Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

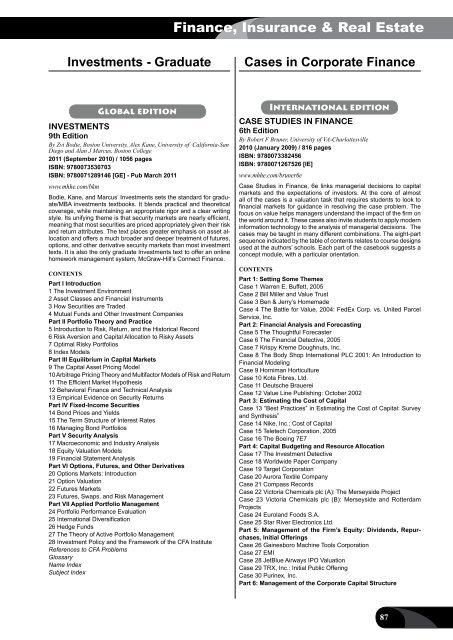

Finance, Insurance & Real EstateInvestments - GraduateCases in Corporate FinanceGlobal editionINVESTMENTS9th EditionBy Zvi Bodie, Boston University, Alex Kane, University of California-SanDiego and Alan J Marcus, Boston College2011 (September 2010) / 1056 pagesISBN: 9780073530703ISBN: 9780071289146 [GE] - Pub March 2011www.mhhe.com/bkmBodie, Kane, and Marcus’ Investments sets the standard for graduate/MBAinvestments textbooks. It blends practical and theoreticalcoverage, while maintaining an appropriate rigor and a clear writingstyle. Its unifying theme is that security markets are nearly efficient,meaning that most securities are priced appropriately given their riskand return attributes. The text places greater emphasis on asset allocationand offers a much broader and deeper treatment of futures,options, and other derivative security markets than most investmenttexts. It is also the only graduate Investments text to offer an onlinehomework management system, <strong>McGraw</strong>-<strong>Hill</strong>’s Connect Finance.ContentsPart I Introduction1 The Investment Environment2 Asset Classes and Financial Instruments3 How Securities are Traded4 Mutual Funds and Other Investment CompaniesPart II Portfolio Theory and Practice5 Introduction to Risk, Return, and the Historical Record6 Risk Aversion and Capital Allocation to Risky Assets7 Optimal Risky Portfolios8 Index ModelsPart III Equilibrium in Capital Markets9 The Capital Asset Pricing Model10 Arbitrage Pricing Theory and Multifactor Models of Risk and Return11 The Efficient Market Hypothesis12 Behavioral Finance and Technical Analysis13 Empirical Evidence on Security ReturnsPart IV Fixed-Income Securities14 Bond Prices and Yields15 The Term Structure of Interest Rates16 Managing Bond PortfoliosPart V Security Analysis17 Macroeconomic and Industry Analysis18 Equity Valuation Models19 Financial Statement AnalysisPart VI Options, Futures, and Other Derivatives20 Options Markets: Introduction21 Option Valuation22 Futures Markets23 Futures, Swaps, and Risk ManagementPart VII Applied Portfolio Management24 Portfolio Performance Evaluation25 International Diversification26 Hedge Funds27 The Theory of Active Portfolio Management28 Investment Policy and the Framework of the CFA InstituteReferences to CFA ProblemsGlossaryName IndexSubject IndexInternational editionCASE STUDIES IN FINANCE6th EditionBy Robert F Bruner, University of VA-Charlottesville2010 (January 2009) / 816 pagesISBN: 9780073382456ISBN: 9780071267526 [IE]www.mhhe.com/bruner6eCase Studies in Finance, 6e links managerial decisions to capitalmarkets and the expectations of investors. At the core of almostall of the cases is a valuation task that requires students to look tofinancial markets for guidance in resolving the case problem. Thefocus on value helps managers understand the impact of the firm onthe world around it. These cases also invite students to apply moderninformation technology to the analysis of managerial decisions. Thecases may be taught in many different combinations. The eight-partsequence indicated by the table of contents relates to course designsused at the authors’ schools. Each part of the casebook suggests aconcept module, with a particular orientation.ContentsPart 1: Setting Some ThemesCase 1 Warren E. Buffett, 2005Case 2 Bill Miller and Value TrustCase 3 Ben & Jerry’s HomemadeCase 4 The Battle for Value, 2004: FedEx Corp. vs. United ParcelService, Inc.Part 2: Financial Analysis and ForecastingCase 5 The Thoughtful ForecasterCase 6 The Financial Detective, 2005Case 7 Krispy Kreme Doughnuts, Inc.Case 8 The Body Shop International PLC 2001: An Introduction toFinancial ModelingCase 9 Horniman HorticultureCase 10 Kota Fibres, Ltd.Case 11 Deutsche BrauereiCase 12 Value Line Publishing: October 2002Part 3: Estimating the Cost of CapitalCase 13 “Best Practices” in Estimating the Cost of Capital: Surveyand Synthesis”Case 14 Nike, Inc.: Cost of CapitalCase 15 Teletech Corporation, 2005Case 16 The Boeing 7E7Part 4: Capital Budgeting and Resource AllocationCase 17 The Investment DetectiveCase 18 Worldwide Paper CompanyCase 19 Target CorporationCase 20 Aurora Textile CompanyCase 21 Compass RecordsCase 22 Victoria Chemicals plc (A): The Merseyside ProjectCase 23 Victoria Chemicals plc (B): Merseyside and RotterdamProjectsCase 24 Euroland Foods S.A.Case 25 Star River Electronics Ltd.Part 5: Management of the Firm’s Equity: Dividends, Repurchases,Initial OfferingsCase 26 Gainesboro Machine Tools CorporationCase 27 EMICase 28 JetBlue Airways IPO ValuationCase 29 TRX, Inc.: Initial Public OfferingCase 30 Purinex, Inc.Part 6: Management of the Corporate Capital Structure87