Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(1) Restated in accordance with IFRS.<br />

(2) See Note 1.K. – “Treasury stock”.<br />

(3) There were no minority interests at December 31, 2006 (see Note 3.B. – “Changes in Group structure: 2006”).<br />

(4) The method for measuring and recognizing stock options and share grants is described in Note 10.A. – “Stock option plans and share grants”.<br />

(5) Dividends paid to shareholders for 2005 totaled €66 million (€0.50 per share).<br />

(6) The second tranche of the alternative public exchange offer for Transiciel shares launched by Cap Gemini S.A. on October 20, 2003, contained an<br />

earn-out mechanism. At December 31, 2005, this additional purchase consideration was estimated at €11 million.<br />

In accordance with section 1.4.13.6 of the prospectus approved on October 29, 2003 by the Commission des Opérations de Bourse under reference<br />

number 03-935, the third-party mediator authorized, on June 27, 2006, a maximum number of 315,332 Cap Gemini shares to be allocated on exercise<br />

of 8,137,600 equity warrants. At the close of the exercise period for these equity warrants (June 30, 2006 to July 31, 2006), 8,055,558 warrants had<br />

been exercised, giving rise to the issue of 312,127 new shares during the second half of 2006 totaling €11 million.<br />

The provisions set aside in 2004 and 2005 in connection with the earn-out mechanism have been reversed (€9 million and €2 million, respectively).<br />

(7) In connection with the increase in share capital of December 6, 2006, the Company issued 11,397,310 new Cap Gemini shares (after exercise of<br />

the greenshoe option relating to 1,036,119 shares) with no preferential subscription rights or priority timing for existing shareholders, at a price of<br />

€44.50 per share. Gross proceeds from this share issue including the issue premium amounted to €507 million. Issue costs totaled €9 million.<br />

(8) See Note 10.B. – “Share buyback program”.<br />

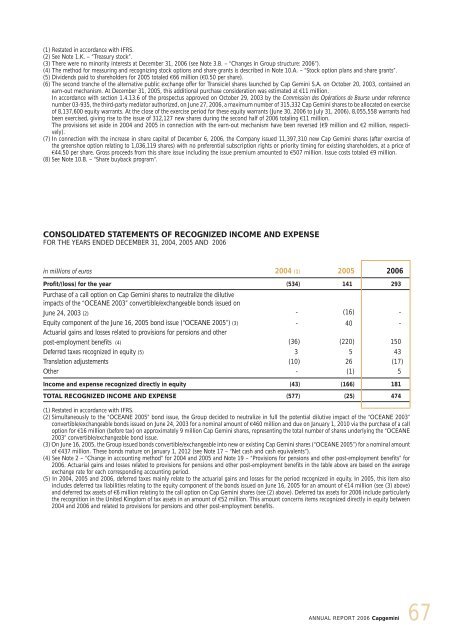

CONSOLIDATED STATEMENTS OF RECOGNIZED INCOME AND EXPENSE<br />

FOR THE YEARS ENDED DECEMBER 31, 2004, 2005 AND 2006<br />

in millions of euros 2004 (1) 2005 2006<br />

Profit/(loss) for the year (534) 141 293<br />

Purchase of a call option on Cap Gemini shares to neutralize the dilutive<br />

impacts of the “OCEANE 2003” convertible/exchangeable bonds issued on<br />

June 24, 2003 (2) - (16) -<br />

Equity component of the June 16, 2005 bond issue (“OCEANE 2005”) (3) - 40 -<br />

Actuarial gains and losses related to provisions for pensions and other<br />

post-employment benefits (4) (36) (220) 150<br />

Deferred taxes recognized in equity (5) 3 5 43<br />

Translation adjustements (10) 26 (17)<br />

Other - (1) 5<br />

Income and expense recognized directly in equity (43) (166) 181<br />

TOTAL RECOGNIZED INCOME AND EXPENSE (577) (25) 474<br />

(1) Restated in accordance with IFRS.<br />

(2) Simultaneously to the “OCEANE 2005” bond issue, the Group decided to neutralize in full the potential dilutive impact of the “OCEANE 2003”<br />

convertible/exchangeable bonds issued on June 24, 2003 for a nominal amount of €460 million and due on January 1, 2010 via the purchase of a call<br />

option for €16 million (before tax) on approximately 9 million Cap Gemini shares, representing the total number of shares underlying the “OCEANE<br />

2003” convertible/exchangeable bond issue.<br />

(3) On June 16, 2005, the Group issued bonds convertible/exchangeable into new or existing Cap Gemini shares (“OCEANE 2005”) for a nominal amount<br />

of €437 million. These bonds mature on January 1, 2012 (see Note 17 – “Net cash and cash equivalents”).<br />

(4) See Note 2 – “Change in accounting method” for 2004 and 2005 and Note 19 – “Provisions for pensions and other post-employment benefits” for<br />

2006. Actuarial gains and losses related to provisions for pensions and other post-employment benefits in the table above are based on the average<br />

exchange rate for each corresponding accounting period.<br />

(5) In 2004, 2005 and 2006, deferred taxes mainly relate to the actuarial gains and losses for the period recognized in equity. In 2005, this item also<br />

includes deferred tax liabilities relating to the equity component of the bonds issued on June 16, 2005 for an amount of €14 million (see (3) above)<br />

and deferred tax assets of €6 million relating to the call option on Cap Gemini shares (see (2) above). Deferred tax assets for 2006 include particularly<br />

the recognition in the United Kingdom of tax assets in an amount of €52 million. This amount concerns items recognized directly in equity between<br />

2004 and 2006 and related to provisions for pensions and other post-employment benefits.<br />

ANNUAL REPORT 2006 <strong>Capgemini</strong><br />

67