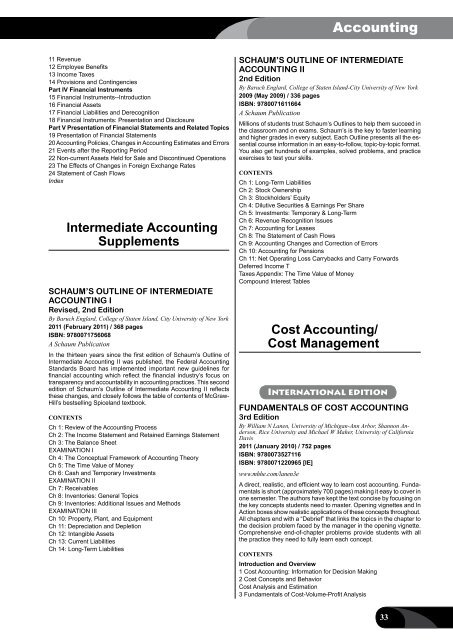

Accounting11 Revenue12 Employee Benefits13 Income Taxes14 Provisions and ContingenciesPart IV Financial Instruments15 Financial Instruments--Introduction16 Financial Assets17 Financial Liabilities and Derecognition18 Financial Instruments: Presentation and DisclosurePart V Presentation of Financial Statements and Related Topics19 Presentation of Financial Statements20 Accounting Policies, Changes in Accounting Estimates and Errors21 Events after the Reporting Period22 Non-current Assets Held for Sale and Discontinued Operations23 The Effects of Changes in Foreign Exchange Rates24 Statement of Cash FlowsIndexIntermediate AccountingSupplementsSCHAUM’S OUTLINE OF INTERMEDIATEACCOUNTING IRevised, 2nd EditionBy Baruch Englard, College of Staten Island, City University of New York2011 (February 2011) / 368 pagesISBN: 9780071756068A Schaum PublicationIn the thirteen years since the first edition of Schaum’s Outline ofIntermediate Accounting II was published, the Federal AccountingStandards Board has implemented important new guidelines forfinancial accounting which reflect the financial industry’s focus ontransparency and accountability in accounting practices. This secondedition of Schaum’s Outline of Intermediate Accounting II reflectsthese changes, and closely follows the table of contents of <strong>McGraw</strong>-<strong>Hill</strong>’s bestselling Spiceland textbook.ContentsCh 1: Review of the Accounting ProcessCh 2: The Income Statement and Retained Earnings StatementCh 3: The Balance SheetEXAMINATION ICh 4: The Conceptual Framework of Accounting TheoryCh 5: The Time Value of MoneyCh 6: Cash and Temporary InvestmentsEXAMINATION IICh 7: ReceivablesCh 8: Inventories: General TopicsCh 9: Inventories: Additional Issues and MethodsEXAMINATION IIICh 10: Property, Plant, and EquipmentCh 11: Depreciation and DepletionCh 12: Intangible AssetsCh 13: Current LiabilitiesCh 14: Long-Term LiabilitiesSCHAUM’S OUTLINE OF INTERMEDIATEACCOUNTING II2nd EditionBy Baruch Englard, College of Staten Island-City University of New York2009 (May 2009) / 336 pagesISBN: 9780071611664A Schaum PublicationMillions of students trust Schaum’s Outlines to help them succeed inthe classroom and on exams. Schaum’s is the key to faster learningand higher grades in every subject. Each Outline presents all the essentialcourse information in an easy-to-follow, topic-by-topic format.You also get hundreds of examples, solved problems, and practiceexercises to test your skills.ContentsCh 1: Long-Term LiabilitiesCh 2: Stock OwnershipCh 3: Stockholders’ EquityCh 4: Dilutive Securities & Earnings Per ShareCh 5: Investments: Temporary & Long-TermCh 6: Revenue Recognition IssuesCh 7: Accounting for LeasesCh 8: The Statement of Cash FlowsCh 9: Accounting Changes and Correction of ErrorsCh 10: Accounting for PensionsCh 11: Net Operating Loss Carrybacks and Carry ForwardsDeferred Income TTaxes Appendix: The Time Value of MoneyCompound Interest TablesCost Accounting/Cost ManagementInternational editionFUNDAMENTALS OF COST ACCOUNTING3rd EditionBy William N Lanen, University of Michigan-Ann Arbor, Shannon Anderson,Rice University and Michael W Maher, University of CaliforniaDavis2011 (January 2010) / 752 pagesISBN: 9780073527116ISBN: 9780071220965 [IE]www.mhhe.com/lanen3eA direct, realistic, and efficient way to learn cost accounting. Fundamentalsis short (approximately 700 pages) making it easy to cover inone semester. The authors have kept the text concise by focusing onthe key concepts students need to master. Opening vignettes and InAction boxes show realistic applications of these concepts throughout.All chapters end with a “Debrief” that links the topics in the chapter tothe decision problem faced by the manager in the opening vignette.Comprehensive end-of-chapter problems provide students with allthe practice they need to fully learn each concept.ContentsIntroduction and Overview1 Cost Accounting: Information for Decision Making2 Cost Concepts and BehaviorCost Analysis and Estimation3 Fundamentals of Cost-Volume-Profit Analysis33

Accounting4 Fundamentals of Cost Analysis for Decision Making5 Cost EstimationCost Management Systems6 Fundamentals of Product and Service Costing7 Job Costing8 Process Costing9 Activity-Based Costing10 Fundamentals of Cost Management11 Service Department and Joint Cost AllocationManagement Control Systems12 Fundamentals of Management Control Systems13 Planning and Budgeting14 Business Unit Performance Measurement15 Transfer Pricing16 Fundamentals of Variance Analysis17 Additional Topics in Variance Analysis18 Nonfinancial and Multiple Measures of PerformanceAppendix: Capital Investment Decisions: an OverviewInternational editionCOST MANAGEMENTA Strategic Emphasis, 5th EditionBy Edward Blocher, University of NC-Chapel <strong>Hill</strong>, David Stout, YoungstownState University and Gary Cokins, Sas/Worldwide Strategy2010 (October 2009) / 928 pagesISBN: 9780073526942ISBN: 9780071267489 [IE]www.mhhe.com/blocher5eCost Management: A Strategic Emphasis, by Blocher/Stout/Cokins isthe first cost accounting text to offer integrated coverage of strategicmanagement topics in cost accounting. The text is written to helpstudents understand more about management and the role of costaccounting in helping an organization succeed. This text aims to teachmanagement concepts and methods, also to demonstrate how managersuse cost management information to make better decisions andimprove their organization’s competitiveness. In teaching these keymanagement skills, the text takes on a strategic focus. It addressesissues such as: How does a firm compete? What type of cost managementinformation is needed for a firm to succeed? How does themanagement accountant develop and present this information? Thistext helps students learn why, when, and how cost information is usedto make effective decisions that lead a firm to success.ContentsPart 1: Introduction to Strategy, Cost Management, and CostSystemsChapter 1: Cost Management and StrategyChapter 2: Implementing Strategy: The Value Chain, the BalancedScorecard, and the Strategy MapChapter 3: Basic Cost-Management ConceptsChapter 4: Job CostingChapter 5: Activity-Based Costing (ABC) and Customer ProfitabilityAnalysisChapter 6: Process CostingChapter 7: Cost Allocation: Departments, Joint Products, and By-ProductsPart 2: Planning and Decision-MakingChapter 8: Cost EstimationChapter 9: Profit Planning: Cost-Volume-Profit (CVP) AnalysisChapter 10: Strategy and the Master BudgetChapter 11: Decision-Making with a Strategic EmphasisChapter 12: Strategy and Long-Term Investment AnalysisChapter 13: Cost Planning for the Product Life-Cycle: Target Costing,Theory of Constraints (TOC), and Strategic PricingPart 3: Operational-Level ControlChapter 14: Operational Performance Measurement: Sales, Direct-Cost Variances, and the Role of Nonfinancial Performance MeasuresChapter 15: Operational Performance Measurement: Indirect CostVariances and Resource-Capacity PlanningChapter 16: Operational Performance Measurement: Further Analysisof Productivity and Sales VariancesChapter 17: The Management and Control of Quality, Six-Sigma,and Lean AccountingPart 4: Management-Level ControlChapter 18: Strategic Performance Measurement: Cost Centers,Profit Centers, and the Balanced Scorecard (BSC)Chapter 19: Strategic Performance Measurement: Investment CentersChapter 20: Management Compensation, Business Analysis, andBusiness ValuationInternational editionCOST MANAGEMENTStrategies for Business Decisions, 4th EditionBy Ronald W Hilton, Cornell University-Ithaca, Michael W Maher,University of California Davis and Frank Selto, University of Colorado-Boulder2008 (September 2007) / 960 pagesISBN: 978 0071287999 [IE]www.mhhe.com/hilton4eHilton/Maher/Selto (HMS) is for instructors who want to teach studentsto manage costs and not just account for costs. HMS maintains that,“Costs don’t just happen,” and with a pro-active approach towardcosts, managers who understand cost implications as well as accountantscan add value to an organization. Hilton, Maher, Seltofocuses on having students learn to make decisions by the use of CostManagement Challenges in the chapter opener, “You’re the DecisionMaker” boxes throughout each chapter, and the “You’re the DecisionMaker” simulation on the text website.ContentsPart 1 Setting the Strategic Foundation: The Importance of Analyzingand Managing Costs1.Cost Management and Strategic Decision Making Evaluating Opportunitiesand Leading Change2.Product Costing Systems: Concepts and Design Issues3.Cost Accumulation for Job-Shop and Batch Production OperationsPart 2 Activity-Based Management4.Activity-Based Costing Systems5.Activity-Based Management6.Managing Customer Profitability7.Managing Quality and Time to Create ValuePart 3 Process Costing and Cost Allocation8.Process-Costing Systems9.Joint-Process Costing10.Managing and Allocating Support-Service CostsPart 4 Planning and Decision Making11.Cost Estimation12.Financial and Cost-Volume-Profit Models13.Cost Management and Decision Making14.Strategic Issues in Making Long-Term Capital Investment Decisions15.Budgeting and Financial PlanningPart 5 Evaluating and Managing Performance Creating andManaging Value-Added Effort16.Standard Costing, Variance Analysis, and Kaizen Costing17.Flexible Budgets, Overhead Cost Management, and Activity-Based Budgeting18.Organizational Design, Responsibility Accounting, and Evaluationof Divisional Performance19.Transfer Pricing20.Performance Measurement SystemsGlossaryPhoto Credits34

- Page 1: Accounting & Finance 2012Accounting

- Page 4 and 5: CONTENTSii

- Page 6 and 7: + =McGraw-Hill Connect ® and McGra

- Page 8: Higher EducationBright futures begi

- Page 11: BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33 and 34: AccountingInternational editionFINA

- Page 35 and 36: AccountingACCOUNTING MADE EASY2nd E

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49: AccountingCONTENTSAbout the Authors

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85: Finance, Insurance & Real Estateref

- Page 86 and 87: Finance, Insurance & Real Estatecom

- Page 88 and 89: Finance, Insurance & Real EstateUK

- Page 90 and 91: Finance, Insurance & Real EstateNEW

- Page 92 and 93: Finance, Insurance & Real Estate26

- Page 94 and 95: Finance, Insurance & Real EstateInt

- Page 96 and 97: Finance, Insurance & Real EstateInt

- Page 98 and 99: Finance, Insurance & Real Estate21.

- Page 101 and 102:

Finance, Insurance & Real EstateCre

- Page 103 and 104:

Finance, Insurance & Real EstateInt

- Page 105 and 106:

Finance, Insurance & Real EstateCas

- Page 107 and 108:

Finance, Insurance & Real EstateCON

- Page 109 and 110:

Finance, Insurance & Real Estate10.

- Page 111 and 112:

Finance, Insurance & Real Estateeas

- Page 113 and 114:

Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha