Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Prospectus re Admission to the Official List - Heritage Oil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

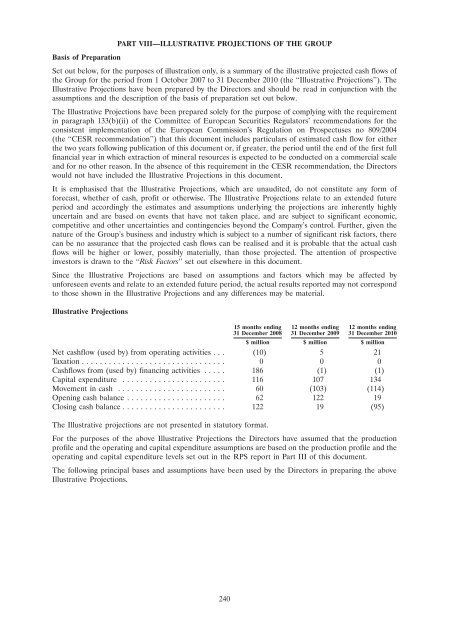

PART VIII—ILLUSTRATIVE PROJECTIONS OF THE GROUPBasis of P<strong>re</strong>parationSet out below, for <strong>the</strong> purposes of illustration only, is a summary of <strong>the</strong> illustrative projected cash flows of<strong>the</strong> Group for <strong>the</strong> period from 1 Oc<strong>to</strong>ber 2007 <strong>to</strong> 31 December 2010 (<strong>the</strong> ‘‘Illustrative Projections’’). TheIllustrative Projections have been p<strong>re</strong>pa<strong>re</strong>d by <strong>the</strong> Di<strong>re</strong>c<strong>to</strong>rs and should be <strong>re</strong>ad in conjunction with <strong>the</strong>assumptions and <strong>the</strong> description of <strong>the</strong> basis of p<strong>re</strong>paration set out below.The Illustrative Projections have been p<strong>re</strong>pa<strong>re</strong>d solely for <strong>the</strong> purpose of complying with <strong>the</strong> <strong>re</strong>qui<strong>re</strong>mentin paragraph 133(b)(ii) of <strong>the</strong> Committee of European Securities Regula<strong>to</strong>rs’ <strong>re</strong>commendations for <strong>the</strong>consistent implementation of <strong>the</strong> European Commission’s Regulation on <strong>Prospectus</strong>es no 809/2004(<strong>the</strong> ‘‘CESR <strong>re</strong>commendation’’) that this document includes particulars of estimated cash flow for ei<strong>the</strong>r<strong>the</strong> two years following publication of this document or, if g<strong>re</strong>ater, <strong>the</strong> period until <strong>the</strong> end of <strong>the</strong> first fullfinancial year in which extraction of mineral <strong>re</strong>sources is expected <strong>to</strong> be conducted on a commercial scaleand for no o<strong>the</strong>r <strong>re</strong>ason. In <strong>the</strong> absence of this <strong>re</strong>qui<strong>re</strong>ment in <strong>the</strong> CESR <strong>re</strong>commendation, <strong>the</strong> Di<strong>re</strong>c<strong>to</strong>rswould not have included <strong>the</strong> Illustrative Projections in this document.It is emphasised that <strong>the</strong> Illustrative Projections, which a<strong>re</strong> unaudited, do not constitute any form offo<strong>re</strong>cast, whe<strong>the</strong>r of cash, profit or o<strong>the</strong>rwise. The Illustrative Projections <strong>re</strong>late <strong>to</strong> an extended futu<strong>re</strong>period and accordingly <strong>the</strong> estimates and assumptions underlying <strong>the</strong> projections a<strong>re</strong> inhe<strong>re</strong>ntly highlyuncertain and a<strong>re</strong> based on events that have not taken place, and a<strong>re</strong> subject <strong>to</strong> significant economic,competitive and o<strong>the</strong>r uncertainties and contingencies beyond <strong>the</strong> Company’s control. Fur<strong>the</strong>r, given <strong>the</strong>natu<strong>re</strong> of <strong>the</strong> Group’s business and industry which is subject <strong>to</strong> a number of significant risk fac<strong>to</strong>rs, <strong>the</strong><strong>re</strong>can be no assurance that <strong>the</strong> projected cash flows can be <strong>re</strong>alised and it is probable that <strong>the</strong> actual cashflows will be higher or lower, possibly materially, than those projected. The attention of prospectiveinves<strong>to</strong>rs is drawn <strong>to</strong> <strong>the</strong> ‘‘Risk Fac<strong>to</strong>rs’’ set out elsewhe<strong>re</strong> in this document.Since <strong>the</strong> Illustrative Projections a<strong>re</strong> based on assumptions and fac<strong>to</strong>rs which may be affected byunfo<strong>re</strong>seen events and <strong>re</strong>late <strong>to</strong> an extended futu<strong>re</strong> period, <strong>the</strong> actual <strong>re</strong>sults <strong>re</strong>ported may not cor<strong>re</strong>spond<strong>to</strong> those shown in <strong>the</strong> Illustrative Projections and any diffe<strong>re</strong>nces may be material.Illustrative Projections15 months ending 12 months ending 12 months ending31 December 2008 31 December 2009 31 December 2010$ million $ million $ millionNet cashflow (used by) from operating activities . . . (10) 5 21Taxation ................................ 0 0 0Cashflows from (used by) financing activities ..... 186 (1) (1)Capital expenditu<strong>re</strong> ....................... 116 107 134Movement in cash ........................ 60 (103) (114)Opening cash balance ...................... 62 122 19Closing cash balance ....................... 122 19 (95)The Illustrative projections a<strong>re</strong> not p<strong>re</strong>sented in statu<strong>to</strong>ry format.For <strong>the</strong> purposes of <strong>the</strong> above Illustrative Projections <strong>the</strong> Di<strong>re</strong>c<strong>to</strong>rs have assumed that <strong>the</strong> productionprofile and <strong>the</strong> operating and capital expenditu<strong>re</strong> assumptions a<strong>re</strong> based on <strong>the</strong> production profile and <strong>the</strong>operating and capital expenditu<strong>re</strong> levels set out in <strong>the</strong> RPS <strong>re</strong>port in Part III of this document.The following principal bases and assumptions have been used by <strong>the</strong> Di<strong>re</strong>c<strong>to</strong>rs in p<strong>re</strong>paring <strong>the</strong> aboveIllustrative Projections.240