Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The facility agreement includes covenants restricting the Company’s<br />

ability to carry out certain operations. These covenants also apply to<br />

Group subsidiaries. They include restrictions primarily relating to:<br />

pledging certain assets as collateral,<br />

asset sales, mergers or similar transactions.<br />

Cap Gemini S.A. also committed to standard obligations, including<br />

obtaining and retaining the necessary authorizations, maintaining<br />

insurance cover and maintaining pari passu treatment.<br />

III. MAIN CHARACTERISTICS OF FINANCIAL DEBT<br />

A) Interest rates and currencies<br />

Average interest rate on Group financial debt<br />

In 2006, the average interest rate on the Group’s financial debt was 5.3%.<br />

Lastly, the agreement contains the usual provisions relating to early<br />

repayment, including for failure to pay sums due, misrepresentation<br />

or failure to comply with other obligations included in the agreement<br />

(subject to any applicable “grace” periods), cross-defaults (in excess<br />

of a minimum threshold), insolvency and bankruptcy proceedings,<br />

change of control, or changes which would have a significant negative<br />

impact on the financial position of the Group.<br />

At the date of this report, no drawdowns had been made on this<br />

credit facility.<br />

Fixed rates/variable rates<br />

At December 31, 2006, 41% of Group financial debt is at variable rates, of which 35% is capped, and 59% is at fixed rates.<br />

Analysis of the sensitivity of net finance costs in 2006 to a rise in interest rates<br />

The impact on gross finance costs of a theoretical 1% annual average rise in interest rates based on an annual average financial debt position,<br />

is an estimated €1 million (€6 million at December 31, 2005).<br />

The impact on income from cash and cash equivalents of a theoretical 1% annual average rise in interest rates based on an annual average<br />

cash and cash equivalents position, is an estimated €20 million (€14 million at December 31, 2005).<br />

Accordingly, a 1% increase in interest rates would have an estimated €19 million positive impact on net finance costs.<br />

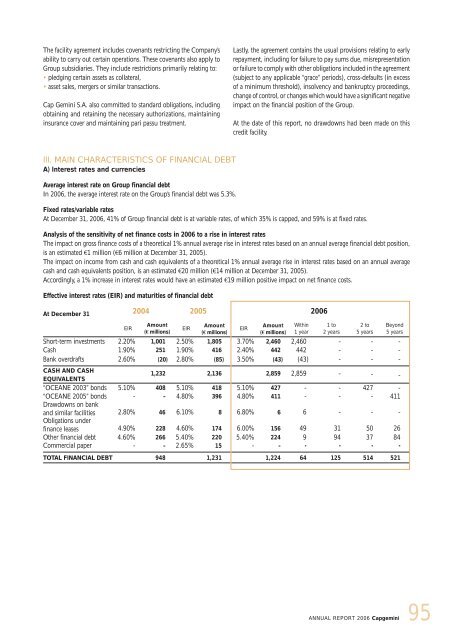

Effective interest rates (EIR) and maturities of financial debt<br />

At December 31 2004 2005 2006<br />

EIR<br />

Amount<br />

(€ millions)<br />

EIR<br />

Amount<br />

(€ millions)<br />

EIR<br />

Amount<br />

(€ millions)<br />

Within<br />

1 year<br />

1 to<br />

2 years<br />

2 to<br />

5 years<br />

Short-term investments 2.20% 1,001 2.50% 1,805 3.70% 2,460 2,460 - - -<br />

Cash 1.90% 251 1.90% 416 2.40% 442 442 - - -<br />

Bank overdrafts 2.60% (20) 2.80% (85) 3.50% (43) (43) - - -<br />

Beyond<br />

5 years<br />

CASH AND CASH<br />

EQUIVALENTS<br />

1,232<br />

2,136 2,859 2,859 - - -<br />

“OCEANE 2003” bonds 5.10% 408 5.10% 418 5.10% 427 - - 427 -<br />

“OCEANE 2005” bonds<br />

Drawdowns on bank<br />

- - 4.80% 396 4.80% 411 - - - 411<br />

and similar facilities<br />

Obligations under<br />

2.80% 46 6.10% 8 6.80% 6 6 - - -<br />

finance leases 4.90% 228 4.60% 174 6.00% 156 49 31 50 26<br />

Other financial debt 4.60% 266 5.40% 220 5.40% 224 9 94 37 84<br />

Commercial paper - - 2.65% 15 - - - - - -<br />

TOTAL FINANCIAL DEBT 948 1,231 1,224 64 125 514 521<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

95