Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

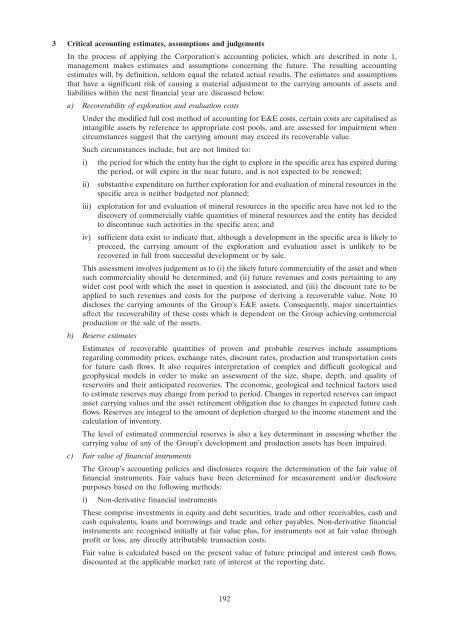

3 Critical accounting estimates, assumptions and judgementsIn <strong>the</strong> process of applying <strong>the</strong> Corporation’s accounting policies, which a<strong>re</strong> described in note 1,management makes estimates and assumptions concerning <strong>the</strong> futu<strong>re</strong>. The <strong>re</strong>sulting accountingestimates will, by definition, seldom equal <strong>the</strong> <strong>re</strong>lated actual <strong>re</strong>sults. The estimates and assumptionsthat have a significant risk of causing a material adjustment <strong>to</strong> <strong>the</strong> carrying amounts of assets andliabilities within <strong>the</strong> next financial year a<strong>re</strong> discussed below:a) Recoverability of exploration and evaluation costsUnder <strong>the</strong> modified full cost method of accounting for E&E costs, certain costs a<strong>re</strong> capitalised asintangible assets by <strong>re</strong>fe<strong>re</strong>nce <strong>to</strong> appropriate cost pools, and a<strong>re</strong> assessed for impairment whencircumstances suggest that <strong>the</strong> carrying amount may exceed its <strong>re</strong>coverable value.Such circumstances include, but a<strong>re</strong> not limited <strong>to</strong>:i) <strong>the</strong> period for which <strong>the</strong> entity has <strong>the</strong> right <strong>to</strong> explo<strong>re</strong> in <strong>the</strong> specific a<strong>re</strong>a has expi<strong>re</strong>d during<strong>the</strong> period, or will expi<strong>re</strong> in <strong>the</strong> near futu<strong>re</strong>, and is not expected <strong>to</strong> be <strong>re</strong>newed;ii) substantive expenditu<strong>re</strong> on fur<strong>the</strong>r exploration for and evaluation of mineral <strong>re</strong>sources in <strong>the</strong>specific a<strong>re</strong>a is nei<strong>the</strong>r budgeted nor planned;iii) exploration for and evaluation of mineral <strong>re</strong>sources in <strong>the</strong> specific a<strong>re</strong>a have not led <strong>to</strong> <strong>the</strong>discovery of commercially viable quantities of mineral <strong>re</strong>sources and <strong>the</strong> entity has decided<strong>to</strong> discontinue such activities in <strong>the</strong> specific a<strong>re</strong>a; andiv) sufficient data exist <strong>to</strong> indicate that, although a development in <strong>the</strong> specific a<strong>re</strong>a is likely <strong>to</strong>proceed, <strong>the</strong> carrying amount of <strong>the</strong> exploration and evaluation asset is unlikely <strong>to</strong> be<strong>re</strong>cove<strong>re</strong>d in full from successful development or by sale.This assessment involves judgement as <strong>to</strong> (i) <strong>the</strong> likely futu<strong>re</strong> commerciality of <strong>the</strong> asset and whensuch commerciality should be determined, and (ii) futu<strong>re</strong> <strong>re</strong>venues and costs pertaining <strong>to</strong> anywider cost pool with which <strong>the</strong> asset in question is associated, and (iii) <strong>the</strong> discount rate <strong>to</strong> beapplied <strong>to</strong> such <strong>re</strong>venues and costs for <strong>the</strong> purpose of deriving a <strong>re</strong>coverable value. Note 10discloses <strong>the</strong> carrying amounts of <strong>the</strong> Group’s E&E assets. Consequently, major uncertaintiesaffect <strong>the</strong> <strong>re</strong>coverability of <strong>the</strong>se costs which is dependent on <strong>the</strong> Group achieving commercialproduction or <strong>the</strong> sale of <strong>the</strong> assets.b) Reserve estimatesEstimates of <strong>re</strong>coverable quantities of proven and probable <strong>re</strong>serves include assumptions<strong>re</strong>garding commodity prices, exchange rates, discount rates, production and transportation costsfor futu<strong>re</strong> cash flows. It also <strong>re</strong>qui<strong>re</strong>s interp<strong>re</strong>tation of complex and difficult geological andgeophysical models in order <strong>to</strong> make an assessment of <strong>the</strong> size, shape, depth, and quality of<strong>re</strong>servoirs and <strong>the</strong>ir anticipated <strong>re</strong>coveries. The economic, geological and technical fac<strong>to</strong>rs used<strong>to</strong> estimate <strong>re</strong>serves may change from period <strong>to</strong> period. Changes in <strong>re</strong>ported <strong>re</strong>serves can impactasset carrying values and <strong>the</strong> asset <strong>re</strong>ti<strong>re</strong>ment obligation due <strong>to</strong> changes in expected futu<strong>re</strong> cashflows. Reserves a<strong>re</strong> integral <strong>to</strong> <strong>the</strong> amount of depletion charged <strong>to</strong> <strong>the</strong> income statement and <strong>the</strong>calculation of inven<strong>to</strong>ry.The level of estimated commercial <strong>re</strong>serves is also a key determinant in assessing whe<strong>the</strong>r <strong>the</strong>carrying value of any of <strong>the</strong> Group’s development and production assets has been impai<strong>re</strong>d.c) Fair value of financial instrumentsThe Group’s accounting policies and disclosu<strong>re</strong>s <strong>re</strong>qui<strong>re</strong> <strong>the</strong> determination of <strong>the</strong> fair value offinancial instruments. Fair values have been determined for measu<strong>re</strong>ment and/or disclosu<strong>re</strong>purposes based on <strong>the</strong> following methods:i) Non-derivative financial instrumentsThese comprise investments in equity and debt securities, trade and o<strong>the</strong>r <strong>re</strong>ceivables, cash andcash equivalents, loans and borrowings and trade and o<strong>the</strong>r payables. Non-derivative financialinstruments a<strong>re</strong> <strong>re</strong>cognised initially at fair value plus, for instruments not at fair value throughprofit or loss, any di<strong>re</strong>ctly attributable transaction costs.Fair value is calculated based on <strong>the</strong> p<strong>re</strong>sent value of futu<strong>re</strong> principal and inte<strong>re</strong>st cash flows,discounted at <strong>the</strong> applicable market rate of inte<strong>re</strong>st at <strong>the</strong> <strong>re</strong>porting date.192