AccountingCOLLEGE ACCOUNTING CHAPTER 1-29WITH ANNUAL REPORT2nd EditionBy John J Wild, University of Wisconsin Madison, Vernon Richardson,University of Arkansas-Fayetteville and Ken Shaw, University ofMissouri-Columbia2011 (January 2010)ISBN: 9780077346096www.mhhe.com/wildCA2eCollege Accounting by Wild, Richardson, and Shaw draws upon thesuccess of Wild’s Fundamental Accounting Principles text. Its innovationis reflected in its extensive use of small business examples,the integration of new computerized learning tools, superior end-ofchaptermaterial, and a highly engaging, pedagogical design. Inclusionof technology products such as Connect, Connect Plus, ExcelTemplates, and Quick<strong>Books</strong> Pro 2010 software provides studentswith every possible advantage as they strive to understand the keyconcepts of accounting and their role in business.CONTENTS1 Introduction to Accounting2 Accounting for Business Transactions3 Applying Double-Entry Accounting4 Preparing the General Journal and General Ledger5 Adjusting Accounts and Preparing Financial Statements6 Closing Process and Financial Statements7 Fraud, Ethics, and Controls8 Cash and Controls9 Employee Earnings, Deductions, and Payroll10 Employer Payroll Tax Reporting11 Merchandise Sales and Accounts Receivable12 Merchandise Purchases and Accounts Payable13 Accrual Accounting Overview14 Financial Statements and the Accounting Cycle15 Accounts Receivable and Uncollectibles16 Notes Receivable and Notes Payable17 Inventories and Cost of Sales18 Plant Assets, Natural Resources, and Intangibles19 Accounting for Partnerships20 Corporate Formation and Stock Transactions21 Corporate Earnings, Taxes, and Distributions22 Long-Term Bonds23 Cash Flow Reporting24 Financial Statement Analysis25 Managerial Accounting Concepts and Principles26 Departmental and Responsibility Accounting27 Job Order Cost Accounting28 Budgets and Standard Costing29 Relevant Costing for Managerial DecisionsAppendix A: Financial Statement InformationAppendix B: Accounting PrinciplesAppendix C*: Capital Budgeting and Investment DecisionsAppendix D*: Time Value of Money* Appendixes C and D are available on the book’s Website, mhhe.com/wildCA, and as print copy from a <strong>McGraw</strong>-<strong>Hill</strong> representativeFUNDAMENTAL ACCOUNTING PRINCIPLES20th EditionBy John Wild, University of Wisconsin at Madison, Barbara Chiappetta,Nassau Community College and Ken Shaw, University of Missouri-Columbia2011 (October 2010) / 1188 pagesISBN: 9780078110870www.mhhe.com/wildFAP20eWith 55 years of success in the principles of accounting market,Fundamental Accounting Principles, 20th edition by Wild, Shaw andChiappetta has endured and adapted to changes in accounting,technology, and student learning styles. Its innovation is reflected inits extensive use of small business examples, the integration of newtechnology learning tools, superior end-of-chapter material, and ahighly engaging, pedagogical design. Inclusion of Connect, ConnectPlus and Carol Yacht’s General Ledger and Peachtree applicationsoftware provides students every advantage as they strive to understandthe key concepts of accounting and their role in business.Contents1. Accounting in Business2. Analyzing and Recording Transactions3. Adjusting Accounts and Preparing Financial Statements4. Completing the Accounting Cycle5. Accounting for Merchandising Operations6. Inventories and Cost of Sales7. Accounting Information Systems8. Cash and Internal Controls9. Accounting for Receivables10. Plant Assets, Natural Resources, and Intangibles11. Current Liabilities and Payroll Accounting12. Accounting for Partnerships13. Accounting for Corporations14. Long-Term Liabilities15. Investments and International Operations16. Reporting the Statement of Cash Flows17. Analysis of Financial Statements18. Managerial Accounting Concepts and Principles19. Job Order Cost Accounting20. Process Cost Accounting21. Cost Allocation and Performance Measurement22. Cost-Volume-Profit Analysis23. Master Budgets and Planning24. Flexible Budgets and Standard Costs25. Capital Budgeting and Managerial DecisionsREVIEW COPY(Available for course adoption only)To request for a review copy,• contact your local <strong>McGraw</strong>-<strong>Hill</strong>representatives or,• fax the Review Copy Request Form foundin this catalog or,• e-mail your request tomghasia_sg@mcgraw-hill.com or,• submit online at www.mheducation.asia7

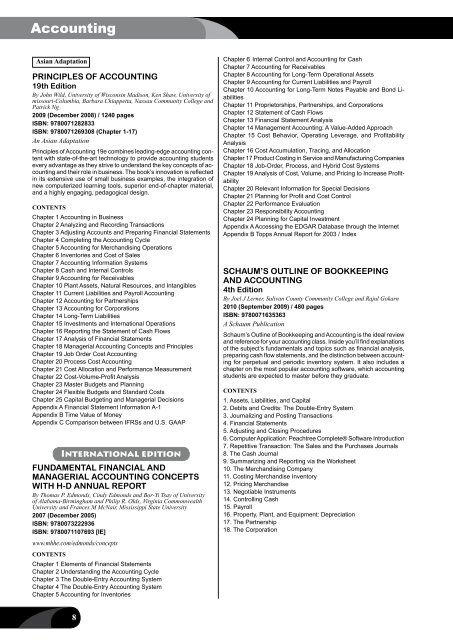

AccountingAsian AdaptationPRINCIPLES OF ACCOUNTING19th EditionBy John Wild, University of Wisconsin Madison, Ken Shaw, University ofmissouri-Columbia, Barbara Chiappetta, Nassau Community College andPatrick Ng2009 (December 2008) / 1240 pagesISBN: 9780071282833ISBN: 9780071269308 (Chapter 1-17)An Asian AdaptationPrinciples of Accounting 19e combines leading-edge accounting contentwith state-of-the-art technology to provide accounting studentsevery advantage as they strive to understand the key concepts of accountingand their role in business. The book’s innovation is reflectedin its extensive use of small business examples, the integration ofnew computerized learning tools, superior end-of-chapter material,and a highly engaging, pedagogical design.ContentsChapter 1 Accounting in BusinessChapter 2 Analyzing and Recording TransactionsChapter 3 Adjusting Accounts and Preparing Financial StatementsChapter 4 Completing the Accounting CycleChapter 5 Accounting for Merchandising OperationsChapter 6 Inventories and Cost of SalesChapter 7 Accounting Information SystemsChapter 8 Cash and Internal ControlsChapter 9 Accounting for ReceivablesChapter 10 Plant Assets, Natural Resources, and IntangiblesChapter 11 Current Liabilities and Payroll AccountingChapter 12 Accounting for PartnershipsChapter 13 Accounting for CorporationsChapter 14 Long-Term LiabilitiesChapter 15 Investments and International OperationsChapter 16 Reporting the Statement of Cash FlowsChapter 17 Analysis of Financial StatementsChapter 18 Managerial Accounting Concepts and PrinciplesChapter 19 Job Order Cost AccountingChapter 20 Process Cost AccountingChapter 21 Cost Allocation and Performance MeasurementChapter 22 Cost-Volume-Profit AnalysisChapter 23 Master Budgets and PlanningChapter 24 Flexible Budgets and Standard CostsChapter 25 Capital Budgeting and Managerial DecisionsAppendix A Financial Statement Information A-1Appendix B Time Value of MoneyAppendix C Comparison between IFRSs and U.S. GAAPInternational editionFUNDAMENTAL FINANCIAL ANDMANAGERIAL ACCOUNTING CONCEPTSWITH H-D ANNUAL REPORTBy Thomas P. Edmonds, Cindy Edmonds and Bor-Yi Tsay of Universityof Alabama-Birmingham and Philip R. Olds, Virginia CommonwealthUniversity and Frances M McNair, Mississippi State University2007 (December 2005)ISBN: 9780073222936ISBN: 9780071107693 [IE]www.mhhe.com/edmonds/conceptsContentsChapter 1 Elements of Financial StatementsChapter 2 Understanding the Accounting CycleChapter 3 The Double-Entry Accounting SystemChapter 4 The Double-Entry Accounting SystemChapter 5 Accounting for InventoriesChapter 6 Internal Control and Accounting for CashChapter 7 Accounting for ReceivablesChapter 8 Accounting for Long-Term Operational AssetsChapter 9 Accounting for Current Liabilities and PayrollChapter 10 Accounting for Long-Term Notes Payable and Bond LiabilitiesChapter 11 Proprietorships, Partnerships, and CorporationsChapter 12 Statement of Cash FlowsChapter 13 Financial Statement AnalysisChapter 14 Management Accounting: A Value-Added ApproachChapter 15 Cost Behavior, Operating Leverage, and ProfitabilityAnalysisChapter 16 Cost Accumulation, Tracing, and AllocationChapter 17 Product Costing in Service and Manufacturing CompaniesChapter 18 Job-Order, Process, and Hybrid Cost SystemsChapter 19 Analysis of Cost, Volume, and Pricing to Increase ProfitabilityChapter 20 Relevant Information for Special DecisionsChapter 21 Planning for Profit and Cost ControlChapter 22 Performance EvaluationChapter 23 Responsibility AccountingChapter 24 Planning for Capital InvestmentAppendix A Accessing the EDGAR Database through the InternetAppendix B Topps Annual Report for 2003 / IndexSCHAUM’S OUTLINE OF BOOKKEEPINGAND ACCOUNTING4th EditionBy Joel J Lerner, Sulivan County Community College and Rajul Gokarn2010 (September 2009) / 480 pagesISBN: 9780071635363A Schaum PublicationSchaum’s Outline of Bookkeeping and Accounting is the ideal reviewand reference for your accounting class. Inside you’ll find explanationsof the subject’s fundamentals and topics such as financial analysis,preparing cash flow statements, and the distinction between accountingfor perpetual and periodic inventory system. It also includes achapter on the most popular accounting software, which accountingstudents are expected to master before they graduate.Contents1. Assets, Liabilities, and Capital2. Debits and Credits: The Double-Entry System3. Journalizing and Posting Transactions4. Financial Statements5. Adjusting and Closing Procedures6. Computer Application: Peachtree Complete® Software Introduction7. Repetitive Transaction: The Sales and the Purchases Journals8. The Cash Journal9. Summarizing and Reporting via the Worksheet10. The Merchandising Company11. Costing Merchandise Inventory12. Pricing Merchandise13. Negotiable Instruments14. Controlling Cash15. Payroll16. Property, Plant, and Equipment: Depreciation17. The Partnership18. The Corporation8

- Page 1: Accounting & Finance 2012Accounting

- Page 4 and 5: CONTENTSii

- Page 6 and 7: + =McGraw-Hill Connect ® and McGra

- Page 8: Higher EducationBright futures begi

- Page 11: BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75:

AccountingChapter 12 Financial Repo

- Page 76 and 77:

AccountingAust AdaptationACCOUNTING

- Page 78 and 79:

AccountingChapter 6 The Role of Fin

- Page 80 and 81:

Bank Management....................

- Page 82 and 83:

Finance, Insurance & Real EstateMan

- Page 84 and 85:

Finance, Insurance & Real Estateref

- Page 86 and 87:

Finance, Insurance & Real Estatecom

- Page 88 and 89:

Finance, Insurance & Real EstateUK

- Page 90 and 91:

Finance, Insurance & Real EstateNEW

- Page 92 and 93:

Finance, Insurance & Real Estate26

- Page 94 and 95:

Finance, Insurance & Real EstateInt

- Page 96 and 97:

Finance, Insurance & Real EstateInt

- Page 98 and 99:

Finance, Insurance & Real Estate21.

- Page 101 and 102:

Finance, Insurance & Real EstateCre

- Page 103 and 104:

Finance, Insurance & Real EstateInt

- Page 105 and 106:

Finance, Insurance & Real EstateCas

- Page 107 and 108:

Finance, Insurance & Real EstateCON

- Page 109 and 110:

Finance, Insurance & Real Estate10.

- Page 111 and 112:

Finance, Insurance & Real Estateeas

- Page 113 and 114:

Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha