Finance, Insurance & Real EstateInvestments - GraduateCases in Corporate FinanceGlobal editionINVESTMENTS9th EditionBy Zvi Bodie, Boston University, Alex Kane, University of California-SanDiego and Alan J Marcus, Boston College2011 (September 2010) / 1056 pagesISBN: 9780073530703ISBN: 9780071289146 [GE] - Pub March 2011www.mhhe.com/bkmBodie, Kane, and Marcus’ Investments sets the standard for graduate/MBAinvestments textbooks. It blends practical and theoreticalcoverage, while maintaining an appropriate rigor and a clear writingstyle. Its unifying theme is that security markets are nearly efficient,meaning that most securities are priced appropriately given their riskand return attributes. The text places greater emphasis on asset allocationand offers a much broader and deeper treatment of futures,options, and other derivative security markets than most investmenttexts. It is also the only graduate Investments text to offer an onlinehomework management system, <strong>McGraw</strong>-<strong>Hill</strong>’s Connect Finance.ContentsPart I Introduction1 The Investment Environment2 Asset Classes and Financial Instruments3 How Securities are Traded4 Mutual Funds and Other Investment CompaniesPart II Portfolio Theory and Practice5 Introduction to Risk, Return, and the Historical Record6 Risk Aversion and Capital Allocation to Risky Assets7 Optimal Risky Portfolios8 Index ModelsPart III Equilibrium in Capital Markets9 The Capital Asset Pricing Model10 Arbitrage Pricing Theory and Multifactor Models of Risk and Return11 The Efficient Market Hypothesis12 Behavioral Finance and Technical Analysis13 Empirical Evidence on Security ReturnsPart IV Fixed-Income Securities14 Bond Prices and Yields15 The Term Structure of Interest Rates16 Managing Bond PortfoliosPart V Security Analysis17 Macroeconomic and Industry Analysis18 Equity Valuation Models19 Financial Statement AnalysisPart VI Options, Futures, and Other Derivatives20 Options Markets: Introduction21 Option Valuation22 Futures Markets23 Futures, Swaps, and Risk ManagementPart VII Applied Portfolio Management24 Portfolio Performance Evaluation25 International Diversification26 Hedge Funds27 The Theory of Active Portfolio Management28 Investment Policy and the Framework of the CFA InstituteReferences to CFA ProblemsGlossaryName IndexSubject IndexInternational editionCASE STUDIES IN FINANCE6th EditionBy Robert F Bruner, University of VA-Charlottesville2010 (January 2009) / 816 pagesISBN: 9780073382456ISBN: 9780071267526 [IE]www.mhhe.com/bruner6eCase Studies in Finance, 6e links managerial decisions to capitalmarkets and the expectations of investors. At the core of almostall of the cases is a valuation task that requires students to look tofinancial markets for guidance in resolving the case problem. Thefocus on value helps managers understand the impact of the firm onthe world around it. These cases also invite students to apply moderninformation technology to the analysis of managerial decisions. Thecases may be taught in many different combinations. The eight-partsequence indicated by the table of contents relates to course designsused at the authors’ schools. Each part of the casebook suggests aconcept module, with a particular orientation.ContentsPart 1: Setting Some ThemesCase 1 Warren E. Buffett, 2005Case 2 Bill Miller and Value TrustCase 3 Ben & Jerry’s HomemadeCase 4 The Battle for Value, 2004: FedEx Corp. vs. United ParcelService, Inc.Part 2: Financial Analysis and ForecastingCase 5 The Thoughtful ForecasterCase 6 The Financial Detective, 2005Case 7 Krispy Kreme Doughnuts, Inc.Case 8 The Body Shop International PLC 2001: An Introduction toFinancial ModelingCase 9 Horniman HorticultureCase 10 Kota Fibres, Ltd.Case 11 Deutsche BrauereiCase 12 Value Line Publishing: October 2002Part 3: Estimating the Cost of CapitalCase 13 “Best Practices” in Estimating the Cost of Capital: Surveyand Synthesis”Case 14 Nike, Inc.: Cost of CapitalCase 15 Teletech Corporation, 2005Case 16 The Boeing 7E7Part 4: Capital Budgeting and Resource AllocationCase 17 The Investment DetectiveCase 18 Worldwide Paper CompanyCase 19 Target CorporationCase 20 Aurora Textile CompanyCase 21 Compass RecordsCase 22 Victoria Chemicals plc (A): The Merseyside ProjectCase 23 Victoria Chemicals plc (B): Merseyside and RotterdamProjectsCase 24 Euroland Foods S.A.Case 25 Star River Electronics Ltd.Part 5: Management of the Firm’s Equity: Dividends, Repurchases,Initial OfferingsCase 26 Gainesboro Machine Tools CorporationCase 27 EMICase 28 JetBlue Airways IPO ValuationCase 29 TRX, Inc.: Initial Public OfferingCase 30 Purinex, Inc.Part 6: Management of the Corporate Capital Structure87

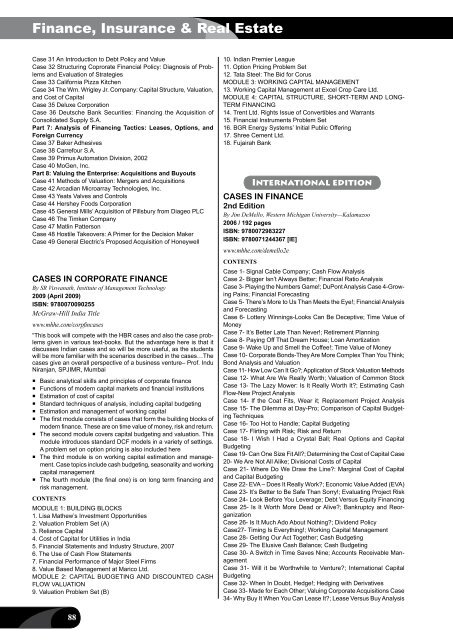

Finance, Insurance & Real EstateCase 31 An Introduction to Debt Policy and ValueCase 32 Structuring Coprorate Financial Policy: Diagnosis of Problemsand Evaluation of StrategiesCase 33 California Pizza KitchenCase 34 The Wm. Wrigley Jr. Company: Capital Structure, Valuation,and Cost of CapitalCase 35 Deluxe CorporationCase 36 Deutsche Bank Securities: Financing the Acquisition ofConsolidated Supply S.A.Part 7: Analysis of Financing Tactics: Leases, Options, andForeign CurrencyCase 37 Baker AdhesivesCase 38 Carrefour S.A.Case 39 Primus Automation Division, 2002Case 40 MoGen, Inc.Part 8: Valuing the Enterprise: Acquisitions and BuyoutsCase 41 Methods of Valuation: Mergers and AcquisitionsCase 42 Arcadian Microarray Technologies, Inc.Case 43 Yeats Valves and ControlsCase 44 Hershey Foods CorporationCase 45 General Mills’ Acquisition of Pillsbury from Diageo PLCCase 46 The Timken CompanyCase 47 Matlin PattersonCase 48 Hostile Takeovers: A Primer for the Decision MakerCase 49 General Electric’s Proposed Acquisition of HoneywellCASES IN CORPORATE FINANCEBy SR Viswanath, Institute of Management Technology2009 (April 2009)ISBN: 9780070090255<strong>McGraw</strong>-<strong>Hill</strong> India Titlewww.mhhe.com/corpfincases“This book will compete with the HBR cases and also the case problemsgiven in various text-books. But the advantage here is that itdiscusses Indian cases and so will be more useful, as the studentswill be more familiar with the scenarios described in the cases…Thecases give an overall perspective of a business venture– Prof. InduNiranjan, SPJIMR, Mumbai• Basic analytical skills and principles of corporate finance• Functions of modern capital markets and financial institutions• Estimation of cost of capital• Standard techniques of analysis, including capital budgeting• Estimation and management of working capital• The first module consists of cases that form the building blocks ofmodern finance. These are on time value of money, risk and return.• The second module covers capital budgeting and valuation. Thismodule introduces standard DCF models in a variety of settings.A problem set on option pricing is also included here• The third module is on working capital estimation and management.Case topics include cash budgeting, seasonality and workingcapital management• The fourth module (the final one) is on long term financing andrisk management.ContentsMODULE 1: BUILDING BLOCKS1. Lisa Mathew’s Investment Opportunities2. Valuation Problem Set (A)3. Reliance Capital4. Cost of Capital for Utilities in India5. Financial Statements and Industry Structure, 20076. The Use of Cash Flow Statements7. Financial Performance of Major Steel Firms8. Value Based Management at Marico Ltd.MODULE 2: CAPITAL BUDGETING AND DISCOUNTED CASHFLOW VALUATION9. Valuation Problem Set (B)10. Indian Premier League11. Option Pricing Problem Set12. Tata Steel: The Bid for CorusMODULE 3: WORKING CAPITAL MANAGEMENT13. Working Capital Management at Excel Crop Care Ltd.MODULE 4: CAPITAL STRUCTURE, SHORT-TERM AND LONG-TERM FINANCING14. Trent Ltd. Rights Issue of Convertibles and Warrants15. Financial Instruments Problem Set16. BGR Energy Systems’ Initial Public Offering17. Shree Cement Ltd.18. Fujairah BankInternational editionCASES IN FINANCE2nd EditionBy Jim DeMello, Western Michigan University—Kalamazoo2006 / 192 pagesISBN: 9780072983227ISBN: 9780071244367 [IE]www.mhhe.com/demello2eCONTENTSCase 1- Signal Cable Company; Cash Flow AnalysisCase 2- Bigger Isn’t Always Better; Financial Ratio AnalysisCase 3- Playing the Numbers Game!; DuPont Analysis Case 4-GrowingPains; Financial ForecastingCase 5- There’s More to Us Than Meets the Eye!; Financial Analysisand ForecastingCase 6- Lottery Winnings-Looks Can Be Deceptive; Time Value ofMoneyCase 7- It’s Better Late Than Never!; Retirement PlanningCase 8- Paying Off That Dream House; Loan AmortizationCase 9- Wake Up and Smell the Coffee!; Time Value of MoneyCase 10- Corporate Bonds-They Are More Complex Than You Think;Bond Analysis and ValuationCase 11- How Low Can It Go?; Application of Stock Valuation MethodsCase 12- What Are We Really Worth; Valuation of Common StockCase 13- The Lazy Mower: Is It Really Worth It?; Estimating CashFlow-New Project AnalysisCase 14- If the Coat Fits, Wear it; Replacement Project AnalysisCase 15- The Dilemma at Day-Pro; Comparison of Capital BudgetingTechniquesCase 16- Too Hot to Handle; Capital BudgetingCase 17- Flirting with Risk; Risk and ReturnCase 18- I Wish I Had a Crystal Ball; Real Options and CapitalBudgetingCase 19- Can One Size Fit All?; Determining the Cost of Capital Case20- We Are Not All Alike; Divisional Costs of CapitalCase 21- Where Do We Draw the Line?: Marginal Cost of Capitaland Capital BudgetingCase 22- EVA – Does It Really Work?; Economic Value Added (EVA)Case 23- It’s Better to Be Safe Than Sorry!; Evaluating Project RiskCase 24- Look Before You Leverage; Debt Versus Equity FinancingCase 25- Is It Worth More Dead or Alive?; Bankruptcy and ReorganizationCase 26- Is It Much Ado About Nothing?; Dividend PolicyCase27- Timing Is Everything!; Working Capital ManagementCase 28- Getting Our Act Together; Cash BudgetingCase 29- The Elusive Cash Balance; Cash BudgetingCase 30- A Switch in Time Saves Nine; Accounts Receivable ManagementCase 31- Will it be Worthwhile to Venture?; International CapitalBudgetingCase 32- When In Doubt, Hedge!; Hedging with DerivativesCase 33- Made for Each Other; Valuing Corporate Acquisitions Case34- Why Buy It When You Can Lease It?; Lease Versus Buy Analysis88

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17:

New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19:

Accounting for Non-Accounting Manag

- Page 20 and 21:

New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23:

AccountingAccounting PrinciplesNEW

- Page 24 and 25:

AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27:

AccountingSCHAUM’S OUTLINE OF FIN

- Page 28:

AccountingFinancial AccountingInter

- Page 31 and 32:

AccountingNEW *9780077328702*2012 (

- Page 33 and 34:

AccountingInternational editionFINA

- Page 35 and 36:

AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38:

Accountingconsolidation accountingC

- Page 39 and 40:

AccountingManagerial AccountingGlob

- Page 41 and 42:

AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44:

Accounting18. Cost volume profit an

- Page 45 and 46:

AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48:

Accounting11 Merchandising Corporat

- Page 49 and 50:

AccountingCONTENTSAbout the Authors

- Page 51 and 52:

Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103: Finance, Insurance & Real EstateInt

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114: Finance, Insurance & Real EstateInt

- Page 115 and 116: Finance, Insurance & Real EstatePer

- Page 118 and 119: Finance, Insurance & Real EstateCha

- Page 120 and 121: Finance, Insurance & Real EstateFIN

- Page 122 and 123: Finance, Insurance & Real EstateUpp

- Page 124 and 125: ATitle IndexAccounting and Bookkeep

- Page 126 and 127: Title IndexFinancial Institutions M

- Page 128 and 129: Title IndexPrinciples of Accounting

- Page 130 and 131: DAuthor IndexDeegan Australian Fina

- Page 132 and 133: Author IndexMintz Ethical Obligatio

- Page 134 and 135: WAuthor IndexWalker Personal Financ

- Page 136 and 137: M c G R A W - H I L L M A I L I N G

- Page 138: Preparing Students forthe World Tha