Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

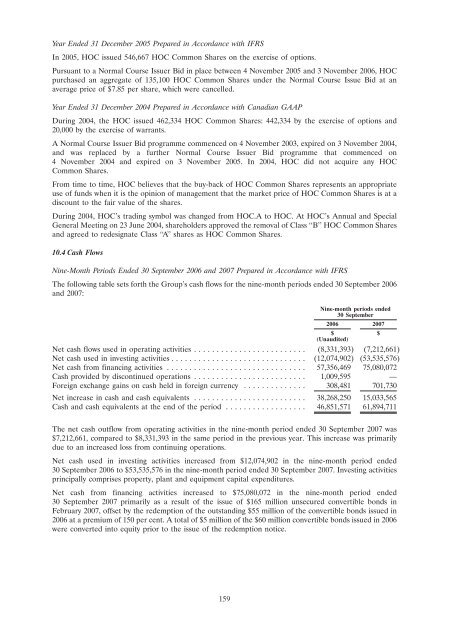

Year Ended 31 December 2005 P<strong>re</strong>pa<strong>re</strong>d in Accordance with IFRSIn 2005, HOC issued 546,667 HOC Common Sha<strong>re</strong>s on <strong>the</strong> exercise of options.Pursuant <strong>to</strong> a Normal Course Issuer Bid in place between 4 November 2005 and 3 November 2006, HOCpurchased an agg<strong>re</strong>gate of 135,100 HOC Common Sha<strong>re</strong>s under <strong>the</strong> Normal Course Issue Bid at anaverage price of $7.85 per sha<strong>re</strong>, which we<strong>re</strong> cancelled.Year Ended 31 December 2004 P<strong>re</strong>pa<strong>re</strong>d in Accordance with Canadian GAAPDuring 2004, <strong>the</strong> HOC issued 462,334 HOC Common Sha<strong>re</strong>s: 442,334 by <strong>the</strong> exercise of options and20,000 by <strong>the</strong> exercise of warrants.A Normal Course Issuer Bid programme commenced on 4 November 2003, expi<strong>re</strong>d on 3 November 2004,and was <strong>re</strong>placed by a fur<strong>the</strong>r Normal Course Issuer Bid programme that commenced on4 November 2004 and expi<strong>re</strong>d on 3 November 2005. In 2004, HOC did not acqui<strong>re</strong> any HOCCommon Sha<strong>re</strong>s.From time <strong>to</strong> time, HOC believes that <strong>the</strong> buy-back of HOC Common Sha<strong>re</strong>s <strong>re</strong>p<strong>re</strong>sents an appropriateuse of funds when it is <strong>the</strong> opinion of management that <strong>the</strong> market price of HOC Common Sha<strong>re</strong>s is at adiscount <strong>to</strong> <strong>the</strong> fair value of <strong>the</strong> sha<strong>re</strong>s.During 2004, HOC’s trading symbol was changed from HOC.A <strong>to</strong> HOC. At HOC’s Annual and SpecialGeneral Meeting on 23 June 2004, sha<strong>re</strong>holders approved <strong>the</strong> <strong>re</strong>moval of Class ‘‘B’’ HOC Common Sha<strong>re</strong>sand ag<strong>re</strong>ed <strong>to</strong> <strong>re</strong>designate Class ‘‘A’’ sha<strong>re</strong>s as HOC Common Sha<strong>re</strong>s.10.4 Cash FlowsNine-Month Periods Ended 30 September 2006 and 2007 P<strong>re</strong>pa<strong>re</strong>d in Accordance with IFRSThe following table sets forth <strong>the</strong> Group’s cash flows for <strong>the</strong> nine-month periods ended 30 September 2006and 2007:Nine-month periods ended30 September2006 2007$ $(Unaudited)Net cash flows used in operating activities ......................... (8,331,393) (7,212,661)Net cash used in investing activities .............................. (12,074,902) (53,535,576)Net cash from financing activities ............................... 57,356,469 75,080,072Cash provided by discontinued operations ......................... 1,009,595 —Fo<strong>re</strong>ign exchange gains on cash held in fo<strong>re</strong>ign cur<strong>re</strong>ncy .............. 308,481 701,730Net inc<strong>re</strong>ase in cash and cash equivalents ......................... 38,268,250 15,033,565Cash and cash equivalents at <strong>the</strong> end of <strong>the</strong> period .................. 46,851,571 61,894,711The net cash outflow from operating activities in <strong>the</strong> nine-month period ended 30 September 2007 was$7,212,661, compa<strong>re</strong>d <strong>to</strong> $8,331,393 in <strong>the</strong> same period in <strong>the</strong> p<strong>re</strong>vious year. This inc<strong>re</strong>ase was primarilydue <strong>to</strong> an inc<strong>re</strong>ased loss from continuing operations.Net cash used in investing activities inc<strong>re</strong>ased from $12,074,902 in <strong>the</strong> nine-month period ended30 September 2006 <strong>to</strong> $53,535,576 in <strong>the</strong> nine-month period ended 30 September 2007. Investing activitiesprincipally comprises property, plant and equipment capital expenditu<strong>re</strong>s.Net cash from financing activities inc<strong>re</strong>ased <strong>to</strong> $75,080,072 in <strong>the</strong> nine-month period ended30 September 2007 primarily as a <strong>re</strong>sult of <strong>the</strong> issue of $165 million unsecu<strong>re</strong>d convertible bonds inFebruary 2007, offset by <strong>the</strong> <strong>re</strong>demption of <strong>the</strong> outstanding $55 million of <strong>the</strong> convertible bonds issued in2006 at a p<strong>re</strong>mium of 150 per cent. A <strong>to</strong>tal of $5 million of <strong>the</strong> $60 million convertible bonds issued in 2006we<strong>re</strong> converted in<strong>to</strong> equity prior <strong>to</strong> <strong>the</strong> issue of <strong>the</strong> <strong>re</strong>demption notice.159