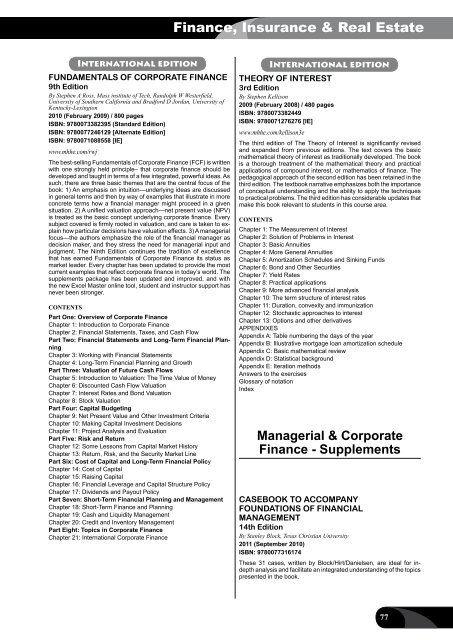

Finance, Insurance & Real EstateInternational editionFUNDAMENTALS OF CORPORATE FINANCE9th EditionBy Stephen A Ross, Mass institute of Tech, Randolph W Westerfield,University of Southern California and Bradford D Jordan, University ofKentucky-Lexington2010 (February 2009) / 800 pagesISBN: 9780073382395 (Standard Edition)ISBN: 9780077246129 [Alternate Edition]ISBN: 9780071088558 [IE]www.mhhe.com/rwjThe best-selling Fundamentals of Corporate Finance (FCF) is writtenwith one strongly held principle– that corporate finance should bedeveloped and taught in terms of a few integrated, powerful ideas. Assuch, there are three basic themes that are the central focus of thebook: 1) An emphasis on intuition—underlying ideas are discussedin general terms and then by way of examples that illustrate in moreconcrete terms how a financial manager might proceed in a givensituation. 2) A unified valuation approach—net present value (NPV)is treated as the basic concept underlying corporate finance. Everysubject covered is firmly rooted in valuation, and care is taken to explainhow particular decisions have valuation effects. 3) A managerialfocus—the authors emphasize the role of the financial manager asdecision maker, and they stress the need for managerial input andjudgment. The Ninth Edition continues the tradition of excellencethat has earned Fundamentals of Corporate Finance its status asmarket leader. Every chapter has been updated to provide the mostcurrent examples that reflect corporate finance in today’s world. Thesupplements package has been updated and improved, and withthe new Excel Master online tool, student and instructor support hasnever been stronger.ContentsPart One: Overview of Corporate FinanceChapter 1: Introduction to Corporate FinanceChapter 2: Financial Statements, Taxes, and Cash FlowPart Two: Financial Statements and Long-Term Financial PlanningChapter 3: Working with Financial StatementsChapter 4: Long-Term Financial Planning and GrowthPart Three: Valuation of Future Cash FlowsChapter 5: Introduction to Valuation: The Time Value of MoneyChapter 6: Discounted Cash Flow ValuationChapter 7: Interest Rates and Bond ValuationChapter 8: Stock ValuationPart Four: Capital BudgetingChapter 9: Net Present Value and Other Investment CriteriaChapter 10: Making Capital Investment DecisionsChapter 11: Project Analysis and EvaluationPart Five: Risk and ReturnChapter 12: Some Lessons from Capital Market HistoryChapter 13: Return, Risk, and the Security Market LinePart Six: Cost of Capital and Long-Term Financial PolicyChapter 14: Cost of CapitalChapter 15: Raising CapitalChapter 16: Financial Leverage and Capital Structure PolicyChapter 17: Dividends and Payout PolicyPart Seven: Short-Term Financial Planning and ManagementChapter 18: Short-Term Finance and PlanningChapter 19: Cash and Liquidity ManagementChapter 20: Credit and Inventory ManagementPart Eight: Topics in Corporate FinanceChapter 21: International Corporate FinanceInternational editionTHEORY OF INTEREST3rd EditionBy Stephen Kellison2009 (February 2008) / 480 pagesISBN: 9780073382449ISBN: 9780071276276 [IE]www.mhhe.com/kellison3eThe third edition of The Theory of Interest is significantly revisedand expanded from previous editions. The text covers the basicmathematical theory of interest as traditionally developed. The bookis a thorough treatment of the mathematical theory and practicalapplications of compound interest, or mathematics of finance. Thepedagogical approach of the second edition has been retained in thethird edition. The textbook narrative emphasizes both the importanceof conceptual understanding and the ability to apply the techniquesto practical problems. The third edition has considerable updates thatmake this book relevant to students in this course area.ContentsChapter 1: The Measurement of InterestChapter 2: Solution of Problems in InterestChapter 3: Basic AnnuitiesChapter 4: More General AnnuitiesChapter 5: Amortization Schedules and Sinking FundsChapter 6: Bond and Other SecuritiesChapter 7: Yield RatesChapter 8: Practical applicationsChapter 9: More advanced financial analysisChapter 10: The term structure of interest ratesChapter 11: Duration, convexity and immunizationChapter 12: Stochastic approaches to interestChapter 13: Options and other derivativesAPPENDIXESAppendix A: Table numbering the days of the yearAppendix B: Illustrative mortgage loan amortization scheduleAppendix C: Basic mathematical reviewAppendix D: Statistical backgroundAppendix E: Iteration methodsAnswers to the exercisesGlossary of notationIndexManagerial & CorporateFinance - SupplementsCASEBOOK TO ACCOMPANYFOUNDATIONS OF FINANCIALMANAGEMENT14th EditionBy Stanley Block, Texas Christian University2011 (September 2010)ISBN: 9780077316174These 31 cases, written by Block/Hirt/Danielsen, are ideal for indepthanalysis and facilitate an integrated understanding of the topicspresented in the book.77

Finance, Insurance & Real EstateInternational editionCASE STUDIES IN FINANCE6th EditionBy Robert Bruner, University of VA-Charlottesville2010 (January 2009) / 816 pagesISBN: 9780073382456ISBN: 9780071267526 [IE]www.mhhe.com/bruner6eCase Studies in Finance links managerial decisions to capital marketsand the expectations of investors. At the core of almost all of the casesis a valuation task that requires students to look to financial marketsfor guidance in resolving the case problem. The focus on value helpsmanagers understand the impact of the firm on the world around it.These cases also invite students to apply modern information technologyto the analysis of managerial decisions.CONTENTSPart 1: Setting Some ThemesCase 1 Warren E. Buffett, 2005Case 2 Bill Miller and Value TrustCase 3 Ben & Jerry’s HomemadeCase 4 The Battle for Value, 2004: FedEx Corp. vs. United ParcelService, Inc.Part 2: Financial Analysis and ForecastingCase 5 The Thoughtful ForecasterCase 6 The Financial Detective, 2005Case 7 Krispy Kreme Doughnuts, Inc.Case 8 The Body Shop International PLC 2001: An Introduction toFinancial ModelingCase 9 Horniman HorticultureCase 10 Kota Fibres, Ltd.Case 11 Deutsche BrauereiCase 12 Value Line Publishing: October 2002Part 3: Estimating the Cost of CapitalCase 13 “Best Practices” in Estimating the Cost of Capital: Surveyand Synthesis”Case 14 Nike, Inc.: Cost of CapitalCase 15 Teletech Corporation, 2005Case 16 The Boeing 7E7Part 4: Capital Budgeting and Resource AllocationCase 17 The Investment DetectiveCase 18 Worldwide Paper CompanyCase 19 Target CorporationCase 20 Aurora Textile CompanyCase 21 Compass RecordsCase 22 Victoria Chemicals plc (A): The Merseyside ProjectCase 23 Victoria Chemicals plc (B): Merseyside and RotterdamProjectsCase 24 Euroland Foods S.A.Case 25 Star River Electronics Ltd.Part 5: Management of the Firm’s Equity: Dividends, Repurchases,Initial OfferingsCase 26 Gainesboro Machine Tools CorporationCase 27 EMICase 28 JetBlue Airways IPO ValuationCase 29 TRX, Inc.: Initial Public OfferingCase 30 Purinex, Inc.Part 6: Management of the Corporate Capital StructureCase 31 An Introduction to Debt Policy and ValueCase 32 Structuring Coprorate Financial Policy: Diagnosis of Problemsand Evaluation of StrategiesCase 33 California Pizza KitchenCase 34 The Wm. Wrigley Jr. Company: Capital Structure, Valuation,and Cost of CapitalCase 35 Deluxe CorporationCase 36 Deutsche Bank Securities: Financing the Acquisition ofConsolidated Supply S.A.Part 7: Analysis of Financing Tactics: Leases, Options, andForeign CurrencyCase 37 Baker AdhesivesCase 38 Carrefour S.A.Case 39 Primus Automation Division, 2002Case 40 MoGen, Inc.Part 8: Valuing the Enterprise: Acquisitions and BuyoutsCase 41 Methods of Valuation: Mergers and AcquisitionsCase 42 Arcadian Microarray Technologies, Inc.Case 43 Yeats Valves and ControlsCase 44 Hershey Foods CorporationCase 45 General Mills’ Acquisition of Pillsbury from Diageo PLCCase 46 The Timken CompanyCase 47 Matlin PattersonCase 48 Hostile Takeovers: A Primer for the Decision MakerCase 49 General Electric’s Proposed Acquisition of HoneywellInternational editionFINGAME 5.0 PARTICIPANT’S MANUALWITH REGISTRATION CODE5th EditionBy Leroy D Brooks, John Carroll University2008 (June 2007) / 170 pagesISBN: 9780077219888ISBN: 9780071275675 [IE]Brooks’ FinGame Online 5.0 is a comprehensive multiple periodfinance case/simulation. In the game, students control a hypotheticalcompany over numerous periods of operation. Students have controlof major financial and operating decisions of their company. Studentsdevelop and enhance skills in financial management, financial accountingstatement analysis, and general decision making. Internetaccess by the instructor and student is required. Students use the Fin-Game Participant’s Manual for instructions to operate their companyon the <strong>McGraw</strong>-<strong>Hill</strong>/Irwin website. The Participant’s Manual includesa password in order to access the website. The Instructor’s Manualis very important and imperative to teaching from FinGame Online5.0. FinGame Online can be found at www.mhhe.com/fingame5.CONTENTSStudent ManualChapter 1 IntroductionChapter 2 Initiation and Use on the WebChapter 3 Establishing a Management PlanChapter 4 The Company Environment and RulesChapter 5 The Game and The Real WorldAppendix Financial Statement ConstructionInstructor’s ManualWelcomeChapter 1 Web Access and Operating InstructionsChapter 2 Use of the Game in a CourseChapter 3 The Company Environment and RulesAppendix: FinGame Report Requirements78

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11:

BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15:

New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17:

New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19:

Accounting for Non-Accounting Manag

- Page 20 and 21:

New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23:

AccountingAccounting PrinciplesNEW

- Page 24 and 25:

AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27:

AccountingSCHAUM’S OUTLINE OF FIN

- Page 28:

AccountingFinancial AccountingInter

- Page 31 and 32:

AccountingNEW *9780077328702*2012 (

- Page 33 and 34:

AccountingInternational editionFINA

- Page 35 and 36:

AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38:

Accountingconsolidation accountingC

- Page 39 and 40:

AccountingManagerial AccountingGlob

- Page 41 and 42:

AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114: Finance, Insurance & Real EstateInt

- Page 115 and 116: Finance, Insurance & Real EstatePer

- Page 118 and 119: Finance, Insurance & Real EstateCha

- Page 120 and 121: Finance, Insurance & Real EstateFIN

- Page 122 and 123: Finance, Insurance & Real EstateUpp

- Page 124 and 125: ATitle IndexAccounting and Bookkeep

- Page 126 and 127: Title IndexFinancial Institutions M

- Page 128 and 129: Title IndexPrinciples of Accounting

- Page 130 and 131: DAuthor IndexDeegan Australian Fina

- Page 132 and 133: Author IndexMintz Ethical Obligatio

- Page 134 and 135: WAuthor IndexWalker Personal Financ

- Page 136 and 137: M c G R A W - H I L L M A I L I N G

- Page 138: Preparing Students forthe World Tha