AccountingAppendix 10C Issuing Bonds between Interest DatesAppendix 10D Leases and PensionsChapter 11 Reporting and Analyzing EquityCorporate Form of OrganizationCommon StockDividendsPreferred StockTreasury StockReporting of EquityDecision Analysis—Earnings per Share, Price-Earnings Ratio, DividendYield, and BookValue per ShareChapter 12 Reporting and Analyzing Cash FlowsBasics of Cash Flow ReportingCash Flows from OperatingCash Flows from InvestingCash Flows from FinancingDecision Analysis—Cash Flow AnalysisAppendix 12A Direct Method of ReportingOperating Cash FlowsChapter 13 Analyzing and Interpreting Financial StatementsBasics of AnalysisHorizontal AnalysisVertical AnalysisRatio AnalysisDecision Analysis—Analysis ReportingAppendix 13A Sustainable IncomeAppendix A Financial Statement InformationNestléKraft FoodsAdidasAppendix B Time Value of Money B-1GlossaryCreditsIndexChart of AccountsFINANCIAL ACCOUNTINGwith IFRS Fold Out Primer, 5th EditionBy John J Wild, University of Wisconsin at Madison2011 (January 2010) / 736 pagesISBN: 9780077408770www.mhhe.com/wild5eFINANCIAL ACCOUNTING: Information for Decisions, 5th Edition addressesthe topics and issues typically covered in Financial Accountingwhile at the same time motivating student interest in accountingthrough the extensive use of entrepreneurial examples, applicationof analysis skills, integration of interactive tutorial software, and ahighly engaging pedagogical design. This book thoroughly integratesideas and practices followed by today’s business entrepreneurs,speaking more directly to students and better preparing them toenter the workforce.New to this editionIntegrated Apple iPod Content: Each chapter features iconsconnecting course content with learning resources available fordownload with the Apple iPod. Available downloads include audioonlylectures, lecture slideshows, narrated lecture slideshows, andeducational videos.New Presentation of Transaction Analysis: Identify – Analyze –Record – Post: a more logical and simple presentation of transactionanalysis that students understand. The change from the forth editionto this approach came directly from reviewer feedback.New IFRS (International Financial Reporting Standards) QuickReference Guide: This reference toll sets the stage for IFRS mappingsimilarities and differences to GAAP for each text chapter in ahandy 8-page laminated fold-out reference tool packaged free withnew copies of the text.New IFRS (International Financial Reporting Standards) Boxes:These boxes reflect recent developments in the business world thatare relevant to accounting practice and how IFRS may differ fromcurrent practices in the U.S. GAAP reporting.New Global View section: Financial accounting according to U.S.GAAP is similar, but not identical, to IFRS. Towards the end of eachchapter, a new “Global View” section highlights international accountingpractices, including the similarities and differences for financialreporting under IFRS versus U.S. GAAP relating to topics coveredwithin that chapter. Most chapters use GOME’s financial statements ascompared to Best Buy to illustrate the differences/similarities betweenthese financial reporting rules and concepts.New Feature Company: Students are provided relevant, realworldcompanies as a resource tool and motivating force in learningaccounting. Best Buy is the new feature company, which means thateach chapter has selected assignments that require student to use,analyze, or interpret its accounting data.New Comparative Companies: For comparative purposes withBest Buy, students are provided the financial statements of RadioShack.Assignments are included that ask students to compareand interpret Best Buy, and RadioShack data. GOME, a Hong Kongbased-company, serves as a global comparison for Best Buy andRadioShack Selected 2009 financial data for all three companiesis included in end-of-book Appendix A. Each of these companies isintegrated into the end-of-chapter material. Finally, Apple financialstatements are also included along assignments for each chapter.NEW! <strong>McGraw</strong>-<strong>Hill</strong>’s Connect uses end-of-chapter material pulleddirectly from the textbook to create static and algorithmic questionsthat can be used for practice, homework, quizzes, and tests. FA 5eConnect also includes The Personal Learning Plan (PLP) that connectseach student to the learning resources needed for success inthe course. For each chapter, students: Take a practice test to initiatethe Personal Learning Plan; Immediately upon completing the practicetest, see how their performance compares to chapter learningobjectives within chapters; Receive a Personal Learning Plan thatrecommends specific readings from the text, supplemental studymaterial, and practice work that will improve their understanding andmastery of each learning objective. All new texts come bundled withConnect Plus at no additional cost.CONTENTS1 Introducing Accounting in Business2 Analyzing and Recording Business Transactions3 Adjusting Accounts and Preparing Financial Statements4 Reporting and Analyzing Merchandising Operations5 Reporting and Analyzing Inventories6 Reporting and Analyzing Cash and Internal Controls7 Reporting and Analyzing Receivables8 Reporting and Analyzing Long-Term Assets9 Reporting and Analyzing Current Liabilities10 Reporting and Analyzing Long-Term Liabilities11 Reporting and Analyzing Equity12 Reporting and Analyzing Cash Flows13 Analyzing and Interpreting Financial StatementsAppendix A: Financial Statements InformationAppendix B: Applying Present and Future ValuesAppendix C: Investments and International Operations*Appendix D: Reporting and Analyzing Partnerships*Appendix E: Reporting and Preparing Special Journals17

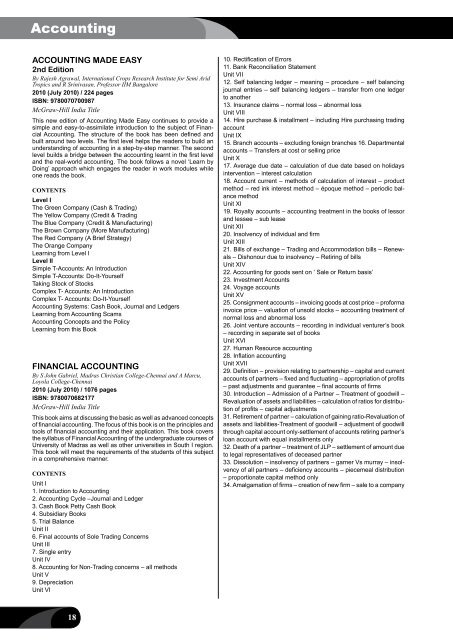

AccountingACCOUNTING MADE EASY2nd EditionBy Rajesh Agrawal, International Crops Research Institute for Semi AridTropics and R Srinivasan, Professor IIM Bangalore2010 (July 2010) / 224 pagesISBN: 9780070700987<strong>McGraw</strong>-<strong>Hill</strong> India TitleThis new edition of Accounting Made Easy continues to provide asimple and easy-to-assimilate introduction to the subject of FinancialAccounting. The structure of the book has been defined andbuilt around two levels. The first level helps the readers to build anunderstanding of accounting in a step-by-step manner. The secondlevel builds a bridge between the accounting learnt in the first leveland the real-world accounting. The book follows a novel ‘Learn byDoing’ approach which engages the reader in work modules whileone reads the book.ContentsLevel IThe Green Company (Cash & Trading)The Yellow Company (Credit & TradingThe Blue Company (Credit & Manufacturing)The Brown Company (More Manufacturing)The Red Company (A Brief Strategy)The Orange CompanyLearning from Level ILevel IISimple T-Accounts: An IntroductionSimple T-Accounts: Do-It-YourselfTaking Stock of StocksComplex T- Accounts: An IntroductionComplex T- Accounts: Do-It-YourselfAccounting Systems: Cash Book, Journal and LedgersLearning from Accounting ScamsAccounting Concepts and the PolicyLearning from this Bookfinancial accountingBy S John Gabriel, Madras Christian College-Chennai and A Marcu,Loyola College-Chennai2010 (July 2010) / 1076 pagesISBN: 9780070682177<strong>McGraw</strong>-<strong>Hill</strong> India TitleThis book aims at discussing the basic as well as advanced conceptsof financial accounting. The focus of this book is on the principles andtools of financial accounting and their application. This book coversthe syllabus of Financial Accounting of the undergraduate courses ofUniversity of Madras as well as other universities in South I region.This book will meet the requirements of the students of this subjectin a comprehensive manner.ContentsUnit I1. Introduction to Accounting2. Accounting Cycle –Journal and Ledger3. Cash Book Petty Cash Book4. Subsidiary <strong>Books</strong>5. Trial BalanceUnit II6. Final accounts of Sole Trading ConcernsUnit III7. Single entryUnit IV8. Accounting for Non-Trading concerns – all methodsUnit V9. DepreciationUnit VI10. Rectification of Errors11. Bank Reconciliation StatementUnit VII12. Self balancing ledger – meaning – procedure – self balancingjournal entries – self balancing ledgers – transfer from one ledgerto another13. Insurance claims – normal loss – abnormal lossUnit VIII14. Hire purchase & installment – including Hire purchasing tradingaccountUnit IX15. Branch accounts – excluding foreign branches 16. Departmentalaccounts – Transfers at cost or selling priceUnit X17. Average due date – calculation of due date based on holidaysintervention – interest calculation18. Account current – methods of calculation of interest – productmethod – red ink interest method – époque method – periodic balancemethodUnit XI19. Royalty accounts – accounting treatment in the books of lessorand lessee – sub leaseUnit XII20. Insolvency of individual and firmUnit XIII21. Bills of exchange – Trading and Accommodation bills – Renewals– Dishonour due to insolvency – Retiring of billsUnit XIV22. Accounting for goods sent on ‘ Sale or Return basis’23. Investment Accounts24. Voyage accountsUnit XV25. Consignment accounts – invoicing goods at cost price – proformainvoice price – valuation of unsold stocks – accounting treatment ofnormal loss and abnormal loss26. Joint venture accounts – recording in individual venturer’s book– recording in separate set of booksUnit XVI27. Human Resource accounting28. Inflation accountingUnit XVII29. Definition – provision relating to partnership – capital and currentaccounts of partners – fixed and fluctuating – appropriation of profits– past adjustments and guarantee – final accounts of firms30. Introduction – Admission of a Partner – Treatment of goodwill –Revaluation of assets and liabilities – calculation of ratios for distributionof profits – capital adjustments31. Retirement of partner – calculation of gaining ratio-Revaluation ofassets and liabilities-Treatment of goodwill – adjustment of goodwillthrough capital account only-settlement of accounts retiring partner’sloan account with equal installments only32. Death of a partner – treatment of JLP – settlement of amount dueto legal representatives of deceased partner33. Dissolution – insolvency of partners – garner Vs murray – insolvencyof all partners – deficiency accounts – piecemeal distribution– proportionate capital method only34. Amalgamation of firms – creation of new firm – sale to a company18

- Page 1: Accounting & Finance 2012Accounting

- Page 4 and 5: CONTENTSii

- Page 6 and 7: + =McGraw-Hill Connect ® and McGra

- Page 8: Higher EducationBright futures begi

- Page 11: BSG and GLO-BUS are Fun, Easy, and

- Page 14 and 15: New TitlesACCOUNTING2013 Author ISB

- Page 16 and 17: New TitlesFINANCE, INSURANCE & REAL

- Page 18 and 19: Accounting for Non-Accounting Manag

- Page 20 and 21: New TitlesACCOUNTING2012 Author ISB

- Page 22 and 23: AccountingAccounting PrinciplesNEW

- Page 24 and 25: AccountingCOLLEGE ACCOUNTING CHAPTE

- Page 26 and 27: AccountingSCHAUM’S OUTLINE OF FIN

- Page 28: AccountingFinancial AccountingInter

- Page 31 and 32: AccountingNEW *9780077328702*2012 (

- Page 33: AccountingInternational editionFINA

- Page 37 and 38: Accountingconsolidation accountingC

- Page 39 and 40: AccountingManagerial AccountingGlob

- Page 41 and 42: AccountingChapter 5)Chapter 7 Plann

- Page 43 and 44: Accounting18. Cost volume profit an

- Page 45 and 46: AccountingMANAGEMENT ACCOUNTINGRevi

- Page 47 and 48: Accounting11 Merchandising Corporat

- Page 49 and 50: AccountingCONTENTSAbout the Authors

- Page 51 and 52: Accounting4 Fundamentals of Cost An

- Page 53 and 54: AccountingContents1. Accounting: Th

- Page 55 and 56: Accounting12 Acquisition/Payment Pr

- Page 57 and 58: Accounting6 Intercompany Inventory

- Page 59 and 60: Accounting6.8 Indirect Shareholding

- Page 61 and 62: AccountingInternational editionNEW*

- Page 63 and 64: AccountingInternational editionAUDI

- Page 65 and 66: AccountingAUDITING AND ASSURANCE SE

- Page 68 and 69: AccountingMcGraw-Hill’s TAXATION

- Page 70 and 71: AccountingUp-to-date information on

- Page 72 and 73: Accounting5. Normative theories of

- Page 74 and 75: AccountingChapter 12 Financial Repo

- Page 76 and 77: AccountingAust AdaptationACCOUNTING

- Page 78 and 79: AccountingChapter 6 The Role of Fin

- Page 80 and 81: Bank Management....................

- Page 82 and 83: Finance, Insurance & Real EstateMan

- Page 84 and 85:

Finance, Insurance & Real Estateref

- Page 86 and 87:

Finance, Insurance & Real Estatecom

- Page 88 and 89:

Finance, Insurance & Real EstateUK

- Page 90 and 91:

Finance, Insurance & Real EstateNEW

- Page 92 and 93:

Finance, Insurance & Real Estate26

- Page 94 and 95:

Finance, Insurance & Real EstateInt

- Page 96 and 97:

Finance, Insurance & Real EstateInt

- Page 98 and 99:

Finance, Insurance & Real Estate21.

- Page 101 and 102:

Finance, Insurance & Real EstateCre

- Page 103 and 104:

Finance, Insurance & Real EstateInt

- Page 105 and 106:

Finance, Insurance & Real EstateCas

- Page 107 and 108:

Finance, Insurance & Real EstateCON

- Page 109 and 110:

Finance, Insurance & Real Estate10.

- Page 111 and 112:

Finance, Insurance & Real Estateeas

- Page 113 and 114:

Finance, Insurance & Real EstateInt

- Page 115 and 116:

Finance, Insurance & Real EstatePer

- Page 118 and 119:

Finance, Insurance & Real EstateCha

- Page 120 and 121:

Finance, Insurance & Real EstateFIN

- Page 122 and 123:

Finance, Insurance & Real EstateUpp

- Page 124 and 125:

ATitle IndexAccounting and Bookkeep

- Page 126 and 127:

Title IndexFinancial Institutions M

- Page 128 and 129:

Title IndexPrinciples of Accounting

- Page 130 and 131:

DAuthor IndexDeegan Australian Fina

- Page 132 and 133:

Author IndexMintz Ethical Obligatio

- Page 134 and 135:

WAuthor IndexWalker Personal Financ

- Page 136 and 137:

M c G R A W - H I L L M A I L I N G

- Page 138:

Preparing Students forthe World Tha