Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

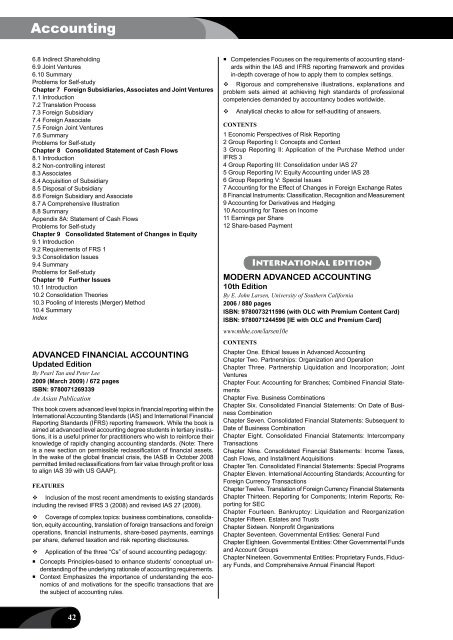

Accounting6.8 Indirect Shareholding6.9 Joint Ventures6.10 SummaryProblems for Self-studyChapter 7 Foreign Subsidiaries, Associates and Joint Ventures7.1 Introduction7.2 Translation Process7.3 Foreign Subsidiary7.4 Foreign Associate7.5 Foreign Joint Ventures7.6 SummaryProblems for Self-studyChapter 8 Consolidated Statement of Cash Flows8.1 Introduction8.2 Non-controlling interest8.3 Associates8.4 Acquisition of Subsidiary8.5 Disposal of Subsidiary8.6 Foreign Subsidiary and Associate8.7 A Comprehensive Illustration8.8 SummaryAppendix 8A: Statement of Cash FlowsProblems for Self-studyChapter 9 Consolidated Statement of Changes in Equity9.1 Introduction9.2 Requirements of FRS 19.3 Consolidation Issues9.4 SummaryProblems for Self-studyChapter 10 Further Issues10.1 Introduction10.2 Consolidation Theories10.3 Pooling of Interests (Merger) Method10.4 SummaryIndexADVANCED FINANCIAL ACCOUNTINGUpdated EditionBy Pearl Tan and Peter Lee2009 (March 2009) / 672 pagesISBN: 9780071269339An Asian PublicationThis book covers advanced level topics in financial reporting within theInternational Accounting Standards (IAS) and International FinancialReporting Standards (IFRS) reporting framework. While the book isaimed at advanced level accounting degree students in tertiary institutions,it is a useful primer for practitioners who wish to reinforce theirknowledge of rapidly changing accounting standards. (Note: Thereis a new section on permissible reclassification of financial assets.In the wake of the global financial crisis, the IASB in October 2008permitted limited reclassifications from fair value through profit or lossto align IAS 39 with US GAAP).FeaturesInclusion of the most recent amendments to existing standardsincluding the revised IFRS 3 (2008) and revised IAS 27 (2008).Coverage of complex topics: business combinations, consolidation,equity accounting, translation of foreign transactions and foreignoperations, financial instruments, share-based payments, earningsper share, deferred taxation and risk reporting disclosures.Application of the three “Cs” of sound accounting pedagogy:• Concepts Principles-based to enhance students’ conceptual understandingof the underlying rationale of accounting requirements.• Context Emphasizes the importance of understanding the economicsof and motivations for the specific transactions that arethe subject of accounting rules.• Competencies Focuses on the requirements of accounting standardswithin the IAS and IFRS reporting framework and providesin-depth coverage of how to apply them to complex settings.Rigorous and comprehensive illustrations, explanations andproblem sets aimed at achieving high standards of professionalcompetencies demanded by accountancy bodies worldwide.Analytical checks to allow for self-auditing of answers.Contents1 Economic Perspectives of Risk Reporting2 Group Reporting I: Concepts and Context3 Group Reporting II: Application of the Purchase Method underIFRS 34 Group Reporting III: Consolidation under IAS 275 Group Reporting IV: Equity Accounting under IAS 286 Group Reporting V: Special Issues7 Accounting for the Effect of Changes in Foreign Exchange Rates8 Financial Instruments: Classification, Recognition and Measurement9 Accounting for Derivatives and Hedging10 Accounting for Taxes on Income11 Earnings per Share12 Share-based PaymentInternational editionMODERN ADVANCED ACCOUNTING10th EditionBy E. John Larsen, University of Southern California2006 / 880 pagesISBN: 9780073211596 (with OLC with Premium Content Card)ISBN: 9780071244596 [IE with OLC and Premium Card]www.mhhe.com/larsen10eCONTENTSChapter One. Ethical Issues in Advanced AccountingChapter Two. Partnerships: Organization and OperationChapter Three. Partnership Liquidation and Incorporation; JointVenturesChapter Four. Accounting for Branches; Combined Financial StatementsChapter Five. Business CombinationsChapter Six. Consolidated Financial Statements: On Date of BusinessCombinationChapter Seven. Consolidated Financial Statements: Subsequent toDate of Business CombinationChapter Eight. Consolidated Financial Statements: IntercompanyTransactionsChapter Nine. Consolidated Financial Statements: Income Taxes,Cash Flows, and Installment AcquisitionsChapter Ten. Consolidated Financial Statements: Special ProgramsChapter Eleven. International Accounting Standards; Accounting forForeign Currency TransactionsChapter Twelve. Translation of Foreign Currency Financial StatementsChapter Thirteen. Reporting for Components; Interim Reports; Reportingfor SECChapter Fourteen. Bankruptcy: Liquidation and ReorganizationChapter Fifteen. Estates and TrustsChapter Sixteen. Nonprofit OrganizationsChapter Seventeen. Governmental Entities: General FundChapter Eighteen. Governmental Entities: Other Governmental Fundsand Account GroupsChapter Nineteen. Governmental Entities: Proprietary Funds, FiduciaryFunds, and Comprehensive Annual Financial Report42