Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

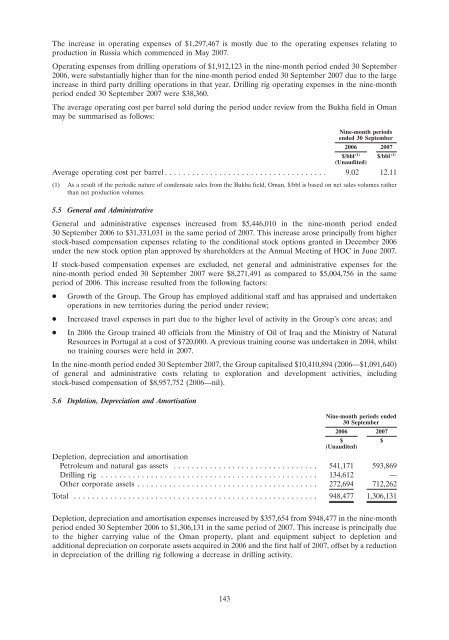

The inc<strong>re</strong>ase in operating expenses of $1,297,467 is mostly due <strong>to</strong> <strong>the</strong> operating expenses <strong>re</strong>lating <strong>to</strong>production in Russia which commenced in May 2007.Operating expenses from drilling operations of $1,912,123 in <strong>the</strong> nine-month period ended 30 September2006, we<strong>re</strong> substantially higher than for <strong>the</strong> nine-month period ended 30 September 2007 due <strong>to</strong> <strong>the</strong> largeinc<strong>re</strong>ase in third party drilling operations in that year. Drilling rig operating expenses in <strong>the</strong> nine-monthperiod ended 30 September 2007 we<strong>re</strong> $38,360.The average operating cost per bar<strong>re</strong>l sold during <strong>the</strong> period under <strong>re</strong>view from <strong>the</strong> Bukha field in Omanmay be summarised as follows:Nine-month periodsended 30 September2006 2007$/bbl (1) $/bbl (1)(Unaudited)Average operating cost per bar<strong>re</strong>l .................................... 9.02 12.11(1) As a <strong>re</strong>sult of <strong>the</strong> periodic natu<strong>re</strong> of condensate sales from <strong>the</strong> Bukha field, Oman, $/bbl is based on net sales volumes ra<strong>the</strong>rthan net production volumes.5.5 General and AdministrativeGeneral and administrative expenses inc<strong>re</strong>ased from $5,446,010 in <strong>the</strong> nine-month period ended30 September 2006 <strong>to</strong> $31,331,031 in <strong>the</strong> same period of 2007. This inc<strong>re</strong>ase arose principally from highers<strong>to</strong>ck-based compensation expenses <strong>re</strong>lating <strong>to</strong> <strong>the</strong> conditional s<strong>to</strong>ck options granted in December 2006under <strong>the</strong> new s<strong>to</strong>ck option plan approved by sha<strong>re</strong>holders at <strong>the</strong> Annual Meeting of HOC in June 2007.If s<strong>to</strong>ck-based compensation expenses a<strong>re</strong> excluded, net general and administrative expenses for <strong>the</strong>nine-month period ended 30 September 2007 we<strong>re</strong> $8,271,491 as compa<strong>re</strong>d <strong>to</strong> $5,004,756 in <strong>the</strong> sameperiod of 2006. This inc<strong>re</strong>ase <strong>re</strong>sulted from <strong>the</strong> following fac<strong>to</strong>rs:Growth of <strong>the</strong> Group. The Group has employed additional staff and has appraised and undertakenoperations in new terri<strong>to</strong>ries during <strong>the</strong> period under <strong>re</strong>view;Inc<strong>re</strong>ased travel expenses in part due <strong>to</strong> <strong>the</strong> higher level of activity in <strong>the</strong> Group’s co<strong>re</strong> a<strong>re</strong>as; andIn 2006 <strong>the</strong> Group trained 40 officials from <strong>the</strong> Ministry of <strong>Oil</strong> of Iraq and <strong>the</strong> Ministry of NaturalResources in Portugal at a cost of $720,000. A p<strong>re</strong>vious training course was undertaken in 2004, whilstno training courses we<strong>re</strong> held in 2007.In <strong>the</strong> nine-month period ended 30 September 2007, <strong>the</strong> Group capitalised $10,410,894 (2006—$1,091,640)of general and administrative costs <strong>re</strong>lating <strong>to</strong> exploration and development activities, includings<strong>to</strong>ck-based compensation of $8,957,752 (2006—nil).5.6 Depletion, Dep<strong>re</strong>ciation and AmortisationNine-month periods ended30 September2006 2007$ $(Unaudited)Depletion, dep<strong>re</strong>ciation and amortisationPetroleum and natural gas assets ................................ 541,171 593,869Drilling rig ................................................ 134,612 —O<strong>the</strong>r corporate assets ........................................ 272,694 712,262Total ...................................................... 948,477 1,306,131Depletion, dep<strong>re</strong>ciation and amortisation expenses inc<strong>re</strong>ased by $357,654 from $948,477 in <strong>the</strong> nine-monthperiod ended 30 September 2006 <strong>to</strong> $1,306,131 in <strong>the</strong> same period of 2007. This inc<strong>re</strong>ase is principally due<strong>to</strong> <strong>the</strong> higher carrying value of <strong>the</strong> Oman property, plant and equipment subject <strong>to</strong> depletion andadditional dep<strong>re</strong>ciation on corporate assets acqui<strong>re</strong>d in 2006 and <strong>the</strong> first half of 2007, offset by a <strong>re</strong>ductionin dep<strong>re</strong>ciation of <strong>the</strong> drilling rig following a dec<strong>re</strong>ase in drilling activity.143