You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

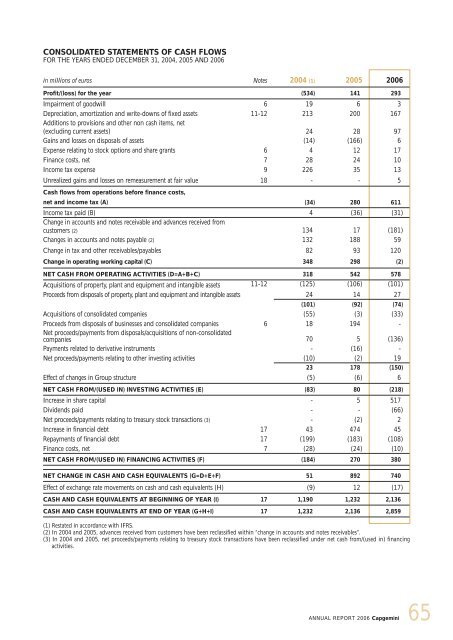

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

FOR THE YEARS ENDED DECEMBER 31, 2004, 2005 AND 2006<br />

in millions of euros Notes 2004 (1) 2005 2006<br />

Profit/(loss) for the year (534) 141 293<br />

Impairment of goodwill 6 19 6 3<br />

Depreciation, amortization and write-downs of fixed assets<br />

Additions to provisions and other non cash items, net<br />

11-12 213 200 167<br />

(excluding current assets) 24 28 97<br />

Gains and losses on disposals of assets (14) (166) 6<br />

Expense relating to stock options and share grants 6 4 12 17<br />

Finance costs, net 7 28 24 10<br />

Income tax expense 9 226 35 13<br />

Unrealized gains and losses on remeasurement at fair value 18 - - 5<br />

Cash flows from operations before finance costs,<br />

net and income tax (A) (34) 280 611<br />

Income tax paid (B)<br />

Change in accounts and notes receivable and advances received from<br />

4 (36) (31)<br />

customers (2) 134 17 (181)<br />

Changes in accounts and notes payable (2) 132 188 59<br />

Change in tax and other receivables/payables 82 93 120<br />

Change in operating working capital (C) 348 298 (2)<br />

NET CASH FROM OPERATING ACTIVITIES (D=A+B+C) 318 542 578<br />

Acquisitions of property, plant and equipment and intangible assets 11-12 (125) (106) (101)<br />

Proceeds from disposals of property, plant and equipment and intangible assets 24 14 27<br />

(101) (92) (74)<br />

Acquisitions of consolidated companies (55) (3) (33)<br />

Proceeds from disposals of businesses and consolidated companies 6 18 194 -<br />

Net proceeds/payments from disposals/acquisitions of non-consolidated<br />

companies 70 5 (136)<br />

Payments related to derivative instruments - (16) -<br />

Net proceeds/payments relating to other investing activities (10) (2) 19<br />

23 178 (150)<br />

Effect of changes in Group structure (5) (6) 6<br />

NET CASH FROM/(USED IN) INVESTING ACTIVITIES (E) (83) 80 (218)<br />

Increase in share capital - 5 517<br />

Dividends paid - - (66)<br />

Net proceeds/payments relating to treasury stock transactions (3) - (2) 2<br />

Increase in financial debt 17 43 474 45<br />

Repayments of financial debt 17 (199) (183) (108)<br />

Finance costs, net 7 (28) (24) (10)<br />

NET CASH FROM/(USED IN) FINANCING ACTIVITIES (F) (184) 270 380<br />

NET CHANGE IN CASH AND CASH EQUIVALENTS (G=D+E+F) 51 892 740<br />

Effect of exchange rate movements on cash and cash equivalents (H) (9) 12 (17)<br />

CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR (I) 17 1,190 1,232 2,136<br />

CASH AND CASH EQUIVALENTS AT END OF YEAR (G+H+I) 17 1,232 2,136 2,859<br />

(1) Restated in accordance with IFRS.<br />

(2) In 2004 and 2005, advances received from customers have been reclassified within “change in accounts and notes receivables”.<br />

(3) In 2004 and 2005, net proceeds/payments relating to treasury stock transactions have been reclassified under net cash from/(used in) financing<br />

activities.<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

65