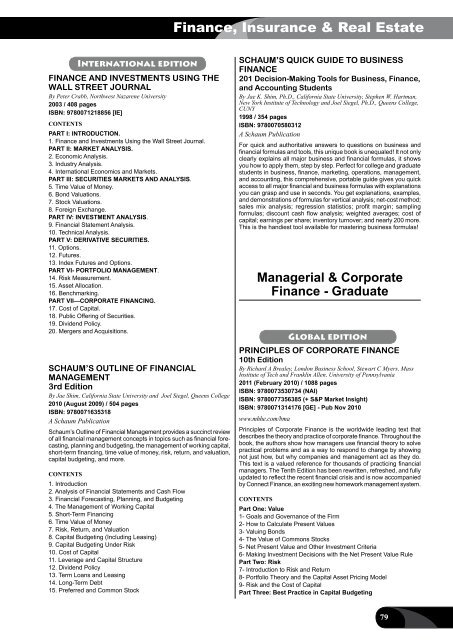

Finance, Insurance & Real EstateInternational editionFINANCE AND INVESTMENTS USING THEWALL STREET JOURNALBy Peter Crabb, Northwest Nazarene University2003 / 408 pagesISBN: 9780071218856 [IE]CONTENTSPART I: INTRODUCTION.1. Finance and Investments Using the Wall Street Journal.PART II: MARKET ANALYSIS.2. Economic Analysis.3. Industry Analysis.4. International Economics and Markets.PART III: SECURITIES MARKETS AND ANALYSIS.5. Time Value of Money.6. Bond Valuations.7. Stock Valuations.8. Foreign Exchange.PART IV: INVESTMENT ANALYSIS.9. Financial Statement Analysis.10. Technical Analysis.PART V: DERIVATIVE SECURITIES.11. Options.12. Futures.13. Index Futures and Options.PART VI- PORTFOLIO MANAGEMENT.14. Risk Measurement.15. Asset Allocation.16. Benchmarking.PART VII—CORPORATE FINANCING.17. Cost of Capital.18. Public Offering of Securities.19. Dividend Policy.20. Mergers and Acquisitions.SCHAUM’S OUTLINE OF FINANCIALMANAGEMENT3rd EditionBy Jae Shim, California State University and Joel Siegel, Queens College2010 (August 2009) / 504 pagesISBN: 9780071635318A Schaum PublicationSchaum’s Outline of Financial Management provides a succinct reviewof all financial management concepts in topics such as financial forecasting,planning and budgeting, the management of working capital,short-term financing, time value of money, risk, return, and valuation,capital budgeting, and more.Contents1. Introduction2. Analysis of Financial Statements and Cash Flow3. Financial Forecasting, Planning, and Budgeting4. The Management of Working Capital5. Short-Term Financing6. Time Value of Money7. Risk, Return, and Valuation8. Capital Budgeting (Including Leasing)9. Capital Budgeting Under Risk10. Cost of Capital11. Leverage and Capital Structure12. Dividend Policy13. Term Loans and Leasing14. Long-Term Debt15. Preferred and Common StockSCHAUM’S QUICK GUIDE TO BUSINESSFINANCE201 Decision-Making Tools for Business, Finance,and Accounting StudentsBy Jae K. Shim, Ph.D., California State University, Stephen W. Hartman,New York Institute of Technology and Joel Siegel, Ph.D., Queens College,CUNY1998 / 354 pagesISBN: 9780070580312A Schaum PublicationFor quick and authoritative answers to questions on business andfinancial formulas and tools, this unique book is unequaled! It not onlyclearly explains all major business and financial formulas, it showsyou how to apply them, step by step. Perfect for college and graduatestudents in business, finance, marketing, operations, management,and accounting, this comprehensive, portable guide gives you quickaccess to all major financial and business formulas with explanationsyou can grasp and use in seconds. You get explanations, examples,and demonstrations of formulas for vertical analysis; net-cost method;sales mix analysis; regression statistics; profit margin; samplingformulas; discount cash flow analysis; weighted averages; cost ofcapital; earnings per share; inventory turnover; and nearly 200 more.This is the handiest tool available for mastering business formulas!Managerial & CorporateFinance - GraduateGlobal editionPRINCIPLES OF CORPORATE FINANCE10th EditionBy Richard A Brealey, London Business School, Stewart C Myers, MassInstitute of Tech and Franklin Allen, University of Pennsylvania2011 (February 2010) / 1088 pagesISBN: 9780073530734 (NAI)ISBN: 9780077356385 (+ S&P Market Insight)ISBN: 9780071314176 [GE] - Pub Nov 2010www.mhhe.com/bmaPrinciples of Corporate Finance is the worldwide leading text thatdescribes the theory and practice of corporate finance. Throughout thebook, the authors show how managers use financial theory to solvepractical problems and as a way to respond to change by showingnot just how, but why companies and management act as they do.This text is a valued reference for thousands of practicing financialmanagers. The Tenth Edition has been rewritten, refreshed, and fullyupdated to reflect the recent financial crisis and is now accompaniedby Connect Finance, an exciting new homework management system.ContentsPart One: Value1- Goals and Governance of the Firm2- How to Calculate Present Values3- Valuing Bonds4- The Value of Commons Stocks5- Net Present Value and Other Investment Criteria6- Making Investment Decisions with the Net Present Value RulePart Two: Risk7- Introduction to Risk and Return8- Portfolio Theory and the Capital Asset Pricing Model9- Risk and the Cost of CapitalPart Three: Best Practice in Capital Budgeting79

Finance, Insurance & Real Estate10- Project Analysis11- Investment, Strategy, and Economic Rents12- Agency Problems, Compensation, and the Performance MeasurementPart Four: Financing Decisions and Market Efficiency13- Efficient Markets and Behavioral Finance14- An Overview of Corporate Financing15- How Corporations Issue SecuritiesPart Five: Payout Policy and Capital Structure16- Payout Policy17- Does Debt Policy Matter?18- How Much Should a Corporation Borrow?19- Financing and ValuationPart Six: Options20- Understanding Options21- Valuing Options22- Real OptionsPart Seven: Debt Financing23- Credit Risk and the Value of Corporate Debt24- The Many Different Kinds of Debt25- LeasingPart Eight: Risk Management26- Managing Risk27- Managing International RisksPart Nine: Financial Planning and Working Capital Management28- Financial Analysis29- Financial Planning30- Working Capital ManagementPart Ten: Mergers, Corporate Control, and Governance31- Mergers32- Corporate Restructuring33- Governance and Corporate Control Around the WorldPart Eleven: Conclusion34- Conclusion: What We Do and Do Not Know About FinanceInternational editionPRINCIPLES OF CORPORATE FINANCEConcise, 2nd EditionBy Richard A Brealey, London Business School, Stewart C Myers, MassInstitute of Tech and Franklin Allen, University of Pennsylvania2011 (April 2010) / 672 pagesISBN: 9780073530741ISBN: 9780071289160 [IE]www.mhhe.com/bma2eThroughout Principles of Corporate Finance, Concise the authorsshow how managers use financial theory to solve practical problemsand as a way of learning how to respond to change by showing notjust how but why companies and management act as they do. Thefirst ten chapters mirror the Principles text, covering the time valueof money, the valuation of bonds and stocks, and practical capitalbudgeting decisions. The remaining chapters discuss market efficiency,payout policy, and capital structure, option valuation, andfinancial planning and analysis. The text is modular, so that Partscan be introduced in an alternative order.ContentsPart One: Value1: Goals and Governance of the Firm2: How to Calculate Present Values3: Valuing Bonds4: The Value of Common Stocks5: Net Present Value and Other Investment Criteria6: Making Investment Decisions with the Net Present Value RulePart Two: Risk7: Introduction to Risk and Return8: Portfolio Theory and the Capital Asset Pricing Model9: Risk and the Cost of CapitalPart Three: Best Practices in Capital Budgeting10: Project AnalysisPart Four: Financing Decisions and Market Efficiency11: Efficient Markets and Behavioral FinancePart Five: Payout Policy and Capital Structure12: Payout Policy13: Does Debt Policy Matter?14: How Much Should a Corporation Borrow?15: Financing and ValuationPart Six: Options16: Understanding Options17: Valuing OptionsPart Seven: Financial Planning and Working Capital Management18: Financial Analysis19: Financial PlanningAppendixGlossaryIndexNEW *9780071067850*FINANCIAL MANAGEMENTText and Problems, 6th EditionBy M Y Khan, Formerly Professor of FInance,Dept of Financial Studies and P K Jain, IndianInstitute of Technology, Delhi2011 (February 2011) / 1404 pagesISBN: 9780071067850<strong>McGraw</strong>-<strong>Hill</strong> India TitleThis new edition of Financial Management continues to emphasise onthe theories, concepts, and techniques that aid in corporate decisionmaking, Apart from updating the chapters with recent developmentsin the subject, it presents to the readers several new cases andexamples, along with new-age tools like ‘excel’ for problem solving.New to this editionAnalytical Approach and Decisional FocusManagerial decision-making perspectiveProcedural Orientation, Practice Discussion and CasesFinancial Tables and BibliographyContents1. Financial Management – An Overview2. Time Value of Money3. Risk and Return4. Valuation of Bonds and Shares5. Cash-flow Statement6. Financial Statement Analysis7. Volume-Cost-Profit Analysis8. Budgeting and Profit Planning9. Capital Budgeting I: Principles and Techniques10. Capital Budgeting II: Additional Aspects11. Concept and Measurement of Cost of Capital12. Analysis of Risk and Uncertainty13. Working Capital Management – An Overview14. Management of Cash and Marketable Securities15. Receivables Management16. Inventory Management17. Working Capital Management18. Operating, Financial and Combined Leverage19. Capital Structure, Cost of Capital and Valuation20. Designing Capital Structure80

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17:

New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19:

Accounting for Non-Accounting Manag

- Page 20 and 21:

New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23:

AccountingAccounting PrinciplesNEW

- Page 24 and 25:

AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27:

AccountingSCHAUM’S OUTLINE OF FIN

- Page 28:

AccountingFinancial AccountingInter

- Page 31 and 32:

AccountingNEW *9780077328702*2012 (

- Page 33 and 34:

AccountingInternational editionFINA

- Page 35 and 36:

AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38:

Accountingconsolidation accountingC

- Page 39 and 40:

AccountingManagerial AccountingGlob

- Page 41 and 42:

AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44:

Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114: Finance, Insurance & Real EstateInt

- Page 115 and 116: Finance, Insurance & Real EstatePer

- Page 118 and 119: Finance, Insurance & Real EstateCha

- Page 120 and 121: Finance, Insurance & Real EstateFIN

- Page 122 and 123: Finance, Insurance & Real EstateUpp

- Page 124 and 125: ATitle IndexAccounting and Bookkeep

- Page 126 and 127: Title IndexFinancial Institutions M

- Page 128 and 129: Title IndexPrinciples of Accounting

- Page 130 and 131: DAuthor IndexDeegan Australian Fina

- Page 132 and 133: Author IndexMintz Ethical Obligatio

- Page 134 and 135: WAuthor IndexWalker Personal Financ

- Page 136 and 137: M c G R A W - H I L L M A I L I N G

- Page 138: Preparing Students forthe World Tha