Download - McGraw-Hill Books

Download - McGraw-Hill Books

Download - McGraw-Hill Books

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

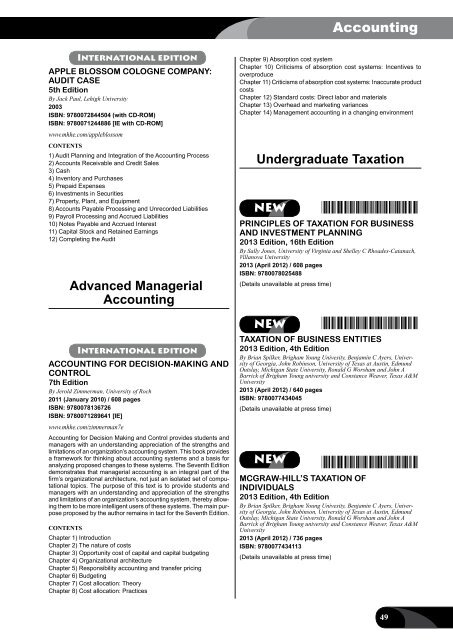

AccountingInternational editionAPPLE BLOSSOM COLOGNE COMPANY:AUDIT CASE5th EditionBy Jack Paul, Lehigh University2003ISBN: 9780072844504 (with CD-ROM)ISBN: 9780071244886 [IE with CD-ROM]www.mhhe.com/appleblossomCONTENTS1) Audit Planning and Integration of the Accounting Process2) Accounts Receivable and Credit Sales3) Cash4) Inventory and Purchases5) Prepaid Expenses6) Investments in Securities7) Property, Plant, and Equipment8) Accounts Payable Processing and Unrecorded Liabilities9) Payroll Processing and Accrued Liabilities10) Notes Payable and Accrued Interest11) Capital Stock and Retained Earnings12) Completing the AuditAdvanced ManagerialAccountingInternational editionaccounting for decision-making andcontrol7th EditionBy Jerold Zimmerman, University of Roch2011 (January 2010) / 608 pagesISBN: 9780078136726ISBN: 9780071289641 [IE]www.mhhe.com/zimmerman7eAccounting for Decision Making and Control provides students andmanagers with an understanding appreciation of the strengths andlimitations of an organization’s accounting system. This book providesa framework for thinking about accounting systems and a basis foranalyzing proposed changes to these systems. The Seventh Editiondemonstrates that managerial accounting is an integral part of thefirm’s organizational architecture, not just an isolated set of computationaltopics. The purpose of this text is to provide students andmanagers with an understanding and appreciation of the strengthsand limitations of an organization’s accounting system, thereby allowingthem to be more intelligent users of these systems. The main purposeproposed by the author remains in tact for the Seventh Edition.ContentsChapter 1) IntroductionChapter 2) The nature of costsChapter 3) Opportunity cost of capital and capital budgetingChapter 4) Organizational architectureChapter 5) Responsibility accounting and transfer pricingChapter 6) BudgetingChapter 7) Cost allocation: TheoryChapter 8) Cost allocation: PracticesChapter 9) Absorption cost systemChapter 10) Criticisms of absorption cost systems: Incentives tooverproduceChapter 11) Criticisms of absorption cost systems: Inaccurate productcostsChapter 12) Standard costs: Direct labor and materialsChapter 13) Overhead and marketing variancesChapter 14) Management accounting in a changing environmentUndergraduate TaxationNEW *9780078025488*PRINCIPLES OF TAXATION FOR BUSINESSAND INVESTMENT PLANNING2013 Edition, 16th EditionBy Sally Jones, University of Virginia and Shelley C Rhoades-Catanach,Villanova University2013 (April 2012) / 608 pagesISBN: 9780078025488(Details unavailable at press time)NEW *9780077434045*TAXATION OF BUSINESS ENtities2013 Edition, 4th EditionBy Brian Spilker, Brigham Young Univesity, Benjamin C Ayers, Universityof Georgia, John Robinson, University of Texas at Austin, EdmundOutslay, Michigan State University, Ronald G Worsham and John ABarrick of Brigham Young university and Constance Weaver, Texas A&MUniversity2013 (April 2012) / 640 pagesISBN: 9780077434045(Details unavailable at press time)NEW*9780077434113*<strong>McGraw</strong>-<strong>Hill</strong>’s TAXATION OFINDIVIDUALS2013 Edition, 4th EditionBy Brian Spilker, Brigham Young Univesity, Benjamin C Ayers, Universityof Georgia, John Robinson, University of Texas at Austin, EdmundOutslay, Michigan State University, Ronald G Worsham and John ABarrick of Brigham Young university and Constance Weaver, Texas A&MUniversity2013 (April 2012) / 736 pagesISBN: 9780077434113(Details unavailable at press time)49