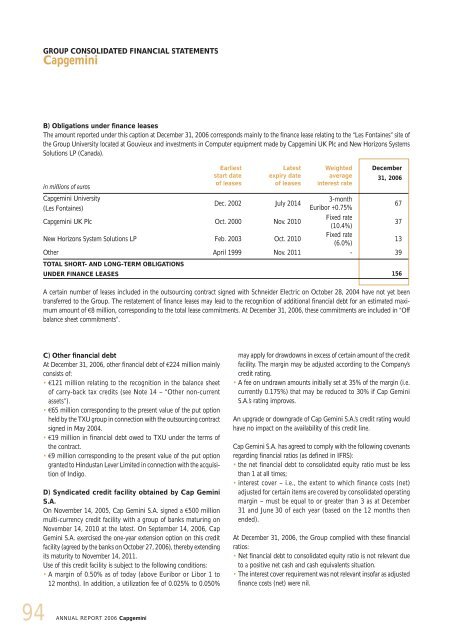

B) Obligations under finance leases<br />

The amount reported under this caption at December 31, 2006 corresponds mainly to the finance lease relating to the “Les Fontaines” site of<br />

the Group University located at Gouvieux and investments in Computer equipment made by <strong>Capgemini</strong> UK Plc and New Horizons Systems<br />

Solutions LP (Canada).<br />

in millions of euros<br />

<strong>Capgemini</strong> University<br />

(Les Fontaines)<br />

C) Other financial debt<br />

At December 31, 2006, other financial debt of €224 million mainly<br />

consists of:<br />

€121 million relating to the recognition in the balance sheet<br />

of carry-back tax credits (see Note 14 – “Other non-current<br />

assets”).<br />

€65 million corresponding to the present value of the put option<br />

held by the TXU group in connection with the outsourcing contract<br />

signed in May 2004.<br />

€19 million in financial debt owed to TXU under the terms of<br />

the contract.<br />

€9 million corresponding to the present value of the put option<br />

granted to Hindustan Lever Limited in connection with the acquisition<br />

of Indigo.<br />

D) Syndicated credit facility obtained by Cap Gemini<br />

S.A.<br />

On November 14, 2005, Cap Gemini S.A. signed a €500 million<br />

multi-currency credit facility with a group of banks maturing on<br />

November 14, 2010 at the latest. On September 14, 2006, Cap<br />

Gemini S.A. exercised the one-year extension option on this credit<br />

facility (agreed by the banks on October 27, 2006), thereby extending<br />

its maturity to November 14, 2011.<br />

Use of this credit facility is subject to the following conditions:<br />

A margin of 0.50% as of today (above Euribor or Libor 1 to<br />

12 months). In addition, a utilization fee of 0.025% to 0.050%<br />

REPORT 2006 <strong>Capgemini</strong><br />

Earliest<br />

start date<br />

of leases<br />

Latest<br />

expiry date<br />

of leases<br />

Weighted<br />

average<br />

interest rate<br />

December<br />

31, 2006<br />

Dec. 2002 July 2014<br />

3-month<br />

Euribor +0.75%<br />

67<br />

<strong>Capgemini</strong> UK Plc Oct. 2000 Nov. 2010<br />

Fixed rate<br />

(10.4%)<br />

37<br />

New Horizons System Solutions LP Feb. 2003 Oct. 2010<br />

Fixed rate<br />

(6.0%)<br />

13<br />

Other April 1999 Nov. 2011 - 39<br />

TOTAL SHORT- AND LONG-TERM OBLIGATIONS<br />

UNDER FINANCE LEASES 156<br />

A certain number of leases included in the outsourcing contract signed with Schneider Electric on October 28, 2004 have not yet been<br />

transferred to the Group. The restatement of finance leases may lead to the recognition of additional financial debt for an estimated maximum<br />

amount of €8 million, corresponding to the total lease commitments. At December 31, 2006, these commitments are included in “Off<br />

balance sheet commitments”.<br />

may apply for drawdowns in excess of certain amount of the credit<br />

facility. The margin may be adjusted according to the Company’s<br />

credit rating.<br />

A fee on undrawn amounts initially set at 35% of the margin (i.e.<br />

currently 0.175%) that may be reduced to 30% if Cap Gemini<br />

S.A.’s rating improves.<br />

An upgrade or downgrade of Cap Gemini S.A.’s credit rating would<br />

have no impact on the availability of this credit line.<br />

Cap Gemini S.A. has agreed to comply with the following covenants<br />

regarding financial ratios (as defined in IFRS):<br />

the net financial debt to consolidated equity ratio must be less<br />

than 1 at all times;<br />

interest cover – i.e., the extent to which finance costs (net)<br />

adjusted for certain items are covered by consolidated operating<br />

margin – must be equal to or greater than 3 as at December<br />

31 and June 30 of each year (based on the 12 months then<br />

ended).<br />

At December 31, 2006, the Group complied with these financial<br />

ratios:<br />

Net financial debt to consolidated equity ratio is not relevant due<br />

to a positive net cash and cash equivalents situation.<br />

The interest cover requirement was not relevant insofar as adjusted<br />

finance costs (net) were nil.