Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

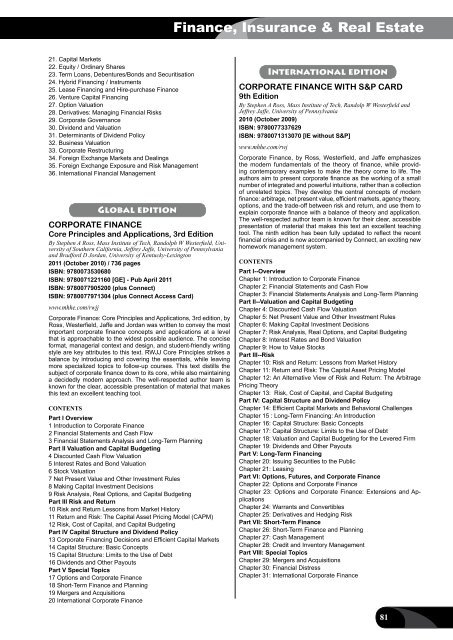

Finance, Insurance & Real Estate21. Capital Markets22. Equity / Ordinary Shares23. Term Loans, Debentures/Bonds and Securitisation24. Hybrid Financing / Instruments25. Lease Financing and Hire-purchase Finance26. Venture Capital Financing27. Option Valuation28. Derivatives: Managing Financial Risks29. Corporate Governance30. Dividend and Valuation31. Determinants of Dividend Policy32. Business Valuation33. Corporate Restructuring34. Foreign Exchange Markets and Dealings35. Foreign Exchange Exposure and Risk Management36. International Financial ManagementGlobal editionCORPORATE FINANCECore Principles and Applications, 3rd EditionBy Stephen A Ross, Mass Institute of Tech, Randolph W Westerfield, Universityof Southern California, Jeffrey Jaffe, University of Pennsylvaniaand Bradford D Jordan, University of Kentucky-Lexington2011 (October 2010) / 736 pagesISBN: 9780073530680ISBN: 9780071221160 [GE] - Pub April 2011ISBN: 9780077905200 (plus Connect)ISBN: 9780077971304 (plus Connect Access Card)www.mhhe.com/rwjjCorporate Finance: Core Principles and Applications, 3rd edition, byRoss, Westerfield, Jaffe and Jordan was written to convey the mostimportant corporate finance concepts and applications at a levelthat is approachable to the widest possible audience. The conciseformat, managerial context and design, and student-friendly writingstyle are key attributes to this text. RWJJ Core Principles strikes abalance by introducing and covering the essentials, while leavingmore specialized topics to follow-up courses. This text distills thesubject of corporate finance down to its core, while also maintaininga decidedly modern approach. The well-respected author team isknown for the clear, accessible presentation of material that makesthis text an excellent teaching tool.ContentsPart I Overview1 Introduction to Corporate Finance2 Financial Statements and Cash Flow3 Financial Statements Analysis and Long-Term PlanningPart II Valuation and Capital Budgeting4 Discounted Cash Flow Valuation5 Interest Rates and Bond Valuation6 Stock Valuation7 Net Present Value and Other Investment Rules8 Making Capital Investment Decisions9 Risk Analysis, Real Options, and Capital BudgetingPart III Risk and Return10 Risk and Return Lessons from Market History11 Return and Risk: The Capital Asset Pricing Model (CAPM)12 Risk, Cost of Capital, and Capital BudgetingPart IV Capital Structure and Dividend Policy13 Corporate Financing Decisions and Efficient Capital Markets14 Capital Structure: Basic Concepts15 Capital Structure: Limits to the Use of Debt16 Dividends and Other PayoutsPart V Special Topics17 Options and Corporate Finance18 Short-Term Finance and Planning19 Mergers and Acquisitions20 International Corporate FinanceInternational editionCORPORATE FINANCE WITH S&P CARD9th EditionBy Stephen A Ross, Mass Institute of Tech, Randolp W Westerfield andJeffrey Jaffe, University of Pennsylvania2010 (October 2009)ISBN: 9780077337629ISBN: 9780071313070 [IE without S&P]www.mhhe.com/rwjCorporate Finance, by Ross, Westerfield, and Jaffe emphasizesthe modern fundamentals of the theory of finance, while providingcontemporary examples to make the theory come to life. Theauthors aim to present corporate finance as the working of a smallnumber of integrated and powerful intuitions, rather than a collectionof unrelated topics. They develop the central concepts of modernfinance: arbitrage, net present value, efficient markets, agency theory,options, and the trade-off between risk and return, and use them toexplain corporate finance with a balance of theory and application.The well-respected author team is known for their clear, accessiblepresentation of material that makes this text an excellent teachingtool. The ninth edition has been fully updated to reflect the recentfinancial crisis and is now accompanied by Connect, an exciting newhomework management system.ContentsPart I--OverviewChapter 1: Introduction to Corporate FinanceChapter 2: Financial Statements and Cash FlowChapter 3: Financial Statements Analysis and Long-Term PlanningPart II--Valuation and Capital BudgetingChapter 4: Discounted Cash Flow ValuationChapter 5: Net Present Value and Other Investment RulesChapter 6: Making Capital Investment DecisionsChapter 7: Risk Analysis, Real Options, and Capital BudgetingChapter 8: Interest Rates and Bond ValuationChapter 9: How to Value StocksPart III--RiskChapter 10: Risk and Return: Lessons from Market HistoryChapter 11: Return and Risk: The Capital Asset Pricing ModelChapter 12: An Alternative View of Risk and Return: The ArbitragePricing TheoryChapter 13: Risk, Cost of Capital, and Capital BudgetingPart IV: Capital Structure and Dividend PolicyChapter 14: Efficient Capital Markets and Behavioral ChallengesChapter 15 : Long-Term Financing: An IntroductionChapter 16: Capital Structure: Basic ConceptsChapter 17: Capital Structure: Limits to the Use of DebtChapter 18: Valuation and Capital Budgeting for the Levered FirmChapter 19: Dividends and Other PayoutsPart V: Long-Term FinancingChapter 20: Issuing Securities to the PublicChapter 21: LeasingPart VI: Options, Futures, and Corporate FinanceChapter 22: Options and Corporate FinanceChapter 23: Options and Corporate Finance: Extensions and ApplicationsChapter 24: Warrants and ConvertiblesChapter 25: Derivatives and Hedging RiskPart VII: Short-Term FinanceChapter 26: Short-Term Finance and PlanningChapter 27: Cash ManagementChapter 28: Credit and Inventory ManagementPart VIII: Special TopicsChapter 29: Mergers and AcquisitionsChapter 30: Financial DistressChapter 31: International Corporate Finance81