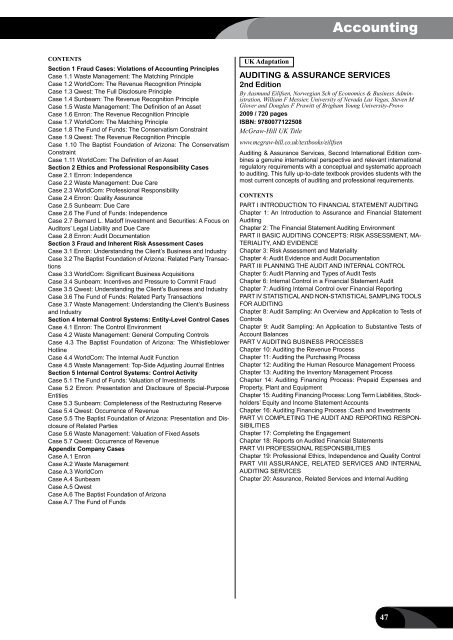

AccountingContentsSection 1 Fraud Cases: Violations of Accounting PrinciplesCase 1.1 Waste Management: The Matching PrincipleCase 1.2 WorldCom: The Revenue Recognition PrincipleCase 1.3 Qwest: The Full Disclosure PrincipleCase 1.4 Sunbeam: The Revenue Recognition PrincipleCase 1.5 Waste Management: The Definition of an AssetCase 1.6 Enron: The Revenue Recognition PrincipleCase 1.7 WorldCom: The Matching PrincipleCase 1.8 The Fund of Funds: The Conservatism ConstraintCase 1.9 Qwest: The Revenue Recognition PrincipleCase 1.10 The Baptist Foundation of Arizona: The ConservatismConstraintCase 1.11 WorldCom: The Definition of an AssetSection 2 Ethics and Professional Responsibility CasesCase 2.1 Enron: IndependenceCase 2.2 Waste Management: Due CareCase 2.3 WorldCom: Professional ResponsibilityCase 2.4 Enron: Quality AssuranceCase 2.5 Sunbeam: Due CareCase 2.6 The Fund of Funds: IndependenceCase 2.7 Bernard L. Madoff Investment and Securities: A Focus onAuditors’ Legal Liability and Due CareCase 2.8 Enron: Audit DocumentationSection 3 Fraud and Inherent Risk Assessment CasesCase 3.1 Enron: Understanding the Client’s Business and IndustryCase 3.2 The Baptist Foundation of Arizona: Related Party TransactionsCase 3.3 WorldCom: Significant Business AcquisitionsCase 3.4 Sunbeam: Incentives and Pressure to Commit FraudCase 3.5 Qwest: Understanding the Client’s Business and IndustryCase 3.6 The Fund of Funds: Related Party TransactionsCase 3.7 Waste Management: Understanding the Client’s Businessand IndustrySection 4 Internal Control Systems: Entity-Level Control CasesCase 4.1 Enron: The Control EnvironmentCase 4.2 Waste Management: General Computing ControlsCase 4.3 The Baptist Foundation of Arizona: The WhistleblowerHotlineCase 4.4 WorldCom: The Internal Audit FunctionCase 4.5 Waste Management: Top-Side Adjusting Journal EntriesSection 5 Internal Control Systems: Control ActivityCase 5.1 The Fund of Funds: Valuation of InvestmentsCase 5.2 Enron: Presentation and Disclosure of Special-PurposeEntitiesCase 5.3 Sunbeam: Completeness of the Restructuring ReserveCase 5.4 Qwest: Occurrence of RevenueCase 5.5 The Baptist Foundation of Arizona: Presentation and Disclosureof Related PartiesCase 5.6 Waste Management: Valuation of Fixed AssetsCase 5.7 Qwest: Occurrence of RevenueAppendix Company CasesCase A.1 EnronCase A.2 Waste ManagementCase A.3 WorldComCase A.4 SunbeamCase A.5 QwestCase A.6 The Baptist Foundation of ArizonaCase A.7 The Fund of FundsUK AdaptationAUDITING & ASSURANCE SERVICES2nd EditionBy Aasmund Eilifsen, Norwegian Sch of Economics & Business Administration,William F Messier, University of Nevada Las Vegas, Steven MGlover and Douglas F Prawitt of Brigham Young University-Provo2009 / 720 pagesISBN: 9780077122508<strong>McGraw</strong>-<strong>Hill</strong> UK Titlewww.mcgraw-hill.co.uk/textbooks/eilifsenAuditing & Assurance Services, Second International Edition combinesa genuine international perspective and relevant internationalregulatory requirements with a conceptual and systematic approachto auditing. This fully up-to-date textbook provides students with themost current concepts of auditing and professional requirements.ContentsPART I INTRODUCTION TO FINANCIAL STATEMENT AUDITINGChapter 1: An Introduction to Assurance and Financial StatementAuditingChapter 2: The Financial Statement Auditing EnvironmentPART II BASIC AUDITING CONCEPTS: RISK ASSESSMENT, MA-TERIALITY, AND EVIDENCEChapter 3: Risk Assessment and MaterialityChapter 4: Audit Evidence and Audit DocumentationPART III PLANNING THE AUDIT AND INTERNAL CONTROLChapter 5: Audit Planning and Types of Audit TestsChapter 6: Internal Control in a Financial Statement AuditChapter 7: Auditing Internal Control over Financial ReportingPART IV STATISTICAL AND NON-STATISTICAL SAMPLING TOOLSFOR AUDITINGChapter 8: Audit Sampling: An Overview and Application to Tests ofControlsChapter 9: Audit Sampling: An Application to Substantive Tests ofAccount BalancesPART V AUDITING BUSINESS PROCESSESChapter 10: Auditing the Revenue ProcessChapter 11: Auditing the Purchasing ProcessChapter 12: Auditing the Human Resource Management ProcessChapter 13: Auditing the Inventory Management ProcessChapter 14: Auditing Financing Process: Prepaid Expenses andProperty, Plant and EquipmentChapter 15: Auditing Financing Process: Long Term Liabilities, Stockholders’Equity and Income Statement AccountsChapter 16: Auditing Financing Process :Cash and InvestmentsPART VI COMPLETING THE AUDIT AND REPORTING RESPON-SIBILITIESChapter 17: Completing the EngagementChapter 18: Reports on Audited Financial StatementsPART VII PROFESSIONAL RESPONSIBILITIESChapter 19: Professional Ethics, Independence and Quality ControlPART VIII ASSURANCE, RELATED SERVICES AND INTERNALAUDITING SERVICESChapter 20: Assurance, Related Services and Internal Auditing47

AccountingAUDITING AND ASSURANCE SERVICES INAUSTRALIA4th EditionBy Grant Gay, Monash University and Roger Simnett, University of NewSouth Wales2009ISBN: 9780070286740<strong>McGraw</strong>-<strong>Hill</strong> Australia Titlewww.mhhe.com/au/gay4eAuditing & Assurance Services takes a business risk approach -thestandard in audit practice that has been incorporated into both nationaland international auditing standards over the past five years.Students are provided with a solid theoretical grounding in all aspectsof auditing, as well as insight into current challenges of the profession.With a reputation built over several editions for timely, comprehensiveand accurate incorporation of auditing standards this edition continuesthe trend. The 4e is current with the revised Australian AuditingStandards arising from the Clarity Project and enforceable from 1January 2010. Instructors can have confidence that students havethe advantage of being exposed to the framework that auditing firmswill be operating in from 2010.ContentsPart 1 The Auditing And Assurance Services ProfessionCh 1. Assurance & auditing: an overviewCh 2. The structure of the professionCh 3. Ethics, independence and corporate governanceCh 4. The legal liability of auditorsPart 2 Planning And RiskCh 5. Overview of elements of the financial report auditprocessCh 6. Planning, understanding the entity and evaluatingbusiness riskCh 7. Assessing specific business risks and materialityCh 8. Understanding and assessing internal controlPart 3 Tests Of Control And Tests Of DetailsCh 9. Tests of controlsCh 10. Substantive tests of transactions and balancesCh 11. Audit samplingPart 4 Completion And CommunicationCh 12. Completion and reviewCh 13. The auditor’s reporting obligationsPart 5 Other Assurance ServicesCh 14. Internal auditingCh 15. Audit and assurance services in the public sectorCh 16. Other assurance services and advanced topicsPRINCIPLES AND CONTEMPORARY ISSUESIN INTERNAL AUDITINGBy Puan Sri Datin Dr Mary Lee, Dr Hasnah Haji Haron, Dr Ishak Ismail,Dr Mohd. Hassan Che Haat, Norlela Zaini, Tong Seuk Ying, Lok CharLee and Mohd, Farook Nasar2009 (June 2009) / 356 pagesISBN: 9789833850679An Asian PublicationThis book provides readers with an overview of the latest developmentsand various contemporary and contentious issues in internalauditing. It gives a good understanding on the role and responsibilitiesof an internal auditor as one of the governance partners and valueaddersin an organization. It highlights the importance of the internalauditing function in risk management, controls and governance. Withthe latest amendments issued under Para 15.18 of Bursa Malaysia’s(Amended) Listing Requirements on 31 January, 2008, mandatinginternal audit function for all public-listed companies, there is a needfor greater understanding of the internal audit function as one of themeans of safeguarding shareholders’ interests. This book also incorporatesthe new IIA’s International Professional Practices Framework(IPPF) which includes the Mandatory Guidance (such as the Code ofEthics and the International Standards for the Professional Practiceof Internal Auditing) and the Strongly Recommended Guidance (suchas the Position Papers, Practice Advisories and Practice Guides).The book is a joint effort of academicians from Universiti TeknologiMARA, Universiti Sains Malaysia, Universiti Malaysia Trengganu andpractitioners in internal auditing. The authors recognize that there isa need for more local and affordable books on internal auditing. Inthis regard, the authors hope that their concerted efforts in writingthis book would contribute to promoting the significance of internalauditing and also encourage continuous professional development inthis area. The authors also feel that they should share their knowledgeand experience on internal auditing to meet the motto of The Instituteof Internal Auditors, “Progress Through Sharing”.Auditing Practice CasesInternational editionPEACH BLOSSOM COLOGNE COMPANY4th EditionBy Jack W. Paul, Lehigh University2007 (December 2005) / 192 pagesISBN: 9780073276595 (with CD)ISBN: 9780071259828 [IE with CD]ContentsI. General Instructions and Preparations.II. Permanent File Materials.1. History and Background.2. Organizational Structure.3. Internal Control.4. Chart of Accounts.5. Minutes of Board of Directors’ Meetings.III. Problem Assignments.Assignment #1: Planning the Integrated Audit. Assignment #2: Cash.Assignment #3: Accounts Receivable and Credit Sales. Assignment#4: Inventory and Purchases. Assignment #5: Property, Plant,and Equipment (Fixed Assets). Assignment #6: Accounts PayableProcessing and Unrecorded Liabilities. Assignment #7: Notes Payableand Accrued Interest. Assignment #8: Completing the Audit.IV. Current Year’s Working Trial Balance.V. Prior Year’s Working Papers.REVIEW COPY(Available for course adoption only)To request for a review copy,• contact your local <strong>McGraw</strong>-<strong>Hill</strong>representatives or,• fax the Review Copy Request Form foundin this catalog or,• e-mail your request tomghasia_sg@mcgraw-hill.com or,• submit online at www.mheducation.asia48

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63: AccountingInternational editionAUDI

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114: Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha