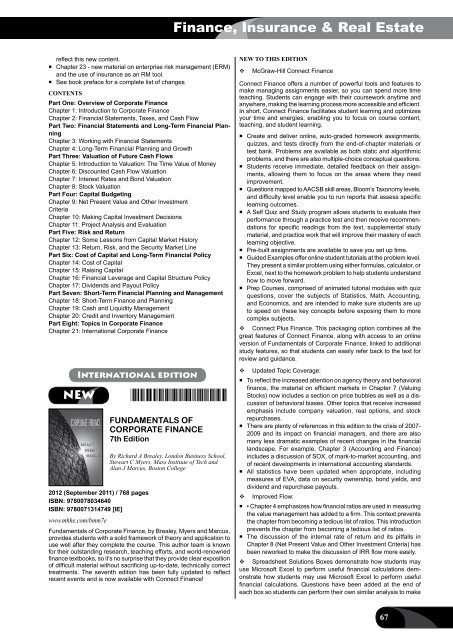

Finance, Insurance & Real Estatereflect this new content.• Chapter 23 - new material on enterprise risk management (ERM)and the use of insurance as an RM tool.• See book preface for a complete list of changesCONTENTSPart One: Overview of Corporate FinanceChapter 1: Introduction to Corporate FinanceChapter 2: Financial Statements, Taxes, and Cash FlowPart Two: Financial Statements and Long-Term Financial PlanningChapter 3: Working with Financial StatementsChapter 4: Long-Term Financial Planning and GrowthPart Three: Valuation of Future Cash FlowsChapter 5: Introduction to Valuation: The Time Value of MoneyChapter 6: Discounted Cash Flow ValuationChapter 7: Interest Rates and Bond ValuationChapter 8: Stock ValuationPart Four: Capital BudgetingChapter 9: Net Present Value and Other InvestmentCriteriaChapter 10: Making Capital Investment DecisionsChapter 11: Project Analysis and EvaluationPart Five: Risk and ReturnChapter 12: Some Lessons from Capital Market HistoryChapter 13: Return, Risk, and the Security Market LinePart Six: Cost of Capital and Long-Term Financial PolicyChapter 14: Cost of CapitalChapter 15: Raising CapitalChapter 16: Financial Leverage and Capital Structure PolicyChapter 17: Dividends and Payout PolicyPart Seven: Short-Term Financial Planning and ManagementChapter 18: Short-Term Finance and PlanningChapter 19: Cash and Liquidity ManagementChapter 20: Credit and Inventory ManagementPart Eight: Topics in Corporate FinanceChapter 21: International Corporate FinanceInternational editionNEW *9780078034640*FUNDAMENTALS OFCORPORATE FINANCE7th EditionBy Richard A Brealey, London Business School,Stewart C Myers, Mass Institute of Tech andAlan J Marcus, Boston College2012 (September 2011) / 768 pagesISBN: 9780078034640ISBN: 9780071314749 [IE]www.mhhe.com/bmm7eFundamentals of Corporate Finance, by Brealey, Myers and Marcus,provides students with a solid framework of theory and application touse well after they complete the course. This author team is knownfor their outstanding research, teaching efforts, and world-renownedfinance textbooks, so it’s no surprise that they provide clear expositionof difficult material without sacrificing up-to-date, technically correcttreatments. The seventh edition has been fully updated to reflectrecent events and is now available with Connect Finance!New to this edition<strong>McGraw</strong>-<strong>Hill</strong> Connect FinanceConnect Finance offers a number of powerful tools and features tomake managing assignments easier, so you can spend more timeteaching. Students can engage with their coursework anytime andanywhere, making the learning process more accessible and efficient.In short, Connect Finance facilitates student learning and optimizesyour time and energies, enabling you to focus on course content,teaching, and student learning.• Create and deliver online, auto-graded homework assignments,quizzes, and tests directly from the end-of-chapter materials ortest bank. Problems are available as both static and algorithmicproblems, and there are also multiple-choice conceptual questions.• Students receive immediate, detailed feedback on their assignments,allowing them to focus on the areas where they needimprovement.• Questions mapped to AACSB skill areas, Bloom’s Taxonomy levels,and difficulty level enable you to run reports that assess specificlearning outcomes.• A Self Quiz and Study program allows students to evaluate theirperformance through a practice test and then receive recommendationsfor specific readings from the text, supplemental studymaterial, and practice work that will improve their mastery of eachlearning objective.• Pre-built assignments are available to save you set up time.• Guided Examples offer online student tutorials at the problem level.They present a similar problem using either formulas, calculator, orExcel, next to the homework problem to help students understandhow to move forward.• Prep Courses, comprised of animated tutorial modules with quizquestions, cover the subjects of Statistics, Math, Accounting,and Economics, and are intended to make sure students are upto speed on these key concepts before exposing them to morecomplex subjects.Connect Plus Finance. This packaging option combines all thegreat features of Connect Finance, along with access to an onlineversion of Fundamentals of Corporate Finance, linked to additionalstudy features, so that students can easily refer back to the text forreview and guidance.Updated Topic Coverage:• To reflect the increased attention on agency theory and behavioralfinance, the material on efficient markets in Chapter 7 (ValuingStocks) now includes a section on price bubbles as well as a discussionof behavioral biases. Other topics that receive increasedemphasis include company valuation, real options, and stockrepurchases.• There are plenty of references in this edition to the crisis of 2007-2009 and its impact on financial managers, and there are alsomany less dramatic examples of recent changes in the financiallandscape. For example, Chapter 3 (Accounting and Finance)includes a discussion of SOX, of mark-to-market accounting, andof recent developments in international accounting standards.• All statistics have been updated when appropriate, includingmeasures of EVA, data on security ownership, bond yields, anddividend and repurchase payouts.Improved Flow:• • Chapter 4 emphasizes how financial ratios are used in measuringthe value management has added to a firm. This context preventsthe chapter from becoming a tedious list of ratios. This introductionprevents the chapter from becoming a tedious list of ratios.• The discussion of the internal rate of return and its pitfalls inChapter 8 (Net Present Value and Other Investment Criteria) hasbeen reworked to make the discussion of IRR flow more easily.Spreadsheet Solutions Boxes demonstrate how students mayuse Microsoft Excel to perform useful financial calculations demonstratehow students may use Microsoft Excel to perform usefulfinancial calculations. Questions have been added at the end ofeach box so students can perform their own similar analysis to make67

Finance, Insurance & Real Estatesure they understand the concept. Students who need assistancein using Microsoft Excel can refer to the student side of the OnlineLearning Center that contains a detailed Excel tutorial with spreadsheettemplates.ContentsPart One Introduction1 Goals and Governance of the Firm2 Financial Markets and Institutions3 Accounting and Finance4 Measuring Corporate PerformancePart Two Value5 The Time Value of Money6 Valuing Bonds7 Valuing Stocks8 Net Present Value and Other Investment Criteria9 Using Discounted Cash-Flow Analysis to Make Investment Decisions10 Project AnalysisPart Three Risk11 Introduction to Risk, Return, and the Opportunity Cost of Capital12 Risk, Return, and Capital Budgeting13 The Weighted-Average Cost of Capital and Company ValuationPart Four Financing14 Introduction to Corporate Financing15 How Corporations Raise Venture Capital and Issue SecuritiesPart Five Debt and Payout Policy16 Debt Policy17 Payout PolicyPart Six Financial Analysis and Planning18 Long-Term Financial Planning19 Short-Term Financial Planning20 Working Capital ManagementPart Seven Special Topics21 Mergers, Acquisitions, and Corporate Control22 International Financial Management23 Options24 Risk ManagementPart Eight Conclusion25 What We Do and Do Not Know about FinanceAppendix AAppendix BGlossaryCreditsGlobal IndexIndexInvitation to Publish<strong>McGraw</strong>-<strong>Hill</strong> is interested to review yourtextbook proposals for publication.Please contact your local <strong>McGraw</strong>-<strong>Hill</strong> office oremail to asiapub@mcgraw-hill.com.Visit <strong>McGraw</strong>-<strong>Hill</strong> Education (Asia)Website: http://www.mheducation.asia/publish/International editionNEW *9780073530673*FINANCE: APPLICATIONSAND THEORY2nd EditionBy Marcia Millon Cornett, Boston University,Troy Adair, Wilkes University and John Nofsinger,Washington State Univesity-Pullman2012 (October 2011) / 736 pagesISBN: 9780073530673ISBN: 9780071314862 [IE]www.mhhe.com/can2eIt’s About Time! Finally, there’s a corporate finance book that incorporatesthe newest technology to facilitate the learning process, savingtime for instructors and students. The Second Edition continues toprovide the core topics for the course, highlighting personal examplesjust as instructors do during their class. New to this edition are uniqueQuick Response (QR) codes that enable students with smartphonesto instantly access online help or explore topics further without everleaving their page in the book. With Connect PlusTM Finance, studentscan take self-graded practice quizzes, homework assignments,or tests, making the learning process more accessible and efficient. Anintegrated, printable eBook is also included in the package, allowingfor anytime, anywhere access to the textbook. Isn’t it time to get themost out of a corporate finance text?New to this edition<strong>McGraw</strong>-<strong>Hill</strong>’s Connect Finance for Cornett/Adair/Nofsinger hasbeen expanded and improved. Connect Finance offers a number ofpowerful tools and features to make managing assignments easier,so you can spend more time teaching. Students can engage with theircoursework anytime and anywhere, making the learning process moreaccessible and efficient. In short, Connect Finance facilitates studentlearning and optimizes your time and energies, enabling you to focuson course content, teaching, and student learning.• Create and deliver online, auto-graded homework assignments,quizzes, and tests directly from the end-of-chapter materials ortest bank. Problems are available as both static and algorithmicproblems, and there are also multiple-choice conceptual questions.• Students receive immediate, detailed feedback on their assignments,allowing them to focus on the areas where they needimprovement.• Questions mapped to AACSB skill areas, Bloom’s Taxonomy levels,and difficulty level enable you to run reports that assess specificlearning outcomes.• Guided Examples offer online student tutorials at the problemlevel. They present a similar problem using formulas, calculator, orExcel, next to the homework problem to help students understandhow to move forward.• Detailed Feedback offers the option to present worked-out solutionsto the problem, showing the students each step of the process.Appropriate chapters and problems include calculator keystrokesolutions in addition to formulas.• A Self Quiz and Study program allows students to evaluate theirperformance through a practice test and then receive recommendationsfor specific readings from the text, supplemental studymaterial, and practice work that will improve their mastery of eachlearning objective.• Pre-built assignments are available to save you set up time.• Prep Courses, comprised of animated tutorial modules with quizquestions, cover the subjects of Statistics, Math, Accounting,and Economics, and are intended to make sure students are upto speed on these key concepts before exposing them to more68

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17:

New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19:

Accounting for Non-Accounting Manag

- Page 20 and 21:

New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23:

AccountingAccounting PrinciplesNEW

- Page 24 and 25:

AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27:

AccountingSCHAUM’S OUTLINE OF FIN

- Page 28:

AccountingFinancial AccountingInter

- Page 31 and 32:

AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114: Finance, Insurance & Real EstateInt

- Page 115 and 116: Finance, Insurance & Real EstatePer

- Page 118 and 119: Finance, Insurance & Real EstateCha

- Page 120 and 121: Finance, Insurance & Real EstateFIN

- Page 122 and 123: Finance, Insurance & Real EstateUpp

- Page 124 and 125: ATitle IndexAccounting and Bookkeep

- Page 126 and 127: Title IndexFinancial Institutions M

- Page 128 and 129: Title IndexPrinciples of Accounting

- Page 130 and 131: DAuthor IndexDeegan Australian Fina

- Page 132 and 133: Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha