Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

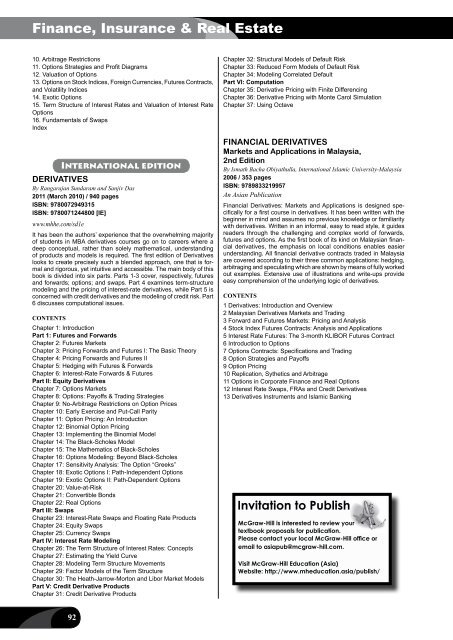

Finance, Insurance & Real Estate10. Arbitrage Restrictions11. Options Strategies and Profit Diagrams12. Valuation of Options13. Options on Stock Indices, Foreign Currencies, Futures Contracts,and Volatility Indices14. Exotic Options15. Term Structure of Interest Rates and Valuation of Interest RateOptions16. Fundamentals of SwapsIndexInternational editionDERIVATIVESBy Rangarajan Sundaram and Sanjiv Das2011 (March 2010) / 940 pagesISBN: 9780072949315ISBN: 9780071244800 [IE]www.mhhe.com/sd1eIt has been the authors’ experience that the overwhelming majorityof students in MBA derivatives courses go on to careers where adeep conceptual, rather than solely mathematical, understandingof products and models is required. The first edition of Derivativeslooks to create precisely such a blended approach, one that is formaland rigorous, yet intuitive and accessible. The main body of thisbook is divided into six parts. Parts 1-3 cover, respectively, futuresand forwards; options; and swaps. Part 4 examines term-structuremodeling and the pricing of interest-rate derivatives, while Part 5 isconcerned with credit derivatives and the modeling of credit risk. Part6 discusses computational issues.ContentsChapter 1: IntroductionPart 1: Futures and ForwardsChapter 2: Futures MarketsChapter 3: Pricing Forwards and Futures I: The Basic TheoryChapter 4: Pricing Forwards and Futures IIChapter 5: Hedging with Futures & ForwardsChapter 6: Interest-Rate Forwards & FuturesPart II: Equity DerivativesChapter 7: Options MarketsChapter 8: Options: Payoffs & Trading StrategiesChapter 9: No-Arbitrage Restrictions on Option PricesChapter 10: Early Exercise and Put-Call ParityChapter 11: Option Pricing: An IntroductionChapter 12: Binomial Option PricingChapter 13: Implementing the Binomial ModelChapter 14: The Black-Scholes ModelChapter 15: The Mathematics of Black-ScholesChapter 16: Options Modeling: Beyond Black-ScholesChapter 17: Sensitivity Analysis: The Option “Greeks”Chapter 18: Exotic Options I: Path-Independent OptionsChapter 19: Exotic Options II: Path-Dependent OptionsChapter 20: Value-at-RiskChapter 21: Convertible BondsChapter 22: Real OptionsPart III: SwapsChapter 23: Interest-Rate Swaps and Floating Rate ProductsChapter 24: Equity SwapsChapter 25: Currency SwapsPart IV: Interest Rate ModelingChapter 26: The Term Structure of Interest Rates: ConceptsChapter 27: Estimating the Yield CurveChapter 28: Modeling Term Structure MovementsChapter 29: Factor Models of the Term StructureChapter 30: The Heath-Jarrow-Morton and Libor Market ModelsPart V: Credit Derivative ProductsChapter 31: Credit Derivative ProductsChapter 32: Structural Models of Default RiskChapter 33: Reduced Form Models of Default RiskChapter 34: Modeling Correlated DefaultPart VI: ComputationChapter 35: Derivative Pricing with Finite DifferencingChapter 36: Derivative Pricing with Monte Carol SimulationChapter 37: Using OctaveFINANCIAL DERIVATIVESMarkets and Applications in Malaysia,2nd EditionBy Ismath Bacha Obiyathulla, International Islamic University-Malaysia2006 / 353 pagesISBN: 9789833219957An Asian PublicationFinancial Derivatives: Markets and Applications is designed specificallyfor a first course in derivatives. It has been written with thebeginner in mind and assumes no previous knowledge or familiaritywith derivatives. Written in an informal, easy to read style, it guidesreaders through the challenging and complex world of forwards,futures and options. As the first book of its kind on Malaysian financialderivatives, the emphasis on local conditions enables easierunderstanding. All financial derivative contracts traded in Malaysiaare covered according to their three common applications: hedging,arbitraging and speculating which are shown by means of fully workedout examples. Extensive use of illustrations and write-ups provideeasy comprehension of the underlying logic of derivatives.CONTENTS1 Derivatives: Introduction and Overview2 Malaysian Derivatives Markets and Trading3 Forward and Futures Markets: Pricing and Analysis4 Stock Index Futures Contracts: Analysis and Applications5 Interest Rate Futures: The 3-month KLIBOR Futures Contract6 Introduction to Options7 Options Contracts: Specifications and Trading8 Option Strategies and Payoffs9 Option Pricing10 Replication, Sythetics and Arbitrage11 Options in Corporate Finance and Real Options12 Interest Rate Swaps, FRAs and Credit Derivatives13 Derivatives Instruments and Islamic BankingInvitation to Publish<strong>McGraw</strong>-<strong>Hill</strong> is interested to review yourtextbook proposals for publication.Please contact your local <strong>McGraw</strong>-<strong>Hill</strong> office oremail to asiapub@mcgraw-hill.com.Visit <strong>McGraw</strong>-<strong>Hill</strong> Education (Asia)Website: http://www.mheducation.asia/publish/92