Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

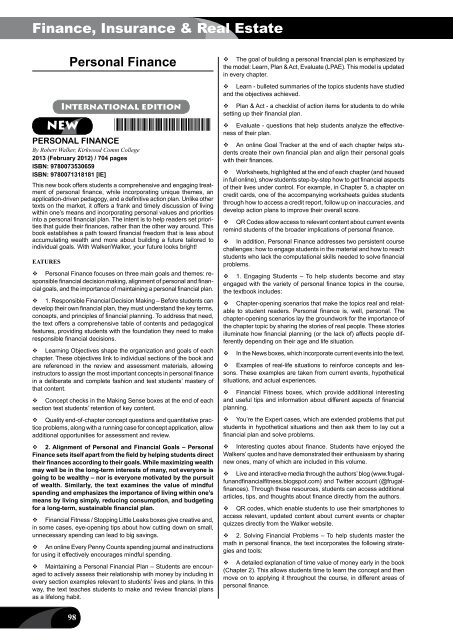

Finance, Insurance & Real EstatePersonal FinanceInternational editionNEW *9780073530659*PERSONAL FINANCEBy Robert Walker, Kirkwood Comm College2013 (February 2012) / 704 pagesISBN: 9780073530659ISBN: 9780071318181 [IE]This new book offers students a comprehensive and engaging treatmentof personal finance, while incorporating unique themes, anapplication-driven pedagogy, and a definitive action plan. Unlike othertexts on the market, it offers a frank and timely discussion of livingwithin one’s means and incorporating personal values and prioritiesinto a personal financial plan. The intent is to help readers set prioritiesthat guide their finances, rather than the other way around. Thisbook establishes a path toward financial freedom that is less aboutaccumulating wealth and more about building a future tailored toindividual goals. With Walker/Walker, your future looks bright!eaturesPersonal Finance focuses on three main goals and themes: responsiblefinancial decision making, alignment of personal and financialgoals, and the importance of maintaining a personal financial plan.1. Responsible Financial Decision Making – Before students candevelop their own financial plan, they must understand the key terms,concepts, and principles of financial planning. To address that need,the text offers a comprehensive table of contents and pedagogicalfeatures, providing students with the foundation they need to makeresponsible financial decisions.Learning Objectives shape the organization and goals of eachchapter. These objectives link to individual sections of the book andare referenced in the review and assessment materials, allowinginstructors to assign the most important concepts in personal financein a deliberate and complete fashion and test students’ mastery ofthat content.Concept checks in the Making Sense boxes at the end of eachsection test students’ retention of key content.Quality end-of-chapter concept questions and quantitative practiceproblems, along with a running case for concept application, allowadditional opportunities for assessment and review.2. Alignment of Personal and Financial Goals – PersonalFinance sets itself apart from the field by helping students directtheir finances according to their goals. While maximizing wealthmay well be in the long-term interests of many, not everyone isgoing to be wealthy – nor is everyone motivated by the pursuitof wealth. Similarly, the text examines the value of mindfulspending and emphasizes the importance of living within one’smeans by living simply, reducing consumption, and budgetingfor a long-term, sustainable financial plan.Financial Fitness / Stopping Little Leaks boxes give creative and,in some cases, eye-opening tips about how cutting down on small,unnecessary spending can lead to big savings.An online Every Penny Counts spending journal and instructionsfor using it effectively encourages mindful spending.Maintaining a Personal Financial Plan – Students are encouragedto actively assess their relationship with money by including inevery section examples relevant to students’ lives and plans. In thisway, the text teaches students to make and review financial plansas a lifelong habit.The goal of building a personal financial plan is emphasized bythe model: Learn, Plan & Act, Evaluate (LPAE). This model is updatedin every chapter.Learn - bulleted summaries of the topics students have studiedand the objectives achieved.Plan & Act - a checklist of action items for students to do whilesetting up their financial plan.Evaluate - questions that help students analyze the effectivenessof their plan.An online Goal Tracker at the end of each chapter helps studentscreate their own financial plan and align their personal goalswith their finances.Worksheets, highlighted at the end of each chapter (and housedin full online), show students step-by-step how to get financial aspectsof their lives under control. For example, in Chapter 5, a chapter oncredit cards, one of the accompanying worksheets guides studentsthrough how to access a credit report, follow up on inaccuracies, anddevelop action plans to improve their overall score.QR Codes allow access to relevant content about current eventsremind students of the broader implications of personal finance.In addition, Personal Finance addresses two persistent coursechallenges: how to engage students in the material and how to reachstudents who lack the computational skills needed to solve financialproblems.1. Engaging Students – To help students become and stayengaged with the variety of personal finance topics in the course,the textbook includes:Chapter-opening scenarios that make the topics real and relatableto student readers. Personal finance is, well, personal. Thechapter-opening scenarios lay the groundwork for the importance ofthe chapter topic by sharing the stories of real people. These storiesilluminate how financial planning (or the lack of) affects people differentlydepending on their age and life situation.In the News boxes, which incorporate current events into the text.Examples of real-life situations to reinforce concepts and lessons.These examples are taken from current events, hypotheticalsituations, and actual experiences.Financial Fitness boxes, which provide additional interestingand useful tips and information about different aspects of financialplanning.You’re the Expert cases, which are extended problems that putstudents in hypothetical situations and then ask them to lay out afinancial plan and solve problems.Interesting quotes about finance. Students have enjoyed theWalkers’ quotes and have demonstrated their enthusiasm by sharingnew ones, many of which are included in this volume.Live and interactive media through the authors’ blog (www.frugalfunandfinancialfitness.blogspot.com)and Twitter account (@frugalfinances).Through these resources, students can access additionalarticles, tips, and thoughts about finance directly from the authors.QR codes, which enable students to use their smartphones toaccess relevant, updated content about current events or chapterquizzes directly from the Walker website.2. Solving Financial Problems – To help students master themath in personal finance, the text incorporates the following strategiesand tools:A detailed explanation of time value of money early in the book(Chapter 2). This allows students time to learn the concept and thenmove on to applying it throughout the course, in different areas ofpersonal finance.98