Finance, Insurance & Real EstateFinance Minutes case studies and chapter on government debtupdated in light of current issues in financeNew chapter on risk management and derivativesCONTENTSCh 1. What is a financial system and how does it work?Ch 2. Interest rates, monetary policy and the economyCh 3. Commercial banks and investment banksCh 4. Personal financeCh 5. Business financeCh 6. Corporate financeCh 7. The stock exchangeCh 8. Understanding the share marketCh 9. International financial marketsCh 10. Government debt and the payments systemCh 11. An introduction to risk management and derivativesCh 12. Case studies in financial crisesFINANCIAL INSTITUTIONS, INSTRUMENTSAND MARKETS6th EditionBy Christopher Viney, Deakin University2009ISBN: 9780070140899<strong>McGraw</strong>-<strong>Hill</strong> Australia Titlewww.mhhe.com/au/viney6eThis text discusses the structure, functions and operations of amodern financial system and, crucially, recognises that finance is aglobal business. Therefore, as well as solid integration of the localfinancial environment, the international aspect has been consideredessential and means the text is as relevant to a commercial bank inHong Kong as to an investment bank in Sydney. Comprehensivelyupdated to take account of the continuing crisis in the world financialmarket, this text has been further improved with an additional chapteron risk management and derivatives. This provides flexibility to thelecturer, who may choose to cover the four chapters in Part 6 or relysimply on the more concise coverage of Chapter 18.ContentsPart 1: Financial Institutions1 A modern financial system: An overview2 Commercial banks3 Non-bank financial institutionsPart 2: Equity Markets4 The share market and the corporation5 Corporations issuing equity in the share market6 Investors in the share market7 Forecasting share price movementsPart 3: The Corporate Debt Market8 Mathematics of finance: An introduction to basic concepts andcalculations9 Short-term debt10 Medium- to long-term debt11 International debt marketsPart 4: Government, Debt, Monetary Policy, The Payment System& Interest Rates12 Government debt, monetary policy and the payments system13 An introduction to interest rate determination and forecasting14 Interest rate risk measurementPart 5: The Foreign Exchange Market15 Foreign exchange: The structure and operation of the FX market16 Foreign exchange: Factors that influence the exchange rate17 Foreign exchange: Risk identification and managementPart 6: Derivative Markets and Risk Management18 An introduction to risk management and derivatives19 Futures contracts and forward rate agreements20 Options21 Interest rate swaps, currency swaps and credit default swapsBank ManagementInternational editionNEW *9780078034671*BANK MANAGEMENT &FINANCIAL SERVICES9th EditionBy Peter S Rose, Texas A&M University andSylvia C Hudgins, Old Dominion University2013 (February 2012) / 768 pagesISBN: 9780078034671ISBN: 9780071326421 [IE]www.mhhe.com/rosehudgins9eBank Management and Financial Services, now in its ninth edition,is designed primarily for students interested in pursuing careers inor learning more about the financial services industry. It explores theservices that banks and their principal competitors (including savingsand loans, credit unions, security and investment firms) offer in anincreasingly competitive financial-services marketplace.ContentsPART ONE Introduction to Banking and Financial Services1. An Overview of the Changing Financial-Services Sector2. The Impact of Government Policy and Regulation on the Financial-Services Industry3. The Organization and Structure of Banking and the Financial-Services Industry4. Establishing New Banks, Branches, ATMs, Telephone Services,and Web SitesPART TWO Financial Statements and Financial-Firm Performance5. The Financial Statements of Banks and Their principal Competitors6. Measuring and Evaluating the Performance of Banks and TheirPrincipal CompetitionPART THREE Tools for Managing and Hedging Against Risk7. Risk Management for Changing Interest Rates: Asset-LiabilityManagement and Duration Techniques8. Risk Management: Financial Futures, Options, Swaps, and OtherHedging Tools9. Risk Management: Asset-Backed Securities, Loan Sales, CreditStanbys, and CreStandbysivativesPART FOUR Managing Investment Portfolios and Liquidity Positionsfor Financial Firms10. The Investment Function in Financial Services Management11. Liquidity and Reserves Management: Strategies and PoliciesPART FIVE Managing Sources of Funds for a Financial Firm12. Managing and Pricing Deposit Services13. Managing Nondeposit Liabilities14. Investment Banking, Insurance, and Other Sources of Fee Income15. The Management of CapitalPART SIX Providing Loans to Businesses and Consumers16. Lending Policies and Procedures: Managing Credit Risk17. Lending to Business Firms and Pricing Business Loans18. Consumer Loans, Credit Cards, and Real Estate Lending95

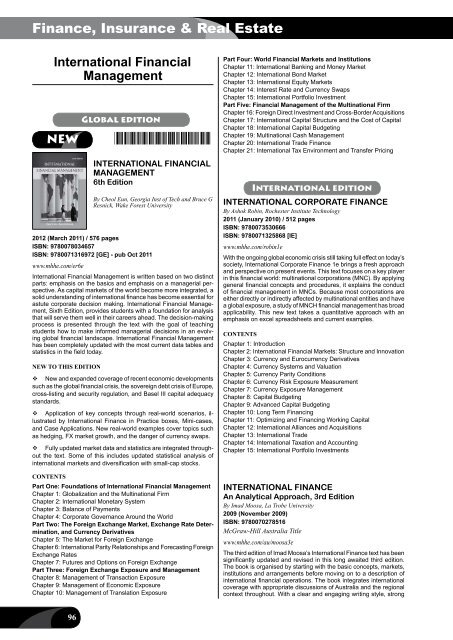

Finance, Insurance & Real EstateInternational FinancialManagementGlobal editionNEW *9780078034657*INTERNATIONAL FINANCIALMANAGEMENT6th EditionBy Cheol Eun, Georgia Inst of Tech and Bruce GResnick, Wake Forest University2012 (March 2011) / 576 pagesISBN: 9780078034657ISBN: 9780071316972 [GE] - pub Oct 2011www.mhhe.com/er6eInternational Financial Management is written based on two distinctparts: emphasis on the basics and emphasis on a managerial perspective.As capital markets of the world become more integrated, asolid understanding of international finance has become essential forastute corporate decision making. International Financial Management,Sixth Edition, provides students with a foundation for analysisthat will serve them well in their careers ahead. The decision-makingprocess is presented through the text with the goal of teachingstudents how to make informed managerial decisions in an evolvingglobal financial landscape. International Financial Managementhas been completely updated with the most current data tables andstatistics in the field today.New to this editionNew and expanded coverage of recent economic developmentssuch as the global financial crisis, the sovereign debt crisis of Europe,cross-listing and security regulation, and Basel III capital adequacystandards.Application of key concepts through real-world scenarios, illustratedby International Finance in Practice boxes, Mini-cases,and Case Applications. New real-world examples cover topics suchas hedging, FX market growth, and the danger of currency swaps.Fully updated market data and statistics are integrated throughoutthe text. Some of this includes updated statistical analysis ofinternational markets and diversification with small-cap stocks.ContentsPart One: Foundations of International Financial ManagementChapter 1: Globalization and the Multinational FirmChapter 2: International Monetary SystemChapter 3: Balance of PaymentsChapter 4: Corporate Governance Around the WorldPart Two: The Foreign Exchange Market, Exchange Rate Determination,and Currency DerivativesChapter 5: The Market for Foreign ExchangeChapter 6: International Parity Relationships and Forecasting ForeignExchange RatesChapter 7: Futures and Options on Foreign ExchangePart Three: Foreign Exchange Exposure and ManagementChapter 8: Management of Transaction ExposureChapter 9: Management of Economic ExposureChapter 10: Management of Translation ExposurePart Four: World Financial Markets and InstitutionsChapter 11: International Banking and Money MarketChapter 12: International Bond MarketChapter 13: International Equity MarketsChapter 14: Interest Rate and Currency SwapsChapter 15: International Portfolio InvestmentPart Five: Financial Management of the Multinational FirmChapter 16: Foreign Direct Investment and Cross-Border AcquisitionsChapter 17: International Capital Structure and the Cost of CapitalChapter 18: International Capital BudgetingChapter 19: Multinational Cash ManagementChapter 20: International Trade FinanceChapter 21: International Tax Environment and Transfer PricingInternational editionINTERNATIONAL CORPORATE FINANCEBy Ashok Robin, Rochester Institute Technology2011 (January 2010) / 512 pagesISBN: 9780073530666ISBN: 9780071325868 [IE]www.mhhe.com/robin1eWith the ongoing global economic crisis still taking full effect on today’ssociety, International Corporate Finance 1e brings a fresh approachand perspective on present events. This text focuses on a key playerin this financial world: multinational corporations (MNC). By applyinggeneral financial concepts and procedures, it explains the conductof financial management in MNCs. Because most corporations areeither directly or indirectly affected by multinational entities and havea global exposure, a study of MNCH financial management has broadapplicability. This new text takes a quantitative approach with anemphasis on excel spreadsheets and current examples.ContentsChapter 1: IntroductionChapter 2: International Financial Markets: Structure and InnovationChapter 3: Currency and Eurocurrency DerivativesChapter 4: Currency Systems and ValuationChapter 5: Currency Parity ConditionsChapter 6: Currency Risk Exposure MeasurementChapter 7: Currency Exposure ManagementChapter 8: Capital BudgetingChapter 9: Advanced Capital BudgetingChapter 10: Long Term FinancingChapter 11: Optimizing and Financing Working CapitalChapter 12: International Alliances and AcquisitionsChapter 13: International TradeChapter 14: International Taxation and AccountingChapter 15: International Portfolio InvestmentsINTERNATIONAL FINANCEAn Analytical Approach, 3rd EditionBy Imad Moosa, La Trobe University2009 (November 2009)ISBN: 9780070278516<strong>McGraw</strong>-<strong>Hill</strong> Australia Titlewww.mhhe.com/au/moosa3eThe third edition of Imad Moosa’s International Finance text has beensignificantly updated and revised in this long awaited third edition.The book is organised by starting with the basic concepts, markets,institutions and arrangements before moving on to a description ofinternational financial operations. The book integrates internationalcoverage with appropriate discussions of Australia and the regionalcontext throughout. With a clear and engaging writing style, strong96

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17:

New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19:

Accounting for Non-Accounting Manag

- Page 20 and 21:

New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23:

AccountingAccounting PrinciplesNEW

- Page 24 and 25:

AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27:

AccountingSCHAUM’S OUTLINE OF FIN

- Page 28:

AccountingFinancial AccountingInter

- Page 31 and 32:

AccountingNEW *9780077328702*2012 (

- Page 33 and 34:

AccountingInternational editionFINA

- Page 35 and 36:

AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38:

Accountingconsolidation accountingC

- Page 39 and 40:

AccountingManagerial AccountingGlob

- Page 41 and 42:

AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44:

Accounting18. Cost volume profit an

- Page 45 and 46:

AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48:

Accounting11 Merchandising Corporat

- Page 49 and 50:

AccountingCONTENTSAbout the Authors

- Page 51 and 52:

Accounting4 Fundamentals of Cost An

- Page 53 and 54:

AccountingContents1. Accounting: Th

- Page 55 and 56:

Accounting12 Acquisition/Payment Pr

- Page 57 and 58:

Accounting6 Intercompany Inventory

- Page 59 and 60:

Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111: Finance, Insurance & Real Estateeas

- Page 115 and 116: Finance, Insurance & Real EstatePer

- Page 118 and 119: Finance, Insurance & Real EstateCha

- Page 120 and 121: Finance, Insurance & Real EstateFIN

- Page 122 and 123: Finance, Insurance & Real EstateUpp

- Page 124 and 125: ATitle IndexAccounting and Bookkeep

- Page 126 and 127: Title IndexFinancial Institutions M

- Page 128 and 129: Title IndexPrinciples of Accounting

- Page 130 and 131: DAuthor IndexDeegan Australian Fina

- Page 132 and 133: Author IndexMintz Ethical Obligatio

- Page 134 and 135: WAuthor IndexWalker Personal Financ

- Page 136 and 137: M c G R A W - H I L L M A I L I N G

- Page 138: Preparing Students forthe World Tha