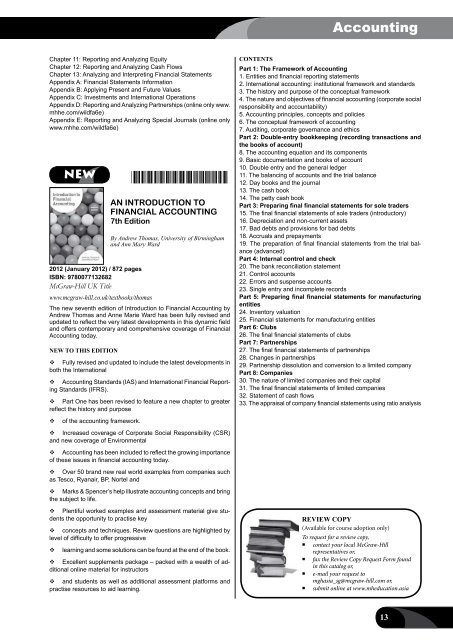

AccountingChapter 11: Reporting and Analyzing EquityChapter 12: Reporting and Analyzing Cash FlowsChapter 13: Analyzing and Interpreting Financial StatementsAppendix A: Financial Statements InformationAppendix B: Applying Present and Future ValuesAppendix C: Investments and International OperationsAppendix D: Reporting and Analyzing Partnerships (online only www.mhhe.com/wildfa6e)Appendix E: Reporting and Analyzing Special Journals (online onlywww.mhhe.com/wildfa6e)NEW*9780077132682*2012 (January 2012) / 872 pagesISBN: 9780077132682<strong>McGraw</strong>-<strong>Hill</strong> UK Titlewww.mcgraw-hill.co.uk/textbooks/thomasAN INTRODUCTION TOFINANCIAL ACCOUNTING7th EditionBy Andrew Thomas, University of Birminghamand Ann Mary WardThe new seventh edition of Introduction to Financial Accounting byAndrew Thomas and Anne Marie Ward has been fully revised andupdated to reflect the very latest developments in this dynamic fieldand offers contemporary and comprehensive coverage of FinancialAccounting today.New to this editionFully revised and updated to include the latest developments inboth the InternationalAccounting Standards (IAS) and International Financial ReportingStandards (IFRS).Part One has been revised to feature a new chapter to greaterreflect the history and purposeof the accounting framework.Increased coverage of Corporate Social Responsibility (CSR)and new coverage of EnvironmentalAccounting has been included to reflect the growing importanceof these issues in financial accounting today.Over 50 brand new real world examples from companies suchas Tesco, Ryanair, BP, Nortel andMarks & Spencer’s help illustrate accounting concepts and bringthe subject to life.Plentiful worked examples and assessment material give studentsthe opportunity to practise keyconcepts and techniques. Review questions are highlighted bylevel of difficulty to offer progressivelearning and some solutions can be found at the end of the book.Excellent supplements package – packed with a wealth of additionalonline material for instructorsand students as well as additional assessment platforms andpractise resources to aid learning.ContentsPart 1: The Framework of Accounting1. Entities and financial reporting statements2. International accounting: institutional framework and standards3. The history and purpose of the conceptual framework4. The nature and objectives of financial accounting (corporate socialresponsibility and accountability)5. Accounting principles, concepts and policies6. The conceptual framework of accounting7. Auditing, corporate governance and ethicsPart 2: Double-entry bookkeeping (recording transactions andthe books of account)8. The accounting equation and its components9. Basic documentation and books of account10. Double entry and the general ledger11. The balancing of accounts and the trial balance12. Day books and the journal13. The cash book14. The petty cash bookPart 3: Preparing final financial statements for sole traders15. The final financial statements of sole traders (introductory)16. Depreciation and non-current assets17. Bad debts and provisions for bad debts18. Accruals and prepayments19. The preparation of final financial statements from the trial balance(advanced)Part 4: Internal control and check20. The bank reconciliation statement21. Control accounts22. Errors and suspense accounts23. Single entry and incomplete recordsPart 5: Preparing final financial statements for manufacturingentities24. Inventory valuation25. Financial statements for manufacturing entitiesPart 6: Clubs26. The final financial statements of clubsPart 7: Partnerships27. The final financial statements of partnerships28. Changes in partnerships29. Partnership dissolution and conversion to a limited companyPart 8: Companies30. The nature of limited companies and their capital31. The final financial statements of limited companies32. Statement of cash flows33. The appraisal of company financial statements using ratio analysisREVIEW COPY(Available for course adoption only)To request for a review copy,• contact your local <strong>McGraw</strong>-<strong>Hill</strong>representatives or,• fax the Review Copy Request Form foundin this catalog or,• e-mail your request tomghasia_sg@mcgraw-hill.com or,• submit online at www.mheducation.asia13

AccountingNEW *9780077328702*2012 (January 2011) / 800 pagesISBN: 9780077328702www.mhhe.com/williamsfinancial15eFINANCIAL ACCOUNTING15th EditionBy Jan Williams, University of Tennessee-Knoxville, Sue Haka, Michigan State University-EastLansing, Mark S Bettner, BucknellUniversity and Joseph V Carcello, University ofTennessee-KnoxvilleWhile many texts characterize themselves as having either a “user”approach or a “preparer” approach, Williams’ Financial Accountingis written for faculty who want to strike a balance between these approaches.Business majors will find relevance in the “Ethics, Fraud& Corporate Governance,” “Your Turn” and “Case in Point” boxesthroughout the chapters while accounting majors will receive a firmgrounding in accounting basics that will prepare them for their intermediatecourse.New to this editionNew International Financial Reporting Standards (IFRS) coveragethroughout the book introduces students to the concept in relationto important topics in accounting such as LIFO, statement of cashflows, and fixed assetsNEW! <strong>McGraw</strong>-<strong>Hill</strong>’s Connect uses end-of-chapter materialpulled directly from the textbook to create static and algorithmic questionsthat can be used for homework and practice tests.ContentsChapter 1: Accounting: Information for Decision MakingChapter 2: Basic Financial StatementsChapter 3: The Accounting Cycle: Capturing Economic EventsChapter 4: The Accounting Cycle: Accruals and DeferralsChapter 5: The Accounting Cycle: Reporting Financial ResultsComprehensive Problem 1: Susquehanna Equipment RentalsChapter 6: Merchandising ActivitiesChapter 7: Financial AssetsChapter 8: Inventories and the Cost of Goods SoldComprehensive Problem 2: Guitar Universe, Inc.Chapter 9: Plant and Intangible AssetsChapter 10: LiabilitiesChapter 11: Stockholders’ Equity: Paid-in CapitalComprehensive Problem 3: McMinn Retail, Inc.Chapter 12: Income and Changes in Retained EarningsChapter 13: Statement of Cash FlowsChapter 14: Financial Statement AnalysisComprehensive Problem 4: Home Depot, Inc.Chapter 15: Global Business and AccountingAppendix A: 2009 Home Depot Financial StatementsAppendix B: The Time Value of Money: Future Amounts and PresentValuesInternational editionFUNDAMENTAL FINANCIAL ACCOUNTINGCONCEPTS7th EditionThomas P Edmonds, University of Alabama at Birmington, Frances MMcNair, Mississippi State University and Philip R Olds, Virginia CommonwealthUniversity2011 (January 2010) / 800 pagesISBN: 9780073527123ISBN: 9780071220712 [IE]www.mhhe.com/edmonds7eStudents are often overwhelmed by the amount of information presentedin the introductory financial accounting course. By focusingon fundamental concepts in a logical sequence, students are ableto fully comprehend the material rather than memorize seeminglyunrelated terms and topics. The goal of Fundamental Financial AccountingConcepts is to enable students to understand how any givenbusiness event affects the financial statements. The “financial statementsmodel” is a highly praised feature because it allows studentsto visualize the simultaneous impact of business events on all of thekey financial statements (the income statement, the balance sheet,and the statement of cash flows).ContentsChapter 1: An Introduction to AccountingChapter 2: Understanding the Accounting CycleChapter 3: The Double-Entry Accounting SystemChapter 4: Accounting for Merchandising BusinessesChapter 5: Accounting for InventoriesChapter 6: Internal Control and Accounting for CashChapter 7: Accounting for ReceivablesChapter 8: Accounting for Long-Term Operational AssetsChapter 9: Accounting for Current Liabilities and PayrollChapter 10: Accounting for Long-Term DebtChapter 11: Proprietorships, Partnerships, and CorporationsChapter 12: Statement of Cash FlowChapter 13: (Online) Financial Statement AnalysisAppendix A: Accessing the EDGAR Database through the InternetAppendix B: Portion of the Form 10-K for Target CorporationAppendix C: Summary of Financial RatiosAppendix D: Annual Report and Financial Statement Analysis ProjectAppendix E: Accounting for Investment SecuritiesAppendix F: Time Value of MoneyInvitation to Publish<strong>McGraw</strong>-<strong>Hill</strong> is interested to review yourtextbook proposals for publication.Please contact your local <strong>McGraw</strong>-<strong>Hill</strong> office oremail to asiapub@mcgraw-hill.com.Visit <strong>McGraw</strong>-<strong>Hill</strong> Education (Asia)Website: http://www.mheducation.asia/publish/14

- Page 1: Accounting & Finance 2012Accounting

- Page 4 and 5: CONTENTSii

- Page 6 and 7: + =McGraw-Hill Connect ® and McGra

- Page 8: Higher EducationBright futures begi

- Page 11: BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81:

Bank Management....................

- Page 82 and 83:

Finance, Insurance & Real EstateMan

- Page 84 and 85:

Finance, Insurance & Real Estateref

- Page 86 and 87:

Finance, Insurance & Real Estatecom

- Page 88 and 89:

Finance, Insurance & Real EstateUK

- Page 90 and 91:

Finance, Insurance & Real EstateNEW

- Page 92 and 93:

Finance, Insurance & Real Estate26

- Page 94 and 95:

Finance, Insurance & Real EstateInt

- Page 96 and 97:

Finance, Insurance & Real EstateInt

- Page 98 and 99:

Finance, Insurance & Real Estate21.

- Page 101 and 102:

Finance, Insurance & Real EstateCre

- Page 103 and 104:

Finance, Insurance & Real EstateInt

- Page 105 and 106:

Finance, Insurance & Real EstateCas

- Page 107 and 108:

Finance, Insurance & Real EstateCON

- Page 109 and 110:

Finance, Insurance & Real Estate10.

- Page 111 and 112:

Finance, Insurance & Real Estateeas

- Page 113 and 114:

Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha