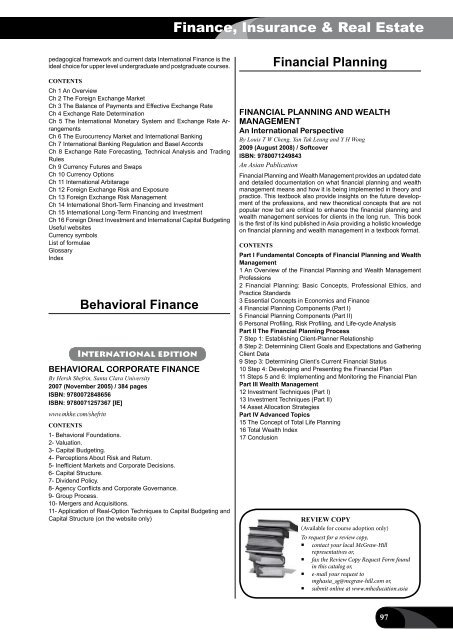

Finance, Insurance & Real Estatepedagogical framework and current data International Finance is theideal choice for upper level undergraduate and postgraduate courses.ContentsCh 1 An OverviewCh 2 The Foreign Exchange MarketCh 3 The Balance of Payments and Effective Exchange RateCh 4 Exchange Rate DeterminationCh 5 The International Monetary System and Exchange Rate ArrangementsCh 6 The Eurocurrency Market and International BankingCh 7 International Banking Regulation and Basel AccordsCh 8 Exchange Rate Forecasting, Technical Analysis and TradingRulesCh 9 Currency Futures and SwapsCh 10 Currency OptionsCh 11 International ArbitarageCh 12 Foreign Exchange Risk and ExposureCh 13 Foreign Exchange Risk ManagementCh 14 International Short-Term Financing and InvestmentCh 15 International Long-Term Financing and InvestmentCh 16 Foreign Direct Investment and International Capital BudgetingUseful websitesCurrency symbolsList of formulaeGlossaryIndexBehavioral FinanceInternational editionBEHAVIORAL CORPORATE FINANCEBy Hersh Shefrin, Santa Clara University2007 (November 2005) / 384 pagesISBN: 9780072848656ISBN: 9780071257367 [IE]www.mhhe.com/shefrinContents1- Behavioral Foundations.2- Valuation.3- Capital Budgeting.4- Perceptions About Risk and Return.5- Inefficient Markets and Corporate Decisions.6- Capital Structure.7- Dividend Policy.8- Agency Conflicts and Corporate Governance.9- Group Process.10- Mergers and Acquisitions.11- Application of Real-Option Techniques to Capital Budgeting andCapital Structure (on the website only)Financial Planningfinancial planning and wealthMANAGEMENTAn International PerspectiveBy Louis T W Cheng, Yan Tak Leung and Y H Wong2009 (August 2008) / SoftcoverISBN: 9780071249843An Asian PublicationFinancial Planning and Wealth Management provides an updated dateand detailed documentation on what financial planning and wealthmanagement means and how it is being implemented in theory andpractice. This textbook also provide insights on the future developmentof the professions, and new theoretical concepts that are notpopular now but are critical to enhance the financial planning andwealth management services for clients in the long run. This bookis the first of its kind published in Asia providing a holistic knowledgeon financial planning and wealth management in a textbook format.ContentsPart I Fundamental Concepts of Financial Planning and WealthManagement1 An Overview of the Financial Planning and Wealth ManagementProfessions2 Financial Planning: Basic Concepts, Professional Ethics, andPractice Standards3 Essential Concepts in Economics and Finance4 Financial Planning Components (Part I)5 Financial Planning Components (Part II)6 Personal Profiling, Risk Profiling, and Life-cycle AnalysisPart II The Financial Planning Process7 Step 1: Establishing Client-Planner Relationship8 Step 2: Determining Client Goals and Expectations and GatheringClient Data9 Step 3: Determining Client’s Current Financial Status10 Step 4: Developing and Presenting the Financial Plan11 Steps 5 and 6: Implementing and Monitoring the Financial PlanPart III Wealth Management12 Investment Techniques (Part I)13 Investment Techniques (Part II)14 Asset Allocation StrategiesPart IV Advanced Topics15 The Concept of Total Life Planning16 Total Wealth Index17 ConclusionREVIEW COPY(Available for course adoption only)To request for a review copy,• contact your local <strong>McGraw</strong>-<strong>Hill</strong>representatives or,• fax the Review Copy Request Form foundin this catalog or,• e-mail your request tomghasia_sg@mcgraw-hill.com or,• submit online at www.mheducation.asia97

Finance, Insurance & Real EstatePersonal FinanceInternational editionNEW *9780073530659*PERSONAL FINANCEBy Robert Walker, Kirkwood Comm College2013 (February 2012) / 704 pagesISBN: 9780073530659ISBN: 9780071318181 [IE]This new book offers students a comprehensive and engaging treatmentof personal finance, while incorporating unique themes, anapplication-driven pedagogy, and a definitive action plan. Unlike othertexts on the market, it offers a frank and timely discussion of livingwithin one’s means and incorporating personal values and prioritiesinto a personal financial plan. The intent is to help readers set prioritiesthat guide their finances, rather than the other way around. Thisbook establishes a path toward financial freedom that is less aboutaccumulating wealth and more about building a future tailored toindividual goals. With Walker/Walker, your future looks bright!eaturesPersonal Finance focuses on three main goals and themes: responsiblefinancial decision making, alignment of personal and financialgoals, and the importance of maintaining a personal financial plan.1. Responsible Financial Decision Making – Before students candevelop their own financial plan, they must understand the key terms,concepts, and principles of financial planning. To address that need,the text offers a comprehensive table of contents and pedagogicalfeatures, providing students with the foundation they need to makeresponsible financial decisions.Learning Objectives shape the organization and goals of eachchapter. These objectives link to individual sections of the book andare referenced in the review and assessment materials, allowinginstructors to assign the most important concepts in personal financein a deliberate and complete fashion and test students’ mastery ofthat content.Concept checks in the Making Sense boxes at the end of eachsection test students’ retention of key content.Quality end-of-chapter concept questions and quantitative practiceproblems, along with a running case for concept application, allowadditional opportunities for assessment and review.2. Alignment of Personal and Financial Goals – PersonalFinance sets itself apart from the field by helping students directtheir finances according to their goals. While maximizing wealthmay well be in the long-term interests of many, not everyone isgoing to be wealthy – nor is everyone motivated by the pursuitof wealth. Similarly, the text examines the value of mindfulspending and emphasizes the importance of living within one’smeans by living simply, reducing consumption, and budgetingfor a long-term, sustainable financial plan.Financial Fitness / Stopping Little Leaks boxes give creative and,in some cases, eye-opening tips about how cutting down on small,unnecessary spending can lead to big savings.An online Every Penny Counts spending journal and instructionsfor using it effectively encourages mindful spending.Maintaining a Personal Financial Plan – Students are encouragedto actively assess their relationship with money by including inevery section examples relevant to students’ lives and plans. In thisway, the text teaches students to make and review financial plansas a lifelong habit.The goal of building a personal financial plan is emphasized bythe model: Learn, Plan & Act, Evaluate (LPAE). This model is updatedin every chapter.Learn - bulleted summaries of the topics students have studiedand the objectives achieved.Plan & Act - a checklist of action items for students to do whilesetting up their financial plan.Evaluate - questions that help students analyze the effectivenessof their plan.An online Goal Tracker at the end of each chapter helps studentscreate their own financial plan and align their personal goalswith their finances.Worksheets, highlighted at the end of each chapter (and housedin full online), show students step-by-step how to get financial aspectsof their lives under control. For example, in Chapter 5, a chapter oncredit cards, one of the accompanying worksheets guides studentsthrough how to access a credit report, follow up on inaccuracies, anddevelop action plans to improve their overall score.QR Codes allow access to relevant content about current eventsremind students of the broader implications of personal finance.In addition, Personal Finance addresses two persistent coursechallenges: how to engage students in the material and how to reachstudents who lack the computational skills needed to solve financialproblems.1. Engaging Students – To help students become and stayengaged with the variety of personal finance topics in the course,the textbook includes:Chapter-opening scenarios that make the topics real and relatableto student readers. Personal finance is, well, personal. Thechapter-opening scenarios lay the groundwork for the importance ofthe chapter topic by sharing the stories of real people. These storiesilluminate how financial planning (or the lack of) affects people differentlydepending on their age and life situation.In the News boxes, which incorporate current events into the text.Examples of real-life situations to reinforce concepts and lessons.These examples are taken from current events, hypotheticalsituations, and actual experiences.Financial Fitness boxes, which provide additional interestingand useful tips and information about different aspects of financialplanning.You’re the Expert cases, which are extended problems that putstudents in hypothetical situations and then ask them to lay out afinancial plan and solve problems.Interesting quotes about finance. Students have enjoyed theWalkers’ quotes and have demonstrated their enthusiasm by sharingnew ones, many of which are included in this volume.Live and interactive media through the authors’ blog (www.frugalfunandfinancialfitness.blogspot.com)and Twitter account (@frugalfinances).Through these resources, students can access additionalarticles, tips, and thoughts about finance directly from the authors.QR codes, which enable students to use their smartphones toaccess relevant, updated content about current events or chapterquizzes directly from the Walker website.2. Solving Financial Problems – To help students master themath in personal finance, the text incorporates the following strategiesand tools:A detailed explanation of time value of money early in the book(Chapter 2). This allows students time to learn the concept and thenmove on to applying it throughout the course, in different areas ofpersonal finance.98

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17:

New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19:

Accounting for Non-Accounting Manag

- Page 20 and 21:

New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23:

AccountingAccounting PrinciplesNEW

- Page 24 and 25:

AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27:

AccountingSCHAUM’S OUTLINE OF FIN

- Page 28:

AccountingFinancial AccountingInter

- Page 31 and 32:

AccountingNEW *9780077328702*2012 (

- Page 33 and 34:

AccountingInternational editionFINA

- Page 35 and 36:

AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38:

Accountingconsolidation accountingC

- Page 39 and 40:

AccountingManagerial AccountingGlob

- Page 41 and 42:

AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44:

Accounting18. Cost volume profit an

- Page 45 and 46:

AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48:

Accounting11 Merchandising Corporat

- Page 49 and 50:

AccountingCONTENTSAbout the Authors

- Page 51 and 52:

Accounting4 Fundamentals of Cost An

- Page 53 and 54:

AccountingContents1. Accounting: Th

- Page 55 and 56:

Accounting12 Acquisition/Payment Pr

- Page 57 and 58:

Accounting6 Intercompany Inventory

- Page 59 and 60:

Accounting6.8 Indirect Shareholding

- Page 61 and 62:

AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113: Finance, Insurance & Real EstateInt

- Page 118 and 119: Finance, Insurance & Real EstateCha

- Page 120 and 121: Finance, Insurance & Real EstateFIN

- Page 122 and 123: Finance, Insurance & Real EstateUpp

- Page 124 and 125: ATitle IndexAccounting and Bookkeep

- Page 126 and 127: Title IndexFinancial Institutions M

- Page 128 and 129: Title IndexPrinciples of Accounting

- Page 130 and 131: DAuthor IndexDeegan Australian Fina

- Page 132 and 133: Author IndexMintz Ethical Obligatio

- Page 134 and 135: WAuthor IndexWalker Personal Financ

- Page 136 and 137: M c G R A W - H I L L M A I L I N G

- Page 138: Preparing Students forthe World Tha