Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

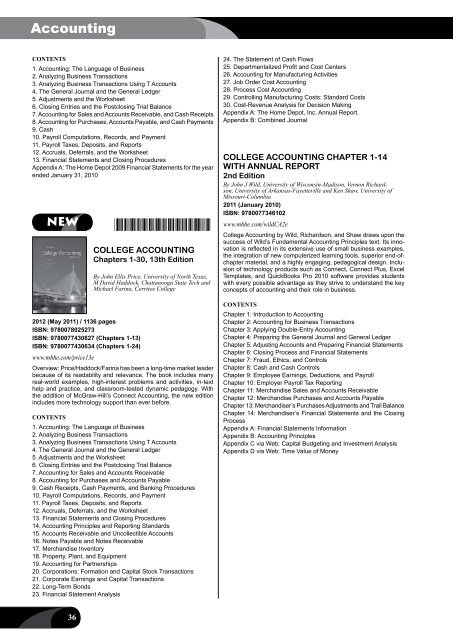

AccountingContents1. Accounting: The Language of Business2. Analyzing Business Transactions3. Analyzing Business Transactions Using T Accounts4. The General Journal and the General Ledger5. Adjustments and the Worksheet6. Closing Entries and the Postclosing Trial Balance7. Accounting for Sales and Accounts Receivable, and Cash Receipts8. Accounting for Purchases, Accounts Payable, and Cash Payments9. Cash10. Payroll Computations, Records, and Payment11. Payroll Taxes, Deposits, and Reports12. Accruals, Deferrals, and the Worksheet13. Financial Statements and Closing ProceduresAppendix A: The Home Depot 2009 Financial Statements for the yearended January 31, 2010NEW*9780078025273*COLLEGE ACCOUNTINGChapters 1-30, 13th Edition2012 (May 2011) / 1136 pagesISBN: 9780078025273ISBN: 9780077430627 (Chapters 1-13)ISBN: 9780077430634 (Chapters 1-24)www.mhhe.com/price13eBy John Ellis Price, University of North Texas,M David Haddock, Chattanooga State Tech andMichael Farina, Cerritos CollegeOverview: Price/Haddock/Farina has been a long-time market leaderbecause of its readability and relevance. The book includes manyreal-world examples, high-interest problems and activities, in-texthelp and practice, and classroom-tested dynamic pedagogy. Withthe addition of <strong>McGraw</strong>-<strong>Hill</strong>’s Connect Accounting, the new editionincludes more technology support than ever before.Contents1. Accounting: The Language of Business2. Analyzing Business Transactions3. Analyzing Business Transactions Using T Accounts4. The General Journal and the General Ledger5. Adjustments and the Worksheet6. Closing Entries and the Postclosing Trial Balance7. Accounting for Sales and Accounts Receivable8. Accounting for Purchases and Accounts Payable9. Cash Receipts, Cash Payments, and Banking Procedures10. Payroll Computations, Records, and Payment11. Payroll Taxes, Deposits, and Reports12. Accruals, Deferrals, and the Worksheet13. Financial Statements and Closing Procedures14. Accounting Principles and Reporting Standards15. Accounts Receivable and Uncollectible Accounts16. Notes Payable and Notes Receivable17. Merchandise Inventory18. Property, Plant, and Equipment19. Accounting for Partnerships20. Corporations: Formation and Capital Stock Transactions21. Corporate Earnings and Capital Transactions22. Long-Term Bonds23. Financial Statement Analysis24. The Statement of Cash Flows25. Departmentalized Profit and Cost Centers26. Accounting for Manufacturing Activities27. Job Order Cost Accounting28. Process Cost Accounting29. Controlling Manufacturing Costs: Standard Costs30. Cost-Revenue Analysis for Decision MakingAppendix A: The Home Depot, Inc. Annual Report.Appendix B: Combined JournalCOLLEGE ACCOUNTING CHAPTER 1-14WITH ANNUAL REPORT2nd EditionBy John J Wild, University of Wisconsin-Madison, Vernon Richardson,University of Arkansas-Fayetteville and Ken Shaw, University ofMissouri-Columbia2011 (January 2010)ISBN: 9780077346102www.mhhe.com/wildCA2eCollege Accounting by Wild, Richardson, and Shaw draws upon thesuccess of Wild’s Fundamental Accounting Principles text. Its innovationis reflected in its extensive use of small business examples,the integration of new computerized learning tools, superior end-ofchaptermaterial, and a highly engaging, pedagogical design. Inclusionof technology products such as Connect, Connect Plus, ExcelTemplates, and Quick<strong>Books</strong> Pro 2010 software provides studentswith every possible advantage as they strive to understand the keyconcepts of accounting and their role in business.CONTENTSChapter 1: Introduction to AccountingChapter 2: Accounting for Business TransactionsChapter 3: Applying Double-Entry AccountingChapter 4: Preparing the General Journal and General LedgerChapter 5: Adjusting Accounts and Preparing Financial StatementsChapter 6: Closing Process and Financial StatementsChapter 7: Fraud, Ethics, and ControlsChapter 8: Cash and Cash ControlsChapter 9: Employee Earnings, Deductions, and PayrollChapter 10: Employer Payroll Tax ReportingChapter 11: Merchandise Sales and Accounts ReceivableChapter 12: Merchandise Purchases and Accounts PayableChapter 13: Merchandiser’s Purchases Adjustments and Trail BalanceChapter 14: Merchandiser’s Financial Statements and the ClosingProcessAppendix A: Financial Statements InformationAppendix B: Accounting PrinciplesAppendix C via Web: Capital Budgeting and Investment AnalysisAppendix D via Web: Time Value of Money36