Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

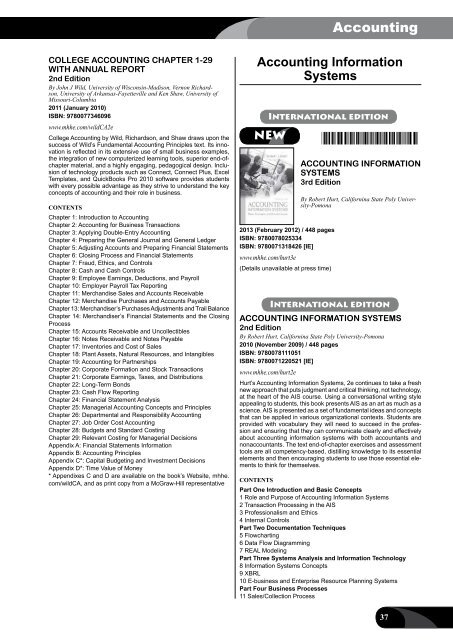

AccountingCOLLEGE ACCOUNTING CHAPTER 1-29WITH ANNUAL REPORT2nd EditionBy John J Wild, University of Wisconsin-Madison, Vernon Richardson,University of Arkansas-Fayetteville and Ken Shaw, University ofMissouri-Columbia2011 (January 2010)ISBN: 9780077346096www.mhhe.com/wildCA2eCollege Accounting by Wild, Richardson, and Shaw draws upon thesuccess of Wild’s Fundamental Accounting Principles text. Its innovationis reflected in its extensive use of small business examples,the integration of new computerized learning tools, superior end-ofchaptermaterial, and a highly engaging, pedagogical design. Inclusionof technology products such as Connect, Connect Plus, ExcelTemplates, and Quick<strong>Books</strong> Pro 2010 software provides studentswith every possible advantage as they strive to understand the keyconcepts of accounting and their role in business.ContentsChapter 1: Introduction to AccountingChapter 2: Accounting for Business TransactionsChapter 3: Applying Double-Entry AccountingChapter 4: Preparing the General Journal and General LedgerChapter 5: Adjusting Accounts and Preparing Financial StatementsChapter 6: Closing Process and Financial StatementsChapter 7: Fraud, Ethics, and ControlsChapter 8: Cash and Cash ControlsChapter 9: Employee Earnings, Deductions, and PayrollChapter 10: Employer Payroll Tax ReportingChapter 11: Merchandise Sales and Accounts ReceivableChapter 12: Merchandise Purchases and Accounts PayableChapter 13: Merchandiser’s Purchases Adjustments and Trail BalanceChapter 14: Merchandiser’s Financial Statements and the ClosingProcessChapter 15: Accounts Receivable and UncollectiblesChapter 16: Notes Receivable and Notes PayableChapter 17: Inventories and Cost of SalesChapter 18: Plant Assets, Natural Resources, and IntangiblesChapter 19: Accounting for PartnershipsChapter 20: Corporate Formation and Stock TransactionsChapter 21: Corporate Earnings, Taxes, and DistributionsChapter 22: Long-Term BondsChapter 23: Cash Flow ReportingChapter 24: Financial Statement AnalysisChapter 25: Managerial Accounting Concepts and PrinciplesChapter 26: Departmental and Responsibility AccountingChapter 27: Job Order Cost AccountingChapter 28: Budgets and Standard CostingChapter 29: Relevant Costing for Managerial DecisionsAppendix A: Financial Statements InformationAppendix B: Accounting PrinciplesAppendix C*: Capital Budgeting and Investment DecisionsAppendix D*: Time Value of Money* Appendixes C and D are available on the book’s Website, mhhe.com/wildCA, and as print copy from a <strong>McGraw</strong>-<strong>Hill</strong> representativeAccounting InformationSystemsInternational editionNEW*9780078025334*2013 (February 2012) / 448 pagesISBN: 9780078025334ISBN: 9780071318426 [IE]www.mhhe.com/hurt3e(Details unavailable at press time)ACCOUNTING INFORMATIONSYSTEMS3rd EditionBy Robert Hurt, Californina State Poly University-PomonaInternational editionACCOUNTING INFORMATION SYSTEMS2nd EditionBy Robert Hurt, Californina State Poly University-Pomona2010 (November 2009) / 448 pagesISBN: 9780078111051ISBN: 9780071220521 [IE]www.mhhe.com/hurt2eHurt’s Accounting Information Systems, 2e continues to take a freshnew approach that puts judgment and critical thinking, not technology,at the heart of the AIS course. Using a conversational writing styleappealing to students, this book presents AIS as an art as much as ascience. AIS is presented as a set of fundamental ideas and conceptsthat can be applied in various organizational contexts. Students areprovided with vocabulary they will need to succeed in the professionand ensuring that they can communicate clearly and effectivelyabout accounting information systems with both accountants andnonaccountants. The text end-of-chapter exercises and assessmenttools are all competency-based, distilling knowledge to its essentialelements and then encouraging students to use those essential elementsto think for themselves.ContentsPart One Introduction and Basic Concepts1 Role and Purpose of Accounting Information Systems2 Transaction Processing in the AIS3 Professionalism and Ethics4 Internal ControlsPart Two Documentation Techniques5 Flowcharting6 Data Flow Diagramming7 REAL ModelingPart Three Systems Analysis and Information Technology8 Information Systems Concepts9 XBRL10 E-business and Enterprise Resource Planning SystemsPart Four Business Processes11 Sales/Collection Process37