Accountingsion and recodification of the Auditing Standards Board’s standards(1) to make standards easier to read, understand, and apply, and(2) to converge those standards with the International Standards ofAuditing to the extent considered desirable. Almost all outstandingStatements on Auditing Standard were revised, with an effective datefor audits of periods ending after December 15, 2012.2) Modification of the CPA exam’s Auditing and Attestation sectioncontent, including elimination of 2 “long” simulations on each examand replacement with 6-7 shorter, completely objective form simulations.Modifications to Reflect Changes in the Auditing Standards:The broad scope of the clarity project has resulted in changes toeach chapter--some relatively minor, but others very major. Amongthe most major clarity project changes are:Chapter 2: Professional Standards This chapter is rewritten toreflect the Auditing Standards Board’s elimination of the longstanding“ten generally accepted auditing standards”--that is, the threegeneral standards, three field work standards, and the four reportingstandards. For purposes of AICPA professional standard coveragethe chapter now discusses in detail the new Principles Underlyingan Audit Conducted in Accordance with Generally Accepted AuditingStandards that replaced the ten standards. Yet, because the PCAOBstandards continue to be structured about the ten standards, thosestandards remain in place for public company audits and are alsodiscussed in the chapter. In addition, coverage includes presentationof the new “standard” audit report and modified reports. An appendixhas been added to this chapter to compare major differences betweeninternational and US standards.Chapter 17: Auditors’ Reports. Changes in AICPA terminologyreflected here better align U.S. GAAS with international standards.For example, an unqualified report is now an unmodified report; anexplanatory paragraph is now an emphasis of matter, an other matterparagraph or a basis for modification paragraph; an audit involvingother auditors is now a group audit. But there have also been manyother changes, including changes in the standard audit report’swording and changes in requirements in a number of areas in whicha report other than “standard” is issued.Chapter 19: Additional Assurance Services: Historical financialInformation. The clarity standards, following the international standardapproach, use the term “financial reporting framework” to representthe standards used to prepare historical financial information. Inessence the “financial reporting framework” becomes the “suitablecriteria” for historical financial information. This results in a numberof changes relating to this chapter, including elimination of “specialreports” and replacement with “special purpose financial reportingframeworks.”In addition, two other key changes include:Chapter 19: Additional Assurance Services: Historical financialInformation. In addition to the Chapter 19 clarity changes, modificationof compilation and review standards are reflected in the chapter. Thisarea is of particular importance to students who plan to take the CPAexam as the new content specification outline shows that the degreeof coverage of this area is significant.Chapter 20: Additional Assurance Services: Other Information isrewritten to reflect the fact that the nature of these other services isevolving as at this point some services seem to have gained a degreeof market acceptance (e.g., SysTrust, PrimePlus/Elder Care) whileothers have not (e.g., WebTrust). Additional new products such asproviding assurance relating to XBRL are discussed.Modifications to reflect CPA Exam Question Format Changes:The CPA exam’s coverage of shorter simulations has resulted inthe replacement of the “long” simulations in the text with a variety ofshorter objective questions. We entitle them “other objective formatquestions” in that they are “objective,” yet in general not structuredcompletely as multiple choice questions. The questions in the backof every chapter now include other objective format questions. Anumber of these are “simulation” questions that meet the new criteriafor CPA exam inclusion. Others are brief, and yet consistent with thenew simulation approach. In addition, every chapter of the instructor’stest bank now includes one or more other objective format questions.The clarity modifications presented force the CPA exam to updateits questions to reflect new terminology and requirements. Wehave revised the text and instructor test bank questions to reflectthese changes.Connect Accounting and Connect Plus Accounting – new to thisedition! Includes end-of-chapter, study guide, and test bank material.Contents1. The Role of the Public Accountant in the American Economy2. Professional StandardsAppendix A International and U.S. Standards Comparison3. Professional Ethics4. Legal Liability of CPAs5. Audit Evidence and Documentation6. Planning the Audit; Linking Audit Procedures to RiskAppendix A Selected Internet AddressesAppendix B Examples of Fraud Risk FactorsAppendix C Illustrative Audit Case7. Internal ControlAppendix A Antifraud Programs and Control Measures8. Consideration of Internal Control in an Information TechnologyEnvironment9. Audit SamplingAppendix A Probability-Proportion-to-Size SamplingAppendix B Audit Risk10. Cash and Financial Investments11. Accounts Receivable, Notes Receivable, and RevenueAppendix A Illustrative Audit CaseAppendix B Illustrative Audit Case12. Inventories and Cost of Goods Sold13. Property, Plant, and Equipment: Depreciation and Depletion14. Accounts Payable and Other LiabilitiesAppendix A Illustrative Audit Cases15. Debt and Equity Capital16. Auditing Operations and Completing the Audit17. Auditors’ Report18. Integrated Audits of Public Companies19. Additional Assurance Services: Historical Financial Information20. Additional Assurance Services: Other Information21. Internal, Operational, and Compliance AuditingInvitation to Publish<strong>McGraw</strong>-<strong>Hill</strong> is interested to review yourtextbook proposals for publication.Please contact your local <strong>McGraw</strong>-<strong>Hill</strong> office oremail to asiapub@mcgraw-hill.com.Visit <strong>McGraw</strong>-<strong>Hill</strong> Education (Asia)Website: http://www.mheducation.asia/publish/45

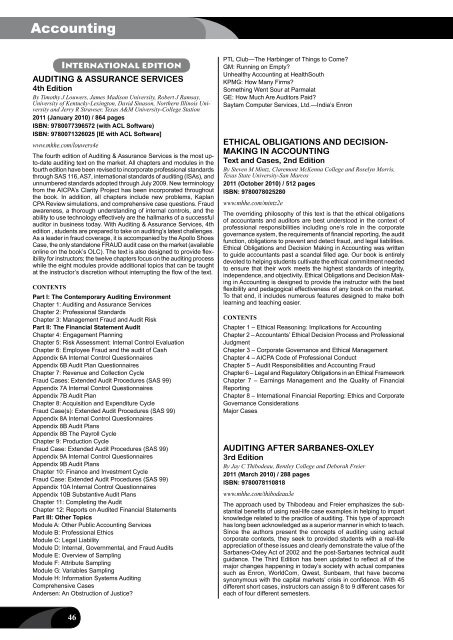

AccountingInternational editionAUDITING & ASSURANCE SERVICES4th EditionBy Timothy J Louwers, James Madison University, Robert J Ramsay,University of Kentucky-Lexington, David Sinason, Northern Illinois Universityand Jerry R Strawser, Texas A&M University-College Station2011 (January 2010) / 864 pagesISBN: 9780077396572 (with ACL Software)ISBN: 9780071326025 [IE with ACL Software]www.mhhe.com/louwers4eThe fourth edition of Auditing & Assurance Services is the most upto-dateauditing text on the market. All chapters and modules in thefourth edition have been revised to incorporate professional standardsthrough SAS 116, AS7, international standards of auditing (ISAs), andunnumbered standards adopted through July 2009. New terminologyfrom the AICPA’s Clarity Project has been incorporated throughoutthe book. In addition, all chapters include new problems, KaplanCPA Review simulations, and comprehensive case questions. Fraudawareness, a thorough understanding of internal controls, and theability to use technology effectively are the hallmarks of a successfulauditor in business today. With Auditing & Assurance Services, 4thedition , students are prepared to take on auditing’s latest challenges.As a leader in fraud coverage, it is accompanied by the Apollo ShoesCase, the only standalone FRAUD audit case on the market (availableonline on the book’s OLC). The text is also designed to provide flexibilityfor instructors; the twelve chapters focus on the auditing processwhile the eight modules provide additional topics that can be taughtat the instructor’s discretion without interrupting the flow of the text.ContentsPart I: The Contemporary Auditing EnvironmentChapter 1: Auditing and Assurance ServicesChapter 2: Professional StandardsChapter 3: Management Fraud and Audit RiskPart II: The Financial Statement AuditChapter 4: Engagement PlanningChapter 5: Risk Assessment: Internal Control EvaluationChapter 6: Employee Fraud and the audit of CashAppendix 6A Internal Control QuestionnairesAppendix 6B Audit Plan QuestionnairesChapter 7: Revenue and Collection CycleFraud Cases: Extended Audit Procedures (SAS 99)Appendix 7A Internal Control QuestionnairesAppendix 7B Audit PlanChapter 8: Acquisition and Expenditure CycleFraud Case(s): Extended Audit Procedures (SAS 99)Appendix 8A Internal Control QuestionnairesAppendix 8B Audit PlansAppendix 8B The Payroll CycleChapter 9: Production CycleFraud Case: Extended Audit Procedures (SAS 99)Appendix 9A Internal Control QuestionnairesAppendix 9B Audit PlansChapter 10: Finance and Investment CycleFraud Case: Extended Audit Procedures (SAS 99)Appendix 10A Internal Control QuestionnairesAppendix 10B Substantive Audit PlansChapter 11: Completing the AuditChapter 12: Reports on Audited Financial StatementsPart III: Other TopicsModule A: Other Public Accounting ServicesModule B: Professional EthicsModule C: Legal LiabilityModule D: Internal, Governmental, and Fraud AuditsModule E: Overview of SamplingModule F: Attribute SamplingModule G: Variables SamplingModule H: Information Systems AuditingComprehensive CasesAndersen: An Obstruction of Justice?PTL Club—The Harbinger of Things to Come?GM: Running on Empty?Unhealthy Accounting at HealthSouthKPMG: How Many Firms?Something Went Sour at ParmalatGE: How Much Are Auditors Paid?Saytam Computer Services, Ltd.—India’s EnronETHICAL OBLIGATIONS AND DECISION-MAKING IN ACCOUNTINGText and Cases, 2nd EditionBy Steven M Mintz, Claremont McKenna College and Roselyn Morris,Texas State University-San Marcos2011 (October 2010) / 512 pagesISBN: 9780078025280www.mhhe.com/mintz2eThe overriding philosophy of this text is that the ethical obligationsof accountants and auditors are best understood in the context ofprofessional responsibilities including one’s role in the corporategovernance system, the requirements of financial reporting, the auditfunction, obligations to prevent and detect fraud, and legal liabilities.Ethical Obligations and Decision Making in Accounting was writtento guide accountants past a scandal filled age. Our book is entirelydevoted to helping students cultivate the ethical commitment neededto ensure that their work meets the highest standards of integrity,independence, and objectivity. Ethical Obligations and Decision Makingin Accounting is designed to provide the instructor with the bestflexibility and pedagogical effectiveness of any book on the market.To that end, it includes numerous features designed to make bothlearning and teaching easier.ContentsChapter 1 – Ethical Reasoning: Implications for AccountingChapter 2 – Accountants’ Ethical Decision Process and ProfessionalJudgmentChapter 3 – Corporate Governance and Ethical ManagementChapter 4 – AICPA Code of Professional ConductChapter 5 – Audit Responsibilities and Accounting FraudChapter 6 – Legal and Regulatory Obligations in an Ethical FrameworkChapter 7 – Earnings Management and the Quality of FinancialReportingChapter 8 – International Financial Reporting: Ethics and CorporateGovernance ConsiderationsMajor CasesAUDITING AFTER SARBANES-OXLEY3rd EditionBy Jay C Thibodeau, Bentley College and Deborah Freier2011 (March 2010) / 288 pagesISBN: 9780078110818www.mhhe.com/thibodeau3eThe approach used by Thibodeau and Freier emphasizes the substantialbenefits of using real-life case examples in helping to impartknowledge related to the practice of auditing. This type of approachhas long been acknowledged as a superior manner in which to teach.Since the authors present the concepts of auditing using actualcorporate contexts, they seek to provided students with a real-lifeappreciation of these issues and clearly demonstrate the value of theSarbanes-Oxley Act of 2002 and the post-Sarbanes technical auditguidance. The Third Edition has been updated to reflect all of themajor changes happening in today’s society with actual companiessuch as Enron, WorldCom, Qwest, Sunbeam, that have becomesynonymous with the capital markets’ crisis in confidence. With 45different short cases, instructors can assign 8 to 9 different cases foreach of four different semesters.46

- Page 1:

Accounting & Finance 2012Accounting

- Page 4 and 5:

CONTENTSii

- Page 6 and 7:

+ =McGraw-Hill Connect ® and McGra

- Page 8:

Higher EducationBright futures begi

- Page 11: BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61: AccountingInternational editionNEW*

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102: Finance, Insurance & Real EstateCre

- Page 103 and 104: Finance, Insurance & Real EstateInt

- Page 105 and 106: Finance, Insurance & Real EstateCas

- Page 107 and 108: Finance, Insurance & Real EstateCON

- Page 109 and 110: Finance, Insurance & Real Estate10.

- Page 111 and 112: Finance, Insurance & Real Estateeas

- Page 113 and 114:

Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha