Finance, Insurance & Real Estate26 Mergers and Acquisitions27 LeasingFUNDAMENTALS OF FINANCIALMANAGEMENT5th EditionBy Pasanna Chandra2010 (April 2010) / 592 pagesISBN: 9780070700796<strong>McGraw</strong>-<strong>Hill</strong> India Titlewww.mhhe.com/chandraffm5eThis book discusses the fundamental principles and techniquesof financial management. Designed for the first course in financialmanagement, it is aimed at students of B.Com, BBM, M.Com, ICSI,ICWAI, ICAI and MBA programmes.The chapter on ‘Basics of CapitalBudgeting’ has been expanded and structured into two chapters, viz.,‘Techniques of Capital Budgeting’ and ‘Project Cash Flows’.Elevennew sections have been added on the following topics: ‘FundamentalPrinciple of Finance,’ ‘Regulatory Framework,’ ‘Profits versus CashFlow,’ ‘Standardised Financial Statement,’ ‘Additional Funding Needs,’‘Sustainable Growth Rate,’ Checklist for Capital Structure Decision,’‘Debt Market,’ ‘Money Market,’ ‘Portfolio Restructuring,’ and ‘MultinationalCorporations,’ContentsPart I: Overview and Financial Environment1. Financial Management: An Overview2. The Financial SystemPart II: Financial Analysis and Planning3. Financial Statements, Taxes, and Cash Flow4. Financial Statement Analysis5. Funds Flow Analysis6. Break-Even Analysis and Leverages7. Financial Planning and ForecastingPart III: Fundamental Valuation Concepts8. Time Value of Money9. Valuation of Securities10. Risk and ReturnPart IV: Capital Budgeting11. Techniques of Capital Budgeting12. Project Cash Flows13. Risk Analysis in Capital Budgeting14. The Cost Of CapitalPart V: Capital Structre and Dividend Policies15. Capital Structure and Cost of Capital16. Planning the Capital Structure17. Dividend Policy and Share Valuation18. Dividend Policy: Practical AspectsPart VI: Long-Term Financing19. Sources of Long-Term Finance20. Raising Long-Term Finance21. Securities MarketPart VII: Working Capital Management22. Working Capital Policy23. Cash Management24. Credit Management25. Inventory Management26. Working Capital FinancingPart VIII: Special Topics27. Leasing, Hire Purchase and Project Finance28. Mergers, Acquisitions, and Restructuring29. International Financial ManagementFINANCIAL MANAGEMENT FORBEGINNERS3rd EditionBy Rodziah Abd Samad, Rohani Abdul Wahab and Shelia Christabel2010 (June 2010) / 460 pagesISBN: 9789675771002An Asian PublicationFinancial Management for Beginners has been written for students ofBusiness and Accountancy. The book is written for both newcomersto finance as well as students with a prior knowledge of the subject.Some prior knowledge of economics, statistics and accounting willbe helpful. Student learning is aided by learning objectives at thebeginning of each chapter, concept questions in each chapter, trueor false, multiple choice, self-test questions and problems at the endof each chapter. It is specifically structured for use in the classroomand as a selfstudy text. Key answers for a number of questions areincluded. The book is composed of narrative explanations with workedexamples and diagrams, as well as relevant formulae which are easyto follow. This book consists of 12 chapters, beginning with an introductionto financial management, followed by evaluation of financialperformance, Financial Training and Forecasting, working capitalmanagement, management of current liability, – management of currentassets, time value of money, risk and return, capital budgeting,cost of capital, analysis and impact of leverage, and ending with dividendpolicy. The aim of this text is to provide a foundation in financialmanagement for students, to help them in their future career. The textis relevant to students pursuing diploma and undergraduate coursesin Business and Accountancy and also professional courses such asthose offered by Malaysian Institute of Certified Public Accountants,Chartered Association of Certified Accountants, Chartered Instituteof Management Accountants and Institute of Chartered Secretariesand Administrators.CONTENTS1. Introduction to Financial Management2. Evaluation of Financial Performance3. Financial Planning and Forecasting4. Management of Working Capital5. Management of Current Assets6. Management of Current Liabilities7. Time Value of Money8. Risk and Return9. Capital Budgeting10. Cost of Capital11. Analysis and Impact of Leverage12. The Dividend DecisionAppendixSuggested SolutionsGlossaryBibliography and Further ReadingIndexInvitation to Publish<strong>McGraw</strong>-<strong>Hill</strong> is interested to review yourtextbook proposals for publication.Please contact your local <strong>McGraw</strong>-<strong>Hill</strong> office oremail to asiapub@mcgraw-hill.com.Visit <strong>McGraw</strong>-<strong>Hill</strong> Education (Asia)Website: http://www.mheducation.asia/publish/75

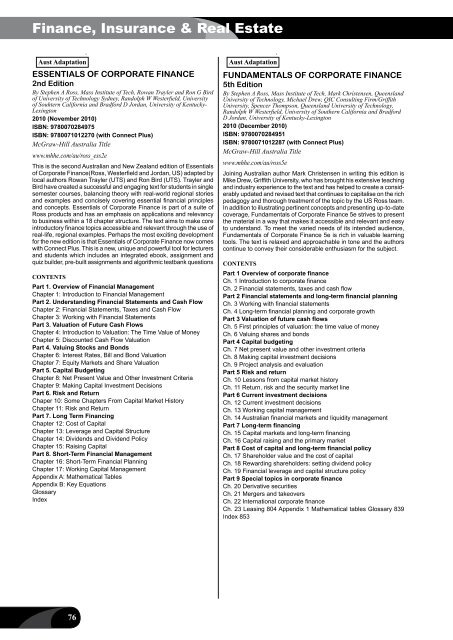

Finance, Insurance & Real EstateAust AdaptationESSENTIALS OF CORPORATE FINANCE2nd EditionBy Stephen A Ross, Mass Institute of Tech, Rowan Trayler and Ron G Birdof University of Technology Sydney, Randolph W Westerfield, Universityof Souhtern California and Bradford D Jordan, University of Kentucky-Lexington2010 (November 2010)ISBN: 9780070284975ISBN: 9780071012270 (with Connect Plus)<strong>McGraw</strong>-<strong>Hill</strong> Australia Titlewww.mhhe.com/au/ross_ess2eThis is the second Australian and New Zealand edition of Essentialsof Corporate Finance(Ross, Westerfield and Jordan, US) adapted bylocal authors Rowan Trayler (UTS) and Ron Bird (UTS). Trayler andBird have created a successful and engaging text for students in singlesemester courses, balancing theory with real-world regional storiesand examples and concisely covering essential financial principlesand concepts. Essentials of Corporate Finance is part of a suite ofRoss products and has an emphasis on applications and relevancyto business within a 18 chapter structure. The text aims to make coreintroductory finance topics accessible and relevant through the use ofreal-life, regional examples. Perhaps the most exciting developmentfor the new edition is that Essentials of Corporate Finance now comeswith Connect Plus. This is a new, unique and powerful tool for lecturersand students which includes an integrated ebook, assignment andquiz builder, pre-built assignments and algorithmic testbank questionsContentsPart 1. Overview of Financial ManagementChapter 1: Introduction to Financial ManagementPart 2. Understanding Financial Statements and Cash FlowChapter 2: Financial Statements, Taxes and Cash FlowChapter 3: Working with Financial StatementsPart 3. Valuation of Future Cash FlowsChapter 4: Introduction to Valuation: The Time Value of MoneyChapter 5: Discounted Cash Flow ValuationPart 4. Valuing Stocks and BondsChapter 6: Interest Rates, Bill and Bond ValuationChapter 7: Equity Markets and Share ValuationPart 5. Capital BudgetingChapter 8: Net Present Value and Other Investment CriteriaChapter 9: Making Capital Investment DecisionsPart 6. Risk and ReturnChaper 10: Some Chapters From Capital Market HistoryChapter 11: Risk and ReturnPart 7. Long Term FinancingChapter 12: Cost of CapitalChapter 13: Leverage and Capital StructureChapter 14: Dividends and Dividend PolicyChapter 15: Raising CapitalPart 8. Short-Term Financial ManagementChapter 16: Short-Term Financial PlanningChapter 17: Working Capital ManagementAppendix A: Mathematical TablesAppendix B: Key EquationsGlossaryIndexAust AdaptationFUNDAMENTALS OF CORPORATE FINANCE5th EditionBy Stephen A Ross, Mass Institute of Tech, Mark Christensen, QueenslandUniversity of Technology, Michael Drew, QIC Consulting Firm/GriffithUniversity, Spencer Thompson, Queensland University of Technology,Randolph W Westerfield, University of Southern California and BradfordD Jordan, University of Kentucky-Lexington2010 (December 2010)ISBN: 9780070284951ISBN: 9780071012287 (with Connect Plus)<strong>McGraw</strong>-<strong>Hill</strong> Australia Titlewww.mhhe.com/au/ross5eJoining Australian author Mark Christensen in writing this edition isMike Drew, Griffith University, who has brought his extensive teachingand industry experience to the text and has helped to create a considerablyupdated and revised text that continues to capitalise on the richpedagogy and thorough treatment of the topic by the US Ross team.In addition to illustrating pertinent concepts and presenting up-to-datecoverage, Fundamentals of Corporate Finance 5e strives to presentthe material in a way that makes it accessible and relevant and easyto understand. To meet the varied needs of its intended audience,Fundamentals of Corporate Finance 5e is rich in valuable learningtools. The text is relaxed and approachable in tone and the authorscontinue to convey their considerable enthusiasm for the subject.CONTENTSPart 1 Overview of corporate financeCh. 1 Introduction to corporate financeCh. 2 Financial statements, taxes and cash flowPart 2 Financial statements and long-term financial planningCh. 3 Working with financial statementsCh. 4 Long-term financial planning and corporate growthPart 3 Valuation of future cash flowsCh. 5 First principles of valuation: the time value of moneyCh. 6 Valuing shares and bondsPart 4 Capital budgetingCh. 7 Net present value and other investment criteriaCh. 8 Making capital investment decisionsCh. 9 Project analysis and evaluationPart 5 Risk and returnCh. 10 Lessons from capital market historyCh. 11 Return, risk and the security market linePart 6 Current investment decisionsCh. 12 Current investment decisionsCh. 13 Working capital managementCh. 14 Australian financial markets and liquidity managementPart 7 Long-term financingCh. 15 Capital markets and long-term financingCh. 16 Capital raising and the primary marketPart 8 Cost of capital and long-term financial policyCh. 17 Shareholder value and the cost of capitalCh. 18 Rewarding shareholders: setting dividend policyCh. 19 Financial leverage and capital structure policyPart 9 Special topics in corporate financeCh. 20 Derivative securitiesCh. 21 Mergers and takeoversCh. 22 International corporate financeCh. 23 Leasing 804 Appendix 1 Mathematical tables Glossary 839Index 85376

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17:

New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19:

Accounting for Non-Accounting Manag

- Page 20 and 21:

New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23:

AccountingAccounting PrinciplesNEW

- Page 24 and 25:

AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27:

AccountingSCHAUM’S OUTLINE OF FIN

- Page 28:

AccountingFinancial AccountingInter

- Page 31 and 32:

AccountingNEW *9780077328702*2012 (

- Page 33 and 34:

AccountingInternational editionFINA

- Page 35 and 36:

AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38:

Accountingconsolidation accountingC

- Page 39 and 40:

AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114: Finance, Insurance & Real EstateInt

- Page 115 and 116: Finance, Insurance & Real EstatePer

- Page 118 and 119: Finance, Insurance & Real EstateCha

- Page 120 and 121: Finance, Insurance & Real EstateFIN

- Page 122 and 123: Finance, Insurance & Real EstateUpp

- Page 124 and 125: ATitle IndexAccounting and Bookkeep

- Page 126 and 127: Title IndexFinancial Institutions M

- Page 128 and 129: Title IndexPrinciples of Accounting

- Page 130 and 131: DAuthor IndexDeegan Australian Fina

- Page 132 and 133: Author IndexMintz Ethical Obligatio

- Page 134 and 135: WAuthor IndexWalker Personal Financ

- Page 136 and 137: M c G R A W - H I L L M A I L I N G

- Page 138: Preparing Students forthe World Tha