AccountingFINANCIAL ACCOUNTINGIncluding International Financial ReportingStandards (IFRS)By Jan R Williams, Sue F Haka, Mark S Bettner, Joseph V Carcello,Nclson Lam and Peter Lau2010 (August 2010) / 816 pagesISBN: 9780071288965An Asian Publicationwww.mheducation.asia/olc/williamlamlauWhile many texts are characterized as having either a “user” approachor a “preparer” approach, Financial Accounting: IncludingInternational Financial Reporting Standards is written for faculty whowant to strike a balance between these approaches. Business majorswill find relevance in the “Ethics, Fraud & Corporate Governance,”“Your Turn” and “Case in Point” boxes throughout the chapters whileaccounting majors will receive a firm grounding in accounting basicsthat will prepare them for their intermediate course. In addition, thetextbook incorporates examples, case studies, and questions drawnfrom Asian contexts and practices. Combined with robust end-ofchapterexercises and exciting interactive supplementary materials,Financial Accounting: Including International Financial ReportingStandards is absolutely relevant and essential for instructors andstudents in the region.CONTENTS1 Accounting: Information for Decision Making2 Basic Financial Statements3 The Accounting Cycle: Capturing Economic Events4 The Accounting Cycle: Accruals and Deferrals5 The Accounting Cycle: Reporting Financial ResultsComprehensive Problem 1: Susquehanna Equipment Rentals6 Merchandising Activities7 Financial Assets8 Inventories and the Cost of Goods SoldComprehensive Problem 2: Guitar Universe Company9 Property, Plant, and Equipment, Intangible Assets and NaturalResources10 Liabilities11 Shareholders’ Equity: CapitalComprehensive Problem 3: McMinn Retail Limited12 Profit and Changes in Retained Earnings13 Statement of Cash Flows14 Financial Statement AnalysisComprehensive Problem 4: Adidas AG, Herzogenaurach15 Global Business and AccountingAppendix A: Adidas AG, Herzogenaurach 2009 Consolidated GroupFinancial Statements (IFRS) and Additional InformationAppendix B: The Time Value of Money: Future Amounts and PresentValuesIndexFINANCIAL ACCOUNTING AND REPORTINGBy Bill Collins and John McKeith of University of Stirling2009 / 608 pagesISBN: 9780077114527<strong>McGraw</strong>-<strong>Hill</strong> UK Titlewww.mcgraw-hill.com.uk/textbooks.collinsFinancial Accounting and Reporting by Bill Collins and John McKeithtakes an uncomplicated, step-by-step approach to intermediate levelfinancial accounting for specialist students. Its unique three-partchapter structure builds up topic understanding without assumingtoo much prior knowledge, offering a manageable way to master thesubject one step at a time.Contents1. The Preparation and Regulation of Company Financial Statements2. Non-Current (Fixed) Assets3. Intangible Assets and Impairment of Assets4. Leases5. Inventories and Construction Contracts6. Share Capital and Reserves7. Liabilities8. Income Taxes9. Cash Flow Statements10. Groups11. Foreign Currency12. Interpretation of Financial StatementsAUSTRALIAN FINANCIAL ACCOUNTING6th EditionBy Craig Deegan, RMIT University in Melbourne2009ISBN: 9780070277748<strong>McGraw</strong>-HIll Australia Titlewww.mhhe.com/au/deegan6eAustralia’s market-leading financial accounting text provides studentswith a detailed grasp of reporting requirements in an accessible andengaging manner. Fully updated throughout, Australian Financial Accountingfurther develops and extends its coverage of consolidationsand encompasses topical issues such as social and environmentalaccounting. Renowned for his clear writing style, Craig Deegan successfullycommunicates the detail necessary to understand, challengeand critically evaluate financial reporting. Complete in theoretical andpractical coverage, this text gives students a strong foundation forcurrent study and their future professional lives.ContentsPart 1--The Australian Accounting EnvironmentCh 1. An overview of the Australian external reporting environmentCh 2. The conceptual framework of accounting and its relevance tofinancial reportingPart 2--Theories of AccountingCh 3. Theories of accountingPart 3--Accounting for AssetsCh 4. An overview of accounting for assetsCh 5. Depreciation of property, plant and equipmentCh 6. Revaluations and impairment testing of non-current assetsCh 7. InventoryCh 8. Accounting for intangiblesCh 9. Accounting for heritage assets and biological assetsPart 4--Accounting for Liability and Owner’s EquityCh 10. An overview of accounting for liabilitiesCh 11. Accounting for leasesCh 12. Set-off and extinguishment of debtCh 13. Accounting for employee benefitsCh 14. Share capital and reservesCh 15. Accounting for financial instrumentsCh 16. Revenue recognition issuesCh 17. The income statementCh 18. Share-based paymentsCh 19. Accounting for income taxPart 5--Accounting for the Disclosure of Cash FlowsCh 20. Statement of cash flowsPart 6--Industry-specific Accounting IssuesCh 21. Accounting for the extractive industriesCh 22. Financial reporting of general insurance activityCh 23. Accounting for superannuation plansPart 7--Other Disclosure IssuesCh 24. Events occurring after reporting dateCh 25. Financial reporting by segmentsCh 26. Related party disclosuresCh 27. Earnings per sharePart 8--Accounting for Equity Interests on Other EntitiesCh 28. Accounting for group structures: an introduction to19

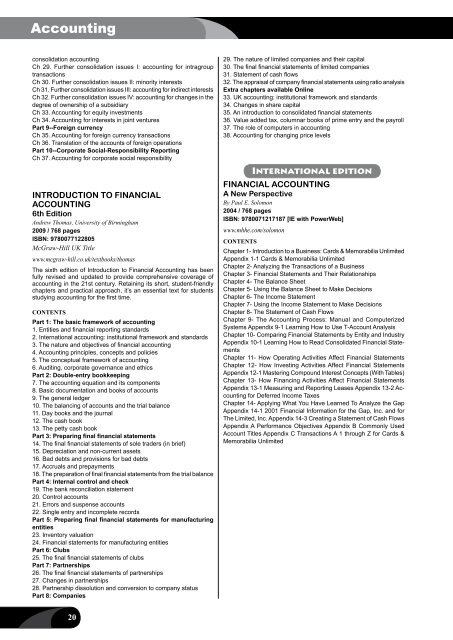

Accountingconsolidation accountingCh 29. Further consolidation issues I: accounting for intragrouptransactionsCh 30. Further consolidation issues II: minority interestsCh 31. Further consolidation issues III: accounting for indirect interestsCh 32. Further consolidation issues IV: accounting for changes in thedegree of ownership of a subsidiaryCh 33. Accounting for equity investmentsCh 34. Accounting for interests in joint venturesPart 9--Foreign currencyCh 35. Accounting for foreign currency transactionsCh 36. Translation of the accounts of foreign operationsPart 10--Corporate Social-Responsibility ReportingCh 37. Accounting for corporate social responsibilityINTRODUCTION TO FINANCIALACCOUNTING6th EditionAndrew Thomas, University of Birmingham2009 / 768 pagesISBN: 9780077122805<strong>McGraw</strong>-<strong>Hill</strong> UK Titlewww.mcgraw-hill.co.uk/textbooks/thomasThe sixth edition of Introduction to Financial Accounting has beenfully revised and updated to provide comprehensive coverage ofaccounting in the 21st century. Retaining its short, student-friendlychapters and practical approach, it’s an essential text for studentsstudying accounting for the first time.ContentsPart 1: The basic framework of accounting1. Entities and financial reporting standards2. International accounting: institutional framework and standards3. The nature and objectives of financial accounting4. Accounting principles, concepts and policies5. The conceptual framework of accounting6. Auditing, corporate governance and ethicsPart 2: Double-entry bookkeeping7. The accounting equation and its components8. Basic documentation and books of accounts9. The general ledger10. The balancing of accounts and the trial balance11. Day books and the journal12. The cash book13. The petty cash bookPart 3: Preparing final financial statements14. The final financial statements of sole traders (in brief)15. Depreciation and non-current assets16. Bad debts and provisions for bad debts17. Accruals and prepayments18. The preparation of final financial statements from the trial balancePart 4: Internal control and check19. The bank reconciliation statement20. Control accounts21. Errors and suspense accounts22. Single entry and incomplete recordsPart 5: Preparing final financial statements for manufacturingentities23. Inventory valuation24. Financial statements for manufacturing entitiesPart 6: Clubs25. The final financial statements of clubsPart 7: Partnerships26. The final financial statements of partnerships27. Changes in partnerships28. Partnership dissolution and conversion to company statusPart 8: Companies29. The nature of limited companies and their capital30. The final financial statements of limited companies31. Statement of cash flows32. The appraisal of company financial statements using ratio analysisExtra chapters available Online33. UK accounting: institutional framework and standards34. Changes in share capital35. An introduction to consolidated financial statements36. Value added tax, columnar books of prime entry and the payroll37. The role of computers in accounting38. Accounting for changing price levelsInternational editionFINANCIAL ACCOUNTINGA New PerspectiveBy Paul E. Solomon2004 / 768 pagesISBN: 9780071217187 [IE with PowerWeb]www.mhhe.com/solomonCONTENTSChapter 1- Introduction to a Business: Cards & Memorabilia UnlimitedAppendix 1-1 Cards & Memorabilia UnlimitedChapter 2- Analyzing the Transactions of a BusinessChapter 3- Financial Statements and Their RelationshipsChapter 4- The Balance SheetChapter 5- Using the Balance Sheet to Make DecisionsChapter 6- The Income StatementChapter 7- Using the Income Statement to Make DecisionsChapter 8- The Statement of Cash FlowsChapter 9- The Accounting Process: Manual and ComputerizedSystems Appendix 9-1 Learning How to Use T-Account AnalysisChapter 10- Comparing Financial Statements by Entity and IndustryAppendix 10-1 Learning How to Read Consolidated Financial StatementsChapter 11- How Operating Activities Affect Financial StatementsChapter 12- How Investing Activities Affect Financial StatementsAppendix 12-1 Mastering Compound Interest Concepts (With Tables)Chapter 13- How Financing Activities Affect Financial StatementsAppendix 13-1 Measuring and Reporting Leases Appendix 13-2 Accountingfor Deferred Income TaxesChapter 14- Applying What You Have Learned To Analyze the GapAppendix 14-1 2001 Financial Information for the Gap, Inc. and forThe Limited, Inc. Appendix 14-3 Creating a Statement of Cash FlowsAppendix A Performance Objectives Appendix B Commonly UsedAccount Titles Appendix C Transactions A 1 through Z for Cards &Memorabilia Unlimited20

- Page 1: Accounting & Finance 2012Accounting

- Page 4 and 5: CONTENTSii

- Page 6 and 7: + =McGraw-Hill Connect ® and McGra

- Page 8: Higher EducationBright futures begi

- Page 11: BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35: AccountingACCOUNTING MADE EASY2nd E

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87:

Finance, Insurance & Real Estatecom

- Page 88 and 89:

Finance, Insurance & Real EstateUK

- Page 90 and 91:

Finance, Insurance & Real EstateNEW

- Page 92 and 93:

Finance, Insurance & Real Estate26

- Page 94 and 95:

Finance, Insurance & Real EstateInt

- Page 96 and 97:

Finance, Insurance & Real EstateInt

- Page 98 and 99:

Finance, Insurance & Real Estate21.

- Page 101 and 102:

Finance, Insurance & Real EstateCre

- Page 103 and 104:

Finance, Insurance & Real EstateInt

- Page 105 and 106:

Finance, Insurance & Real EstateCas

- Page 107 and 108:

Finance, Insurance & Real EstateCON

- Page 109 and 110:

Finance, Insurance & Real Estate10.

- Page 111 and 112:

Finance, Insurance & Real Estateeas

- Page 113 and 114:

Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha