Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

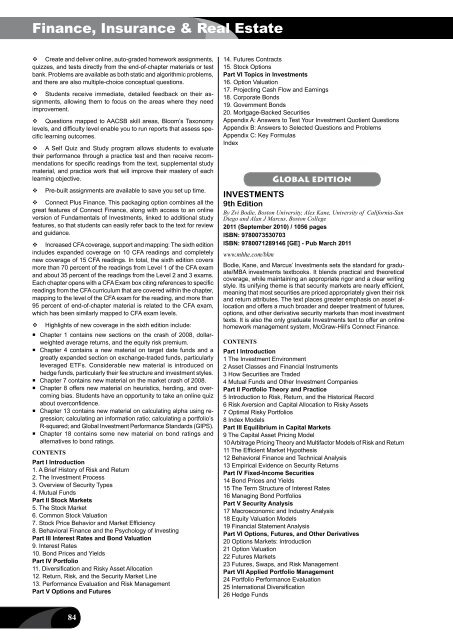

Finance, Insurance & Real EstateCreate and deliver online, auto-graded homework assignments,quizzes, and tests directly from the end-of-chapter materials or testbank. Problems are available as both static and algorithmic problems,and there are also multiple-choice conceptual questions.Students receive immediate, detailed feedback on their assignments,allowing them to focus on the areas where they needimprovement.Questions mapped to AACSB skill areas, Bloom’s Taxonomylevels, and difficulty level enable you to run reports that assess specificlearning outcomes.A Self Quiz and Study program allows students to evaluatetheir performance through a practice test and then receive recommendationsfor specific readings from the text, supplemental studymaterial, and practice work that will improve their mastery of eachlearning objective.Pre-built assignments are available to save you set up time.Connect Plus Finance. This packaging option combines all thegreat features of Connect Finance, along with access to an onlineversion of Fundamentals of Investments, linked to additional studyfeatures, so that students can easily refer back to the text for reviewand guidance.Increased CFA coverage, support and mapping: The sixth editionincludes expanded coverage on 10 CFA readings and completelynew coverage of 15 CFA readings. In total, the sixth edition coversmore than 70 percent of the readings from Level 1 of the CFA examand about 35 percent of the readings from the Level 2 and 3 exams.Each chapter opens with a CFA Exam box citing references to specificreadings from the CFA curriculum that are covered within the chapter,mapping to the level of the CFA exam for the reading, and more than95 percent of end-of-chapter material is related to the CFA exam,which has been similarly mapped to CFA exam levels.Highlights of new coverage in the sixth edition include:• Chapter 1 contains new sections on the crash of 2008, dollarweightedaverage returns, and the equity risk premium.• Chapter 4 contains a new material on target date funds and agreatly expanded section on exchange-traded funds, particularlyleveraged ETFs. Considerable new material is introduced onhedge funds, particularly their fee structure and investment styles.• Chapter 7 contains new material on the market crash of 2008.• Chapter 8 offers new material on heuristics, herding, and overcomingbias. Students have an opportunity to take an online quizabout overconfidence.• Chapter 13 contains new material on calculating alpha using regression;calculating an information ratio; calculating a portfolio’sR-squared; and Global Investment Performance Standards (GIPS).• Chapter 18 contains some new material on bond ratings andalternatives to bond ratings.CONTENTSPart I Introduction1. A Brief History of Risk and Return2. The Investment Process3. Overview of Security Types4. Mutual FundsPart II Stock Markets5. The Stock Market6. Common Stock Valuation7. Stock Price Behavior and Market Efficiency8. Behavioral Finance and the Psychology of InvestingPart III Interest Rates and Bond Valuation9. Interest Rates10. Bond Prices and YieldsPart IV Portfolio11. Diversification and Risky Asset Allocation12. Return, Risk, and the Security Market Line13. Performance Evaluation and Risk ManagementPart V Options and Futures14. Futures Contracts15. Stock OptionsPart VI Topics in Investments16. Option Valuation17. Projecting Cash Flow and Earnings18. Corporate Bonds19. Government Bonds20. Mortgage-Backed SecuritiesAppendix A: Answers to Test Your Investment Quotient QuestionsAppendix B: Answers to Selected Questions and ProblemsAppendix C: Key FormulasIndexGlobal editionINVESTMENTS9th EditionBy Zvi Bodie, Boston University, Alex Kane, University of California-SanDiego and Alan J Marcus, Boston College2011 (September 2010) / 1056 pagesISBN: 9780073530703ISBN: 9780071289146 [GE] - Pub March 2011www.mhhe.com/bkmBodie, Kane, and Marcus’ Investments sets the standard for graduate/MBAinvestments textbooks. It blends practical and theoreticalcoverage, while maintaining an appropriate rigor and a clear writingstyle. Its unifying theme is that security markets are nearly efficient,meaning that most securities are priced appropriately given their riskand return attributes. The text places greater emphasis on asset allocationand offers a much broader and deeper treatment of futures,options, and other derivative security markets than most investmenttexts. It is also the only graduate Investments text to offer an onlinehomework management system, <strong>McGraw</strong>-<strong>Hill</strong>’s Connect Finance.ContentsPart I Introduction1 The Investment Environment2 Asset Classes and Financial Instruments3 How Securities are Traded4 Mutual Funds and Other Investment CompaniesPart II Portfolio Theory and Practice5 Introduction to Risk, Return, and the Historical Record6 Risk Aversion and Capital Allocation to Risky Assets7 Optimal Risky Portfolios8 Index ModelsPart III Equilibrium in Capital Markets9 The Capital Asset Pricing Model10 Arbitrage Pricing Theory and Multifactor Models of Risk and Return11 The Efficient Market Hypothesis12 Behavioral Finance and Technical Analysis13 Empirical Evidence on Security ReturnsPart IV Fixed-Income Securities14 Bond Prices and Yields15 The Term Structure of Interest Rates16 Managing Bond PortfoliosPart V Security Analysis17 Macroeconomic and Industry Analysis18 Equity Valuation Models19 Financial Statement AnalysisPart VI Options, Futures, and Other Derivatives20 Options Markets: Introduction21 Option Valuation22 Futures Markets23 Futures, Swaps, and Risk ManagementPart VII Applied Portfolio Management24 Portfolio Performance Evaluation25 International Diversification26 Hedge Funds84