Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

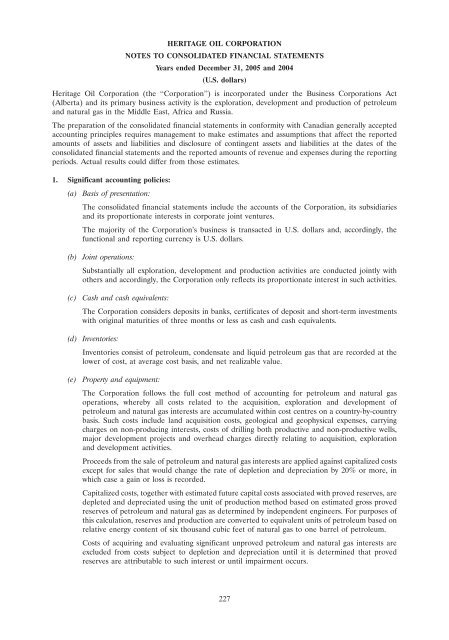

HERITAGE OIL CORPORATIONNOTES TO CONSOLIDATED FINANCIAL STATEMENTSYears ended December 31, 2005 and 2004(U.S. dollars)<strong>Heritage</strong> <strong>Oil</strong> Corporation (<strong>the</strong> ‘‘Corporation’’) is incorporated under <strong>the</strong> Business Corporations Act(Alberta) and its primary business activity is <strong>the</strong> exploration, development and production of petroleumand natural gas in <strong>the</strong> Middle East, Africa and Russia.The p<strong>re</strong>paration of <strong>the</strong> consolidated financial statements in conformity with Canadian generally acceptedaccounting principles <strong>re</strong>qui<strong>re</strong>s management <strong>to</strong> make estimates and assumptions that affect <strong>the</strong> <strong>re</strong>portedamounts of assets and liabilities and disclosu<strong>re</strong> of contingent assets and liabilities at <strong>the</strong> dates of <strong>the</strong>consolidated financial statements and <strong>the</strong> <strong>re</strong>ported amounts of <strong>re</strong>venue and expenses during <strong>the</strong> <strong>re</strong>portingperiods. Actual <strong>re</strong>sults could differ from those estimates.1. Significant accounting policies:(a) Basis of p<strong>re</strong>sentation:The consolidated financial statements include <strong>the</strong> accounts of <strong>the</strong> Corporation, its subsidiariesand its proportionate inte<strong>re</strong>sts in corporate joint ventu<strong>re</strong>s.The majority of <strong>the</strong> Corporation’s business is transacted in U.S. dollars and, accordingly, <strong>the</strong>functional and <strong>re</strong>porting cur<strong>re</strong>ncy is U.S. dollars.(b) Joint operations:Substantially all exploration, development and production activities a<strong>re</strong> conducted jointly witho<strong>the</strong>rs and accordingly, <strong>the</strong> Corporation only <strong>re</strong>flects its proportionate inte<strong>re</strong>st in such activities.(c)Cash and cash equivalents:The Corporation considers deposits in banks, certificates of deposit and short-term investmentswith original maturities of th<strong>re</strong>e months or less as cash and cash equivalents.(d) Inven<strong>to</strong>ries:Inven<strong>to</strong>ries consist of petroleum, condensate and liquid petroleum gas that a<strong>re</strong> <strong>re</strong>corded at <strong>the</strong>lower of cost, at average cost basis, and net <strong>re</strong>alizable value.(e)Property and equipment:The Corporation follows <strong>the</strong> full cost method of accounting for petroleum and natural gasoperations, whe<strong>re</strong>by all costs <strong>re</strong>lated <strong>to</strong> <strong>the</strong> acquisition, exploration and development ofpetroleum and natural gas inte<strong>re</strong>sts a<strong>re</strong> accumulated within cost cent<strong>re</strong>s on a country-by-countrybasis. Such costs include land acquisition costs, geological and geophysical expenses, carryingcharges on non-producing inte<strong>re</strong>sts, costs of drilling both productive and non-productive wells,major development projects and overhead charges di<strong>re</strong>ctly <strong>re</strong>lating <strong>to</strong> acquisition, explorationand development activities.Proceeds from <strong>the</strong> sale of petroleum and natural gas inte<strong>re</strong>sts a<strong>re</strong> applied against capitalized costsexcept for sales that would change <strong>the</strong> rate of depletion and dep<strong>re</strong>ciation by 20% or mo<strong>re</strong>, inwhich case a gain or loss is <strong>re</strong>corded.Capitalized costs, <strong>to</strong>ge<strong>the</strong>r with estimated futu<strong>re</strong> capital costs associated with proved <strong>re</strong>serves, a<strong>re</strong>depleted and dep<strong>re</strong>ciated using <strong>the</strong> unit of production method based on estimated gross proved<strong>re</strong>serves of petroleum and natural gas as determined by independent engineers. For purposes ofthis calculation, <strong>re</strong>serves and production a<strong>re</strong> converted <strong>to</strong> equivalent units of petroleum based on<strong>re</strong>lative energy content of six thousand cubic feet of natural gas <strong>to</strong> one bar<strong>re</strong>l of petroleum.Costs of acquiring and evaluating significant unproved petroleum and natural gas inte<strong>re</strong>sts a<strong>re</strong>excluded from costs subject <strong>to</strong> depletion and dep<strong>re</strong>ciation until it is determined that proved<strong>re</strong>serves a<strong>re</strong> attributable <strong>to</strong> such inte<strong>re</strong>st or until impairment occurs.227