Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

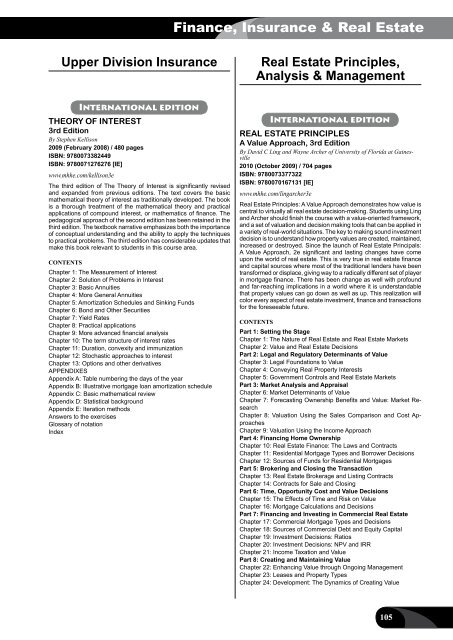

Finance, Insurance & Real EstateUpper Division InsuranceReal Estate Principles,Analysis & ManagementInternational editionTHEORY OF INTEREST3rd EditionBy Stephen Kellison2009 (February 2008) / 480 pagesISBN: 9780073382449ISBN: 9780071276276 [IE]www.mhhe.com/kellison3eThe third edition of The Theory of Interest is significantly revisedand expanded from previous editions. The text covers the basicmathematical theory of interest as traditionally developed. The bookis a thorough treatment of the mathematical theory and practicalapplications of compound interest, or mathematics of finance. Thepedagogical approach of the second edition has been retained in thethird edition. The textbook narrative emphasizes both the importanceof conceptual understanding and the ability to apply the techniquesto practical problems. The third edition has considerable updates thatmake this book relevant to students in this course area.ContentsChapter 1: The Measurement of InterestChapter 2: Solution of Problems in InterestChapter 3: Basic AnnuitiesChapter 4: More General AnnuitiesChapter 5: Amortization Schedules and Sinking FundsChapter 6: Bond and Other SecuritiesChapter 7: Yield RatesChapter 8: Practical applicationsChapter 9: More advanced financial analysisChapter 10: The term structure of interest ratesChapter 11: Duration, convexity and immunizationChapter 12: Stochastic approaches to interestChapter 13: Options and other derivativesAPPENDIXESAppendix A: Table numbering the days of the yearAppendix B: Illustrative mortgage loan amortization scheduleAppendix C: Basic mathematical reviewAppendix D: Statistical backgroundAppendix E: Iteration methodsAnswers to the exercisesGlossary of notationIndexInternational editionREAL ESTATE PRINCIPLESA Value Approach, 3rd EditionBy David C Ling and Wayne Archer of University of Florida at Gainesville2010 (October 2009) / 704 pagesISBN: 9780073377322ISBN: 9780070167131 [IE]www.mhhe.com/lingarcher3eReal Estate Principles: A Value Approach demonstrates how value iscentral to virtually all real estate decision-making. Students using Lingand Archer should finish the course with a value-oriented framework,and a set of valuation and decision making tools that can be applied ina variety of real-world situations. The key to making sound investmentdecision is to understand how property values are created, maintained,increased or destroyed. Since the launch of Real Estate Principals:A Value Approach, 2e significant and lasting changes have comeupon the world of real estate. This is very true in real estate financeand capital sources where most of the traditional lenders have beentransformed or displace, giving way to a radically different set of playerin mortgage finance. There has been change as well with profoundand far-reaching implications in a world where it is understandablethat property values can go down as well as up. This realization willcolor every aspect of real estate investment, finance and transactionsfor the foreseeable future.ContentsPart 1: Setting the StageChapter 1: The Nature of Real Estate and Real Estate MarketsChapter 2: Value and Real Estate DecisionsPart 2: Legal and Regulatory Determinants of ValueChapter 3: Legal Foundations to ValueChapter 4: Conveying Real Property InterestsChapter 5: Government Controls and Real Estate MarketsPart 3: Market Analysis and AppraisalChapter 6: Market Determinants of ValueChapter 7: Forecasting Ownership Benefits and Value: Market ResearchChapter 8: Valuation Using the Sales Comparison and Cost ApproachesChapter 9: Valuation Using the Income ApproachPart 4: Financing Home OwnershipChapter 10: Real Estate Finance: The Laws and ContractsChapter 11: Residential Mortgage Types and Borrower DecisionsChapter 12: Sources of Funds for Residential MortgagesPart 5: Brokering and Closing the TransactionChapter 13: Real Estate Brokerage and Listing ContractsChapter 14: Contracts for Sale and ClosingPart 6: Time, Opportunity Cost and Value DecisionsChapter 15: The Effects of Time and Risk on ValueChapter 16: Mortgage Calculations and DecisionsPart 7: Financing and Investing in Commercial Real EstateChapter 17: Commercial Mortgage Types and DecisionsChapter 18: Sources of Commercial Debt and Equity CapitalChapter 19: Investment Decisions: RatiosChapter 20: Investment Decisions: NPV and IRRChapter 21: Income Taxation and ValuePart 8: Creating and Maintaining ValueChapter 22: Enhancing Value through Ongoing ManagementChapter 23: Leases and Property TypesChapter 24: Development: The Dynamics of Creating Value105