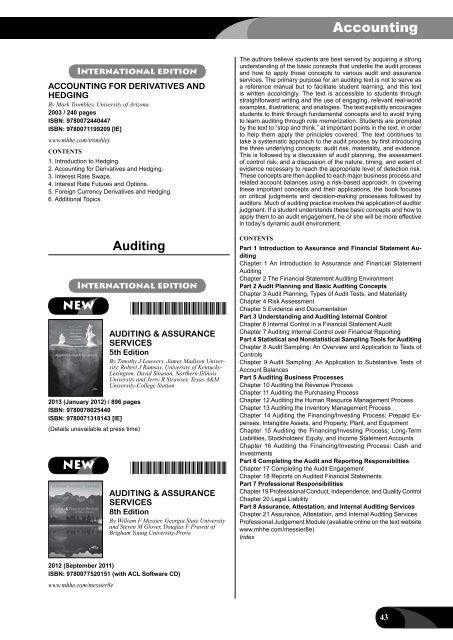

AccountingInternational editionACCOUNTING FOR DERIVATIVES ANDHEDGINGBy Mark Trombley, University of Arizona2003 / 240 pagesISBN: 9780072440447ISBN: 9780071199209 [IE]www.mhhe.com/trombleyCONTENTS1. Introduction to Hedging.2. Accounting for Derivatives and Hedging.3. Interest Rate Swaps.4. Interest Rate Futures and Options.5. Foreign Currency Derivatives and Hedging.6. Additional Topics.AuditingInternational editionNEW*9780078025440*2013 (January 2012) / 896 pagesISBN: 9780078025440ISBN: 9780071318143 [IE](Details unavailable at press time)AUDITING & ASSURANCESERVICES5th EditionBy Timothy J Louwers, James Madison University,Robert J Ramsay, University of Kentucky-Lexington, David Sinason, Northern IllinoisUniversity and Jerry R Strawser, Texas A&MUniversity-College StationNEW*9780077520151*AUDITING & ASSURANCESERVICES8th EditionBy William F Messier, Georgia State Universityand Steven M Glover, Douglas F Prawitt ofBrigham Young University-ProvoThe authors believe students are best served by acquiring a strongunderstanding of the basic concepts that underlie the audit processand how to apply those concepts to various audit and assuranceservices. The primary purpose for an auditing text is not to serve asa reference manual but to facilitate student learning, and this textis written accordingly. The text is accessible to students throughstraightforward writing and the use of engaging, relevant real-worldexamples, illustrations, and analogies. The text explicitly encouragesstudents to think through fundamental concepts and to avoid tryingto learn auditing through rote memorization. Students are promptedby the text to “stop and think,” at important points in the text, in orderto help them apply the principles covered. The text continues totake a systematic approach to the audit process by first introducingthe three underlying concepts: audit risk, materiality, and evidence.This is followed by a discussion of audit planning, the assessmentof control risk, and a discussion of the nature, timing, and extent ofevidence necessary to reach the appropriate level of detection risk.These concepts are then applied to each major business process andrelated account balances using a risk-based approach. In coveringthese important concepts and their applications, the book focuseson critical judgments and decision-making processes followed byauditors. Much of auditing practice involves the application of auditorjudgment. If a student understands these basic concepts and how toapply them to an audit engagement, he or she will be more effectivein today’s dynamic audit environment.ContentsPart 1 Introduction to Assurance and Financial Statement AuditingChapter 1 An Introduction to Assurance and Financial StatementAuditingChapter 2 The Financial Statement Auditing EnvironmentPart 2 Audit Planning and Basic Auditing ConceptsChapter 3 Audit Planning, Types of Audit Tests, and MaterialityChapter 4 Risk AssessmentChapter 5 Evidence and DocumentationPart 3 Understanding and Auditing Internal ControlChapter 6 Internal Control in a Financial Statement AuditChapter 7 Auditing Internal Control over Financial ReportingPart 4 Statistical and Nonstatistical Sampling Tools for AuditingChapter 8 Audit Sampling: An Overview and Application to Tests ofControlsChapter 9 Audit Sampling: An Application to Substantive Tests ofAccount BalancesPart 5 Auditing Business ProcessesChapter 10 Auditing the Revenue ProcessChapter 11 Auditing the Purchasing ProcessChapter 12 Auditing the Human Resource Management ProcessChapter 13 Auditing the Inventory Management ProcessChapter 14 Auditing the Financing/Investing Process: Prepaid Expenses,Intangible Assets, and Property, Plant, and EquipmentChapter 15 Auditing the Financing/Investing Process: Long-TermLiabilities, Stockholders’ Equity, and Income Statement AccountsChapter 16 Auditing the Financing/Investing Process: Cash andInvestmentsPart 6 Completing the Audit and Reporting ResponsiblitiesChapter 17 Completing the Audit EngagementChapter 18 Reports on Audited Financial StatementsPart 7 Professional ResponsibilitiesChapter 19 Professsional Conduct, Independence, and Quality ControlChapter 20 Legal LiabilityPart 8 Assurance, Attestation, and Internal Auditing ServicesChapter 21 Assurance, Attestation, amd Internal Auditing ServicesProfessional Judgement Module (avaliable online on the text websitewww.mhhe.com/messier8e)Index2012 (September 2011)ISBN: 9780077520151 (with ACL Software CD)www.mhhe.com/messier8e43

AccountingInternational editionNEW*9780073404004*2012 (February 2011) / 464 pagesISBN: 9780073404004ISBN: 9780071317160 [IE]www.mhhe.com/stuart1eAUDITING AND ASSURANCESERVICESAn Applied ApproachBy Iris Stuart, California State University--FullertonStuart’s Auditing and Assurance Services: An Applied Approach is aconcise, easy-to-read auditing text that trains students of today for thebusiness world that they will face tomorrow. Using a fresh approachthat introduces auditing application prior to auditing theory, studentswill encounter auditing in practice first, become more engaged inthe subject matter, and consequently feel more readily prepared tounderstand the more challenging theoretical concepts. Stuart furtherengages students by highlighting real-world accounting scandals andby including the most up-to-date standards, including internationalcoverage.Most chapters begin with an overview to set the stage. All chaptersend with a takeaway summary of key points. Stuart’s writing style isconversational and easy to read.ExhibitsMany exhibits are highlighted throughout the text to call attention tokey points.ContentsChapter 1 What Is Auditing?Chapter 2 The Audit Planning Process: Understanding the Risk ofMaterial MisstatementChapter 3 Internal ControlsAppendix A: Information Systems AuditingChapter 4 Auditing the Revenue Business ProcessAppendix A: BCS Private Ltd.Appendix B: BCS Private Ltd.Chapter 5 Audit Evidence and the Auditor’s Responsibility for FraudDetectionChapter 6 Auditing the Acquisition and Expenditure Business ProcessChapter 7 Auditing the Inventory Business ProcessChapter 8 Audit Sampling: Tests of Internal ControlsChapter 9 Audit Sampling: Substantive Tests of DetailsChapter 10 Cash and Investment Business ProcessesChapter 11 Long-Term Debt and Owner’s Equity Business ProcessChapter 12 Completing the AuditChapter 13 Audit ReportsChapter 14 The Auditing ProfessionGLOSSARYFeaturesUnique Topical OrganizationMost auditing books are organized with the first half covering theoryand the second half covering how to audit an accounting cycle.Stuart, however, introduces the applications of auditing before thetheoretical details and, in doing so, this text helps to retain studentinterest, understanding, and motivation in a traditionally dry and difficultsubject area.Non-Traditional Treatment of Sampling ChaptersThe concepts of sampling, sampling and non-sampling risk, andstatistical and non-statistical sampling have been retained, but thesampling plans for internal control testing and substantive testing havebeen written to expose students to sampling issues that they actuallywill face in an audit. To further enhance this element, standardizedworksheets and written examples collaborated on with the “Big Four”CPA firms have been utilized to give students the most accurate realworldexperiences possible.High Quality End-of-Chapter Assignment MaterialThe end-of-chapter assignment material includes Review Questions,Multiple Choice Questions from CPA Examinations, DiscussionQuestions and Research Problems, Real-World Auditing Problems,and Internet Assignments, all tied to the respective chapter’s keylearning objectives.Current and Comprehensive StandardsStuart begins each chapter by noting the relevant standards fromthe following sets: auditing standards for private companies, auditingstandards for public companies, and international standards. “Did You Know?” FeaturesThis pedagogical feature highlights real-world accounting scandalsto further engage students in ethical dilemmas and connect theoryto practice. After each source document, Stuart asks the studentsa relevant critical thinking question. The feature is integrated withinthe text so that students do not assume it is unimportant and skips it.International editionNEW*9780077486273*PRINCIPLES OF AUDITINGAND OTHER ASSURANCESERVICES18th EditionBy Ray Whittington, DePaul University/McGowanCenter, Kurt Pany, Arizona State University-Tempe2012 (March 2011) / 864 pagesISBN: 9780077486273 (with ACL Software CD)ISBN: 9780071317139 [IE with ACL Software CD]www.mhhe.com/whittington18eWhittington/Pany is our market leader in the auditing discipline. Whilemost textbooks use a cycles approach, Whittington/Pany enlists abalance sheet approach – making it particularly straightforward anduser-friendly in addressing the auditing profession’s risk-based approachfor financial statement audits as well as for integrated audits offinancial statements and internal control. The 18th edition covers thelatest auditing standards to meet the needs of the current marketplace.The authors are well connected – both Ray Whittington and Kurt Panyserved as members of the Audit Standards Board, and Whittingtonrecently completed his term as President of the Auditing Section ofthe American Accounting Association.New to this editionThe 18th edition has been thoroughly revised to reflect two verymajor changes in auditing:Chapter Overview and Chapter Takeaways1) The AICPA’s “clarity project” which has resulted in complete revi-44

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11: BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59: Accounting6.8 Indirect Shareholding

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112:

Finance, Insurance & Real Estateeas

- Page 113 and 114:

Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha