Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

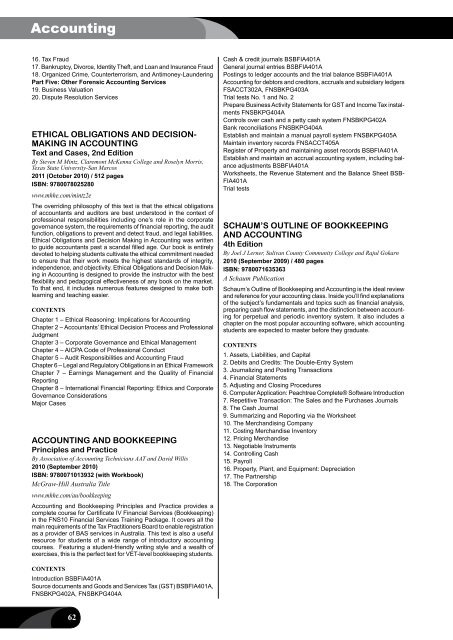

Accounting16. Tax Fraud17. Bankruptcy, Divorce, Identity Theft, and Loan and Insurance Fraud18. Organized Crime, Counterterrorism, and Antimoney-LaunderingPart Five: Other Forensic Accounting Services19. Business Valuation20. Dispute Resolution ServicesETHICAL OBLIGATIONS AND DECISION-MAKING IN ACCOUNTINGText and Cases, 2nd EditionBy Steven M Mintz, Claremont McKenna College and Roselyn Morris,Texas State University-San Marcos2011 (October 2010) / 512 pagesISBN: 9780078025280www.mhhe.com/mintz2eThe overriding philosophy of this text is that the ethical obligationsof accountants and auditors are best understood in the context ofprofessional responsibilities including one’s role in the corporategovernance system, the requirements of financial reporting, the auditfunction, obligations to prevent and detect fraud, and legal liabilities.Ethical Obligations and Decision Making in Accounting was writtento guide accountants past a scandal filled age. Our book is entirelydevoted to helping students cultivate the ethical commitment neededto ensure that their work meets the highest standards of integrity,independence, and objectivity. Ethical Obligations and Decision Makingin Accounting is designed to provide the instructor with the bestflexibility and pedagogical effectiveness of any book on the market.To that end, it includes numerous features designed to make bothlearning and teaching easier.ContentsChapter 1 – Ethical Reasoning: Implications for AccountingChapter 2 – Accountants’ Ethical Decision Process and ProfessionalJudgmentChapter 3 – Corporate Governance and Ethical ManagementChapter 4 – AICPA Code of Professional ConductChapter 5 – Audit Responsibilities and Accounting FraudChapter 6 – Legal and Regulatory Obligations in an Ethical FrameworkChapter 7 – Earnings Management and the Quality of FinancialReportingChapter 8 – International Financial Reporting: Ethics and CorporateGovernance ConsiderationsMajor CasesACCOUNTING AND BOOKKEEPINGPrinciples and PracticeBy Association of Accounting Technicians AAT and David Willis2010 (September 2010)ISBN: 9780071013932 (with Workbook)<strong>McGraw</strong>-<strong>Hill</strong> Australia Titlewww.mhhe.com/au/bookkeepingAccounting and Bookkeeping Principles and Practice provides acomplete course for Certificate IV Financial Services (Bookkeeping)in the FNS10 Financial Services Training Package. It covers all themain requirements of the Tax Practitioners Board to enable registrationas a provider of BAS services in Australia. This text is also a usefulresource for students of a wide range of introductory accountingcourses. Featuring a student-friendly writing style and a wealth ofexercises, this is the perfect text for VET-level bookkeeping students.Cash & credit journals BSBFIA401AGeneral journal entries BSBFIA401APostings to ledger accounts and the trial balance BSBFIA401AAccounting for debtors and creditors, accruals and subsidiary ledgersFSACCT302A, FNSBKPG403ATrial tests No. 1 and No. 2Prepare Business Activity Statements for GST and Income Tax instalmentsFNSBKPG404AControls over cash and a petty cash system FNSBKPG402ABank reconciliations FNSBKPG404AEstablish and maintain a manual payroll system FNSBKPG405AMaintain inventory records FNSACCT405ARegister of Property and maintaining asset records BSBFIA401AEstablish and maintain an accrual accounting system, including balanceadjustments BSBFIA401AWorksheets, the Revenue Statement and the Balance Sheet BSB-FIA401ATrial testsSCHAUM’S OUTLINE OF BOOKKEEPINGAND ACCOUNTING4th EditionBy Joel J Lerner, Sulivan County Community College and Rajul Gokarn2010 (September 2009) / 480 pagesISBN: 9780071635363A Schaum PublicationSchaum’s Outline of Bookkeeping and Accounting is the ideal reviewand reference for your accounting class. Inside you’ll find explanationsof the subject’s fundamentals and topics such as financial analysis,preparing cash flow statements, and the distinction between accountingfor perpetual and periodic inventory system. It also includes achapter on the most popular accounting software, which accountingstudents are expected to master before they graduate.Contents1. Assets, Liabilities, and Capital2. Debits and Credits: The Double-Entry System3. Journalizing and Posting Transactions4. Financial Statements5. Adjusting and Closing Procedures6. Computer Application: Peachtree Complete® Software Introduction7. Repetitive Transaction: The Sales and the Purchases Journals8. The Cash Journal9. Summarizing and Reporting via the Worksheet10. The Merchandising Company11. Costing Merchandise Inventory12. Pricing Merchandise13. Negotiable Instruments14. Controlling Cash15. Payroll16. Property, Plant, and Equipment: Depreciation17. The Partnership18. The CorporationContentsIntroduction BSBFIA401ASource documents and Goods and Services Tax (GST) BSBFIA401A,FNSBKPG402A, FNSBKPG404A62